What amazing power the Masters of the Universe at Goldman Sachs and the US Fed do possess. In two short day they managed to destroy a vital thriving source of human wealth and well being that has survived for well over 5000 years of recorded human history.

And they did it simply by dousing it in reams and reams of paper.

When Perseus killed the Gorgon he had to capture a winged horse, and procure a cape of darkness, a sword with a diamond edge and a polished shield. He also had to travel to the ends of the earth and trick secrets from the Dark Ladies and then slay the Fierce Medusa through a combination of bravery, force and cunning - at the peril of his life.

All the Fed and Goldman Sachs had to do was to award themselves 100,000 paper gold contracts and dump them on the Comex all at once. It cost them nothing in risk or exertion - And presto - 5000 years of Human History extinguished.

Is there anything those super Heroes can't accomplish?

Nothing, really.

That is if you believe everything being written about gold and the US economy.

Who needs gold, when the world economy has magically healed?

How?

By the Fed creating reams of paper - through no exertion or risk or cunning - just by waving its might arm and saying it is so. While cohorts at Goldman Sachs and JP Morgan use the free paper to enrich themselves in the risk markets - without risk, without, exertion, and without cunning. Simply by dint of their superior position as Creators of the Paper.

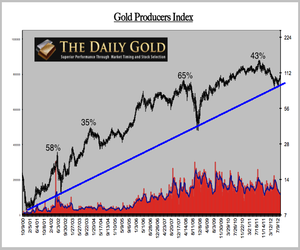

But then if you look at the chart above: it sure looks like Gold is thriving. Hmmm. The chart must be wrong.

And if you look at the bellwether rate on the 10 year note at 1.6 percent - for the last 5 years - and if you look at the accumulating debt in the system growing ever greater as you read this - it sure looks like the economy is dying.

But that couldn't be. After all the Stock Market is at an all time high.

So things must be good.

No comments:

Post a Comment