http://gold-stater.com is now providing daily gold market and gold coin market commentary and updates. Please check in regularly to find the latest developments in gold and gold coins.

Total Pageviews

Thursday, October 31, 2019

GOLD VERSUS BITCOIN - IRREVERSIBLE TRENDS CONTINUED

Gold is here to stay. Block Chain currencies though in it's infancy is also here to stay

But they serve completely diametrically opposite functions.

Bitcoin is a gambling vehicle. It is more akin to Fantasy Football or Black Jack than it is to gold.

The thing about gambling is that it is a completely unproductive use of capital.

Someone gets rich Someone gets poor. Zero Sum. There is no multiplier

effect. Money gets transferred. Those who get rich just turn the money over

back into the gambling complex. Because gambling is an addictive illness.

Gamblers use profits to Gamble.

This is highly deflationary as productive capital is sucked out of the economy.

Gold on the other hand is like stored energy. It is a stable store of money that is not likely

to make many people rich but over time it holds its value as Gambling Instruments become

overvalued and crash.

Crashes come periodically. The last one was only 12 years ago. It was bailed out in the most

temporary fashion by transferring trillions from tax payers to the banks,

It seems unlikely the Government will be able to do that again without a vicious

backlash.

After a crash the capital stored in gold, can be reconverted and employed back in the

real economy.

When the economy crashes Block Chain currencies can easily be shutdown.

Just pull the plug.

Gold can aslo be outlawed. But if it's hidden in a hole in your yard it's not likely

anyone will be able to take it away from you.

When order is restored it's unlikely anyone will want to. There will be other priorities.

The tangible nature of gold though viewed as antiquated by block chain

enthusiasts, is exactly what protects it in a crash.

Tuesday, September 10, 2019

Irreversible Trends:

IRREVERSIBLE TRENDS:

Debt owed by governments, businesses and households around the globe is up nearly 50% since before the financial crisis to $246.6 trillion at the beginning of March, according to the Institute of International Finance, an association of global financial firms. And the high debt levels are weighing heavily on economies

The consumer is holding up though!! How so:

For the month of July, consumer credit increased at a seasonally adjusted annual rate of 6.75%. Revolving credit, which are credit cards increased at an annual rate of 11.25% while non-revolving credit increased at an annual rate of 5.25%.

That’s over 11% increase in July from June in credit card debt….

Therefor: Rates must continue to fall, negative yielding debt continues to grow, which means the global economy continues to stall

The Unstoppable Surge in Negative

Yields Reaches $17 Trillion

The global stock of negative-yielding debt is now in excess of $17 trillion as rising market volatility lends extra force to this year’s unprecedented bond rally.

Thirty percent of all investment-grade securities now bear sub-zero yields, meaning that investors who acquire the debt and hold it to maturity are guaranteed to make a loss. Yet buyers are still piling in, seeking to benefit from further increases in bond prices and favorable cross-currency hedging rates—or at least to avoid greater losses elsewhere.

Monday, August 26, 2019

The Gold versus bitcoin debate is absurd. There are no similarities.

Bitcoin is a risk asset that exists in virtual reality.

Gold is a hard asset that exists in the real world.

Bitcoin is a gambling tool

Gold is a hedge against gambling tools.

Suggesting that bitcoin could replace gold is like suggesting

a computer program of a sprawling palace could replace the apartment

or house that you live in.

It may seam to have advantages, like it appears bigger and grander and needs

no upkeep. But you can't actually live in it because it doesn't exist outside

your computer.

People may even begin flipping their virtual houses and make tons of money -

temporarily they may make more money than people buying and selling real

houses. But you still can't live in them.

The fact that gold really exists in the natural world may seem quaint and

antiquated to some young people. But the thing they forget is that they

too exist in the natural world.

And everything that does not exist in the natural world is by the very definition

of the word: SPECULATIVE.

Something that is speculative can never be a hedge against speculation.

That should be obvious. Yet somehow it's not anymore.

