There are so many theories as to what could destabilize an inherently unstable position.

People liken the Fed Easy Money Policy stabilizing the economy to a doctor stabilizing a patient with drugs. The analogy continues with just the right dose enabling the patient to lead a happy prosperous life.

The analogy falters when you consider the number of economic factors the Fed is attempting to stabilize. Interest rates. Money Supply. Debt. Employment. The Stock Market.

Each factor takes the right amount of policy tweaking. It's more like a shrink prescribing a huge drug cocktail. Try stabilizing a patient with drugs for depression, drugs for bipolar disorder, drugs for seasonal affect disorder, drugs to combat the lethargy that ensues from the other drugs, and see how tough it is over time to maintain a happy and prosperous life.

Because a drugged up patient is likely to go through spells where normal inhibitions are inoperative. A drugged up patient is likely to misdirect his energies into a variety of inappropriate targets. Just as a drugged up economy is likely to misdirect hot money into a variety inappropriate targets.

There are all sorts of theories about how the Fed might lose control of its delicate drug cocktail. Most of these theories center around Inflationary and Deflationary events. These certainly might happen.

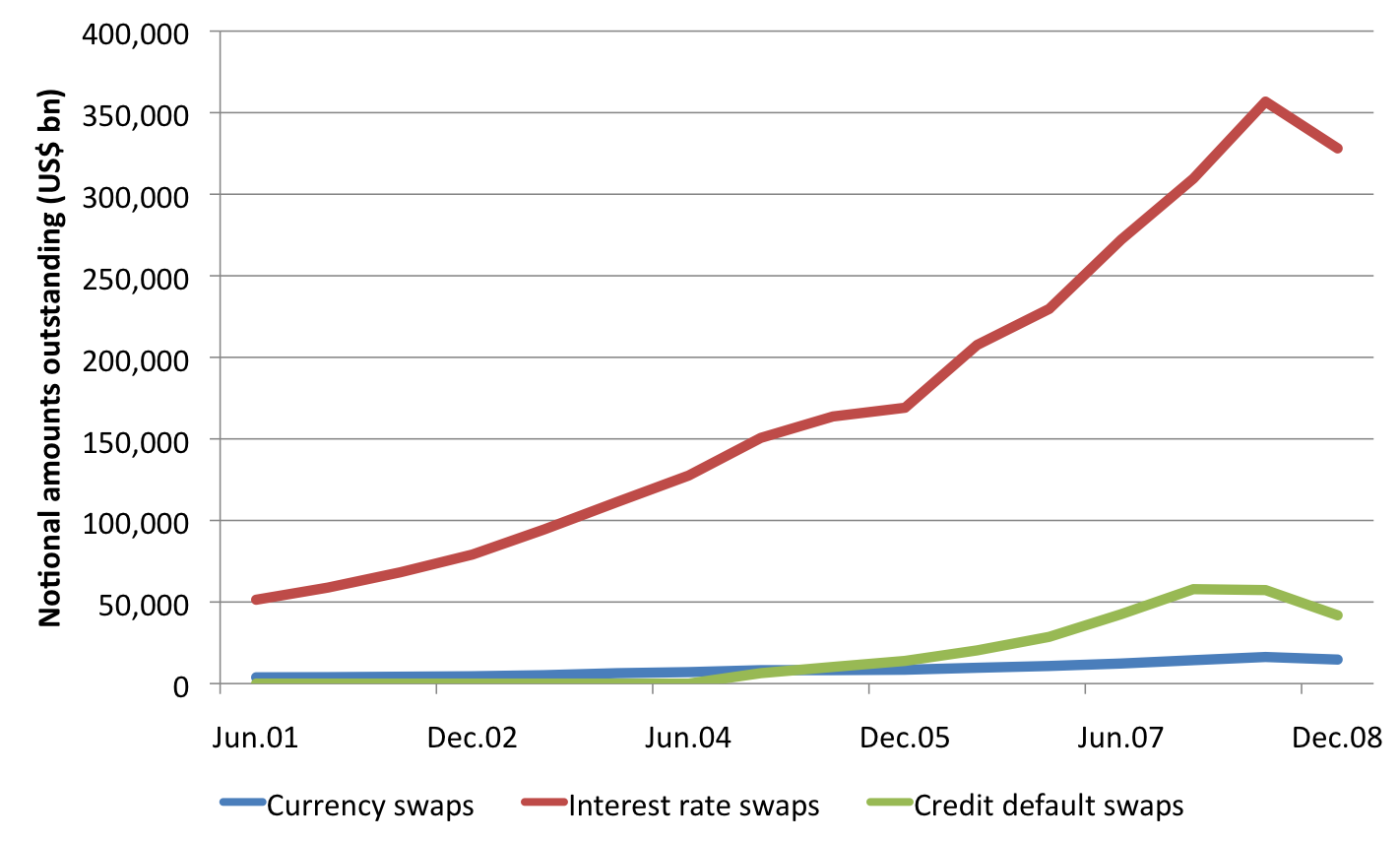

But the over-riding likelihood, which is never discussed because it can't be planned for, combated, or treated, is that of a massive counter-party collapse resulting from a single bad trade. Obviously it would have to be a huge trade. But plenty of those are put on every day. And because of the herd mentality, a massive bad trade misdirected at a single inappropriate source could cause a counterparty collapse at any moment. Because these trades are stilled being levered up at fantastic ratios.

In fact, this disastrous scenario is every bit as likely as a massively drugged up patient committing a single massively inappropriate act that derails, once and for all, his happiness and prosperity.

how do you price this coin?

how do you price this coin?