The price of gold is on an almighty tear. Which leads most Americans who have missed the entire gold move to wonder: Is it too expensive to get in here?

The answer is simple: Gold has to keep rising because inflation has to keep rising. There is simply too much debt for anything else to happen. The debt must either be defaulted or inflated away. Inflation is the only politically viable solution.

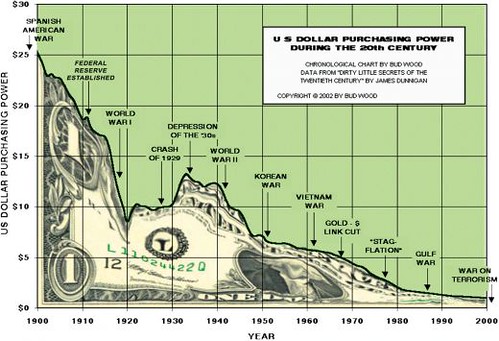

Gold moves in relation to inflation because they measure the same thing: the erosion fo the purchasing power of the elctronic/paper currency.

To understand where gold is headed you only need understand where inflation is headed.

That doesn't mean the "Rate of Inflation." This is a political number created by the government to reflect what the government wants the citizen to think about the job it is doing holding down the cost of living.

In most cases the "Rate of Inflation" corresponds to the CPI Consumer Price Index. That sounds as if it should reflect the cost of living for consumers.

I does not.

Because of what is excludes:

I doesn't measure the cost of health care.

It doesn't measure: the cost of buying a house.

I doesn't measure the cost of insurance: medical insurance, car insurance, home owner's insurance, life insurance, etc etc

It doesn't measure the cost of food. (core cpi)

It doesn't measure the cost of energy: gasolline, electricity, heating oil, etc etc (core cpi)

It doesn't measure the cost of education.

It doesn't meaure the cost of child care outside of education: child health care (physical, mental psychological and special needs), child pre school, child tutoring, child music, sports, and other ineterests.

It dosn't measure almost everything that makes up the cost of non discretionary spending.

In short it measures the cost of your toilet paper and your air conditoner and your Iphone. But even with your Iphone it doesn't measure the real cost because of "Hedonics" which makes up a pretend price based on reductions of your actual dollar outlay for things like "AI" which the governement says makes the same Iphone cheaper even though you pay more for it because it "does more." Hedonics is applied to all comsumer items. They say your LG air conditoner costs less than you paid for it because it has a function which lets you turn it on from your Iphone (which also makes your Iphone cost less in CPI terms). Like you can't just push the button on the remote.

Real inflatioin grows at about 10 percent a year as measured by the 500 most purchased items (iincluding everything) in the 500 largest cities in the US every year. See the CHAPWOOD INDEX.

Or go see SHADOWSTATS which measure the CPI with exactly the same metrics the government used in the 1980's, which still reveals a near 10 percent inflation rate even excluding food energy education health care, insurance etc.

The problem is the government lies. And most financial analysts you see on TV are multimillionaires (like the plutocrats running the govenment) who don't really feel the inflation because when you have that much money it's not a big deal.

But for most Americans it is the biggest deal on earth. Because they can't afford to live.

But the point of this post is that GOLD has to keep appreciating because INFLATION is embedded into our financial system wherein the US Dollar is a unit of DEBT rather than a store of value.

There is no way out except a DEBT DEFAULT which would lead to a DEFLATIONARY DEPRESSION. Or to just keep inflating away the debt which makes more and more debt.

The more debt we have the more debt we need to issue just to pay the service on the debt - which is now the largest item in the Federal Budget. And this is why the Debt Ceiling has just been eradicated.

So, don't think there is limit on the natural price of Gold until there is a limit on the unvirtuous DEBT/INFLATION spiral in which wer are ensnared.

And the longer you wait to accumulate a gold position, the more you will eventually have to pay for it.