Sunday, August 18, 2019

TRUST AND MONEY

THE foundation of all economy is trust. When accepting any form

of money as payment we must trust that the parties involved in the

next transaction will also trust that form of money. To do so we must

have ultimate trust in either the intrinsic value of the money, or in the ability of

the issuing institution to provide a safe and stable and enforceable

environment for the continued value and acceptance of the money.

It is becoming increasingly difficult for many citizens to trust their own

governments. It is difficult to trust Governments run by officials who

clearly have only their own personal interests at heart.

It is difficult to place trust in a form of money that charges prohibitive

fees for the use of the money - such as money that doesn't

provide interest to offset decaying value from over-issuance or actually

charges the user in absolute terms through negative interest rates.

This is institutionalized theft, which doesn't foster trust.

Some citizens prefer to place their trust in anonymous issuers using

mathematical " guarantees" for their money such are bitcoin type currencies.

This is a sort of blind trust in technology, which is only possible as

trust in humans erodes.

This brings us back to the idea of "Intrinsic Value," which may be argued

is a form of mass delusion over time - but the delusion is academic.

It's mass acceptance over long periods of time that comprises

the intrinsic value. Old master paintings. Real Estate in popular locations.

Artifacts related to historically important figures like Julius Caesar

or Alexander the Great or George Washington, for example.

These things all hold value over time. But they

are not divisible so are difficult to use in transactions as money.

This brings us back to gold, which has held its value for over five thousand years.

There is no need for trust in an issuing authority except as a guarantee of

weight and purity - which can be easily verified independently.

And it is divisible into any desired quantity. Perfect as a store of value.

Perfect for transactions, even if it means an intermediary step of

conversion into a local currency.

As trust erodes, gold rises.

Tuesday, August 13, 2019

THE PERFECT STORM FOR GOLD WITH TRUMP IN THE EYE

GOLD THRIVES ON INSTABILITY, TRUMP IS INSTABILITY PERSONIFIED.

THINGS GOLD LOVES THAT TRUMP IS PUSHING:

1) GLOBAL COMPETITIVE DEVALUATION OF CURRENCY.

2) NEGATIVE RATE ENVIRONMENT. (there is 15 trillion dollars of negative yielding debt )

3) INTERNATIONAL STRIFE SUCH AS TRADE WARS

4) LOSS OF CONFIDENCE IN GOVERNMENT

AND 5 - gold's stealth weapon - (as though it needed anything else) -

A GLOBAL PUSH FOR DEDOLARIZATION - which is untethering gold to it's anti-dollar role, and encouraging governments to increase their gold reserves.

Government’s around the world are becoming increasingly wary of the dollar’s hegemony in international trade, as Trump's polices become increasingly belligerent. and they’re doing their best to distance themselves from the dollar by stoking their gold reserves.

This process is already underway mainly in nations with strong anti-U.S. sentiment including Russia, China, Iran, Venezuela, Syria, Turkey, Qatar, India, Pakistan, Libya, Egypt and the Philippines among others.

Naturally, these countries are turning to gold since the yellow metal is not under lock-and-key like the greenback and other electronic payment methods.

This trend is abundantly clear when you look at central banks’ buying activity.

According to the World Gold Council, central banks purchased nearly 70 percent more gold during the first quarter of the year than they did during the previous year’s corresponding period.

That’s the most they bought since the first quarter of 2013.

And goblal central banks are pushing to settle traditional dollar denominated markets with non-dollars payments: SOME HEADLINES{

In a challenge to longstanding American dominance of the oil industry, China is reportedly planning to launch a pilot program to pay for oil in its own RMB, potentially starting in the second half of this year.

Russia, China Sign Deal To Settle All Trade In Respective Currencies And Drop Bilateral Use Of US Dollars

Iran and China have found a way for China to continue buying Iranian crude and pay for it without risking a U.S. sanction breach, an Iranian official said.

"A Chinese bank will start its banking exchanges with the Iranian side on December 2," the head of the Iran-China Chamber of Commerce, Asadollah Asgaroladi said, adding "The Chinese side is due to introduce its second bank for exchanges with the Iranian side in a month." Sales of crude will begin next week, Asgaroladi also said.

China had a special bank dedicated to handling payments for Iranian oil during the international sanctions against Tehran earlier this decade, so finding ways around sanctions is hardly new

Thursday, August 8, 2019

CENTRAL BANKS BUYING GOLD

central bank demand at highest level since becoming net buyers in 2010

- Central bank net purchases rose 47% y-o-y to 224.4t in Q2

- H1 2019 net purchases totalled 374.1t, the highest level since becoming net buyers in 2010

- Poland was the largest purchaser in the quarter; reserves grew by 100t (+77%)

| Tonnes | Q2'18 | Q2'19 | YoY | |

|---|---|---|---|---|

| Central banks & others | 152.8 | 224.4 |  | 47% |

Central bank net purchases totalled 224.4t in Q2, 47% higher y-o-y.

Total net purchases

for the first six months of 2019 rose to 374.1t: 57% higher y-o-y,

and the highest

level of y-t-d demand since central banks became net purchasers

(on an annual basis)

in 2010. Buying momentum has continued strongly from last year

– 2018

saw the highest level of annual purchases in 50 years –

and is a clear indication of the central banking community’s

mind-set towards gold.

Total net purchases

for the first six months of 2019 rose to 374.1t: 57% higher y-o-y,

and the highest

level of y-t-d demand since central banks became net purchasers

(on an annual basis)

in 2010. Buying momentum has continued strongly from last year

– 2018

saw the highest level of annual purchases in 50 years –

and is a clear indication of the central banking community’s

mind-set towards gold.

Central Banks control the global economy.

They control the issue, distribution and cost of currency.

They control the issue, distribution and cost of currency.

Central Banks don't buy bitcoin. They buy gold.

You hear many cranky old analysts striving to be hip saying things like

"The kids don't even know what gold is anymore.

It's a useless barbarous relic."

"The kids don't even know what gold is anymore.

It's a useless barbarous relic."

Maybe. But the kids don't run the global central banks.

The central banks don't worry about being hip,

The central banks don't worry about being hip,

or getting in on the next big thing.

They worry about solvency.

They worry about solvency.

And when rates are going negative all across the

globe, the safest CURRENCY is gold.

Is it really still a currency?

A) The Central Banks own it in quantity.

B) It can be changed for any other currency on demand

in every city in the world.

in every city in the world.

C) It has a stable 5000 year track record.

Yes, true, you can't buy food with it in a grocery store.

Good point. But that's not

Good point. But that's not

why you hold it.

Wednesday, August 7, 2019

TRUMP'S UNWINNABLE TRADE WAR AND GOLD

Trade wars are winnable, in a sense, if conducted by brilliant strategists who understand the win/win psychology of game theory.

That is not Mr Trump. Mr Trump demands capitulation. That is why his trade war is doomed to go on and on and on while all sides suffer, until there is total chaos.

Gold loves Chaos.

A long time ago I worked for a US financial concern in China. I learned two things that nobody in the Trump Wolrd seems to understand.

ONE: The Chinese will never tolerate a loss of face. No amount of pain and suffering from the Western perspective is worth a loss of face in the Eastern perspective. Trump demands a loss of face.

TWO: The Chinese time frame is different from the Western time frame. And not just because they are totalitarian, or communist or however you'd like to categorize them. Their time frame is informed by their view of life as a continuum. They literally worship Ancestors. For the Chinese if Mr Xi's great grandson wins the Trade War against some President who isn't yet born, that will be a great victory, no matter how much pain is suffered in the meantime.

Trump's time frame can be measured in nanoseconds.

Meanwhile, Trump is convinced he is winning the trade war. Because in his mind he always wins everything.

The continuing chaos, both economic and social resulting from this bizarre personality disorder is ideal for gold.

Add to this a hyper-drive of global competitive devaluation of currencies (which was happening anyway, but on a much slower scale) and you have the perfect storm for gold.

It's only just begun.

Saturday, July 27, 2019

Thursday, July 18, 2019

WSJ weighs in on easing cycle

Global Easing Cycle Gains Momentum as Central Banks Cut Rates

With Fed and ECB expected to cut rates soon, central banks in South Korea, Indonesia and South Africa move first

By

Brian Blackstone

ZURICH—Central banks in Asia and South Africa lowered their interest rates Thursday, joining a global easing bandwagon that started earlier this year in the Asia-Pacific region and is expected to include the U.S. and Europe within weeks.

The latest moves, by central banks in South Korea, Indonesia and South Africa, underscore the global nature of the brewing rate-cutting cycle, as policy makers attempt to ward off signs of weaker economic growth. With economies and financial markets interconnected, expectations of lower interest rates by the Federal Reserve and European Central Bank have given central banks in emerging markets scope to lower rates and prop up their economies.

“I think this will provide further impetus for Asian central banks in their easing cycle ahead,” said Prakash Sakpal, an economist at ING Bank.

Since April, New Zealand, India, Malaysia and the Philippines have lowered rates. China’s central bank has taken a number of measures to encourage lending to small businesses, and investors expect it to reduce benchmark rates if the Fed lowers its rates.

The Bank of Korea unexpectedly lowered interest rates for the first time in three years Thursday, responding to pressure to ease policy as economic growth slows. It lowered the base rate by a quarter percentage point to 1.5%.The move took analysts by surprise.

Of the 19 analysts polled by The Wall Street Journal ahead of the decision, 12 had forecast the central bank would stand pat this month and cut the rate in August.The central bank signaled more rate cuts may be coming, downgrading its growth and inflation forecasts for 2019.

Of the 19 analysts polled by The Wall Street Journal ahead of the decision, 12 had forecast the central bank would stand pat this month and cut the rate in August.The central bank signaled more rate cuts may be coming, downgrading its growth and inflation forecasts for 2019.

Monday, July 15, 2019

GOLD AND THE COMPLACENCY BUBBLE

We are living through perhaps the greatest complacency bubble of all time.

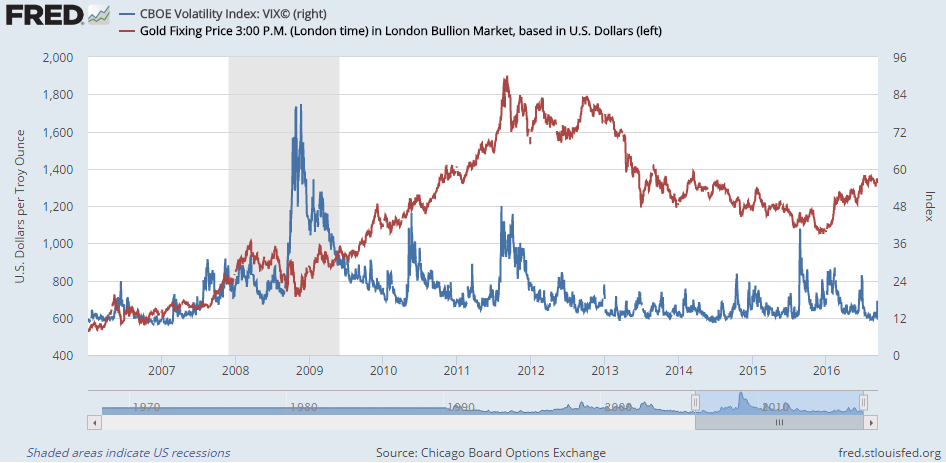

The vix, a measure of stock market volatility is at 12. During the panic in 2008 it was at 60.

Yet debt levels - government, corporate and private are all higher than they were before the crash of 2008. And they are currently exploding higher.

The wealth gap in this country - and around the world - is so serious that the vast middle class is going broke simply attempting to educate, feed and house and care for their children.

We have an openly racist president and a political party that tacitly supports this open racism; who regularly demonize large swaths of the population; who separate children from parents of asylum seekers and keep the children in cages, because it plays well with their base.

And we have a global regime of deeply negative real rates that transfers money out of the pockets of middle class savers and into the pockets of wealthy speculators in the risk markets.

Sure, there is a certain amount of media concern for all these problems. But overwhelmingly people seem to yawn and say "Sure it's sad but things could be a lot worse for me and most of my friends."

This spectacular bubble complacency will end like all bubbles.

The most interesting gauge of the end of the complacency bubble is the price of gold.

Gold is a hedge against instability.

And though gold peaked after the crash of 2008 and the peaking of the vix, it never came back down to where it was before the last complacency bubble. Defensive money was in gold early and held its position through the correction. The price drifted downward as complacency rose. But if you look at the chart below you see an interesting divergence beginning right now.

The vix is still falling but gold is rising. Markedly so. Somebody out there is seeing the end to complacency and loading up before the bubble bursts.

These somebodies have names like Stanley Druckenmiller, Ray Dalio, Paul Tudor Jones and David Einhorn. The paper gold market where these billionaire hedge fund managers load up, is quite thin compared to say the bond market or the stock market. When are few billionaires - along with a few governments like those of Russia, Turkey, Poland and Hungary, start buying, it can move the markets.

But the general complacency has left most retail buyers completely out of this gold rise. In fact, most media commentators believe this to be just another gold blip, that will surely deflate soon.

Maybe.

But to me it looks like some very smart money is beginning to sense the end of the Complacency Bubble.

And when it bursts, gold will be a reliable measure of the instability sure to follow.

Thursday, June 20, 2019

WHY DOES GOLD HEDGE AGAINST INSTABILITY?

Many many people see and feel the profound instability in the global economy.

Even if you're part of the one percent - in which case you're personally stable, you probably understand the instability even if you can't feel it.

The structural problem is that the value of money is deteriorating at a terrifying clip as the cost of housing, food, clean water, health care, and education continue to spiral out of control all the while the Central Banks of the World keep real rates deeply negative thus providing a huge return on risk assets for the rich all the while destroying the value of the savings of the middle class and the poor.

This can never end. The central banks can not raise rates because the bi-product of their rate policy is spiraling out of control debt.

Besides, they now see their mission as supporting the risk markets for the wealthy.

Thas is the definition of SOCIALISM FOR THE RICH.

It makes me laugh//cry when commentators decry the call for Socialsim. What the hell system do they think a Central Bank represents?

But the question here is why is Gold a hedge against this instability.

The answer is that gold serves as an alternate currency the can not be printed/created at the will of a third party. The supply is steady and limited. And once in the possession of the private citizen it is totally under the control of that citizen. It cannot be debased or devalued by decree. It does not tarnish. It can't be hacked. It is traded in every market in the world and readily convertible into any and every currency. It t leaves no electronic footprint.

And most important of all to stability - it has a 5000 year record of holding its value over time. Try to think of something else with that track record.

Tuesday, June 18, 2019

What do Billionaire Traders Jeff Gundlach, Ray Dalio, Paul Tudor Jones, Stanley Druckenmiller and David Einhorn have in common?

What do Billionaire Traders Jeff Gundlach, Ray Dalio, Paul Tudor Jones, Stanley Druckenmiller and David Einhorn have in common?

If you guessed they are all long gold - as their favorite investment right now, you'd be correct.

If you guessed they are all long gold - as their favorite investment right now, you'd be correct.

Greenlight Capital CEO David Einhorn, In a letter to shareholders, said he is using gold to hedge against “imprudent” global monetary and fiscal policies. Like Gundlach, he is concerned about US debt hitting new limits.

While speaking to Bloomberg on June 12, billionaire investor Paul Tudor Jones revealed that his favorite pick in the next 12–24 months is gold. He thinks that if gold hits $1,400 per ounce, it will quickly move to $1,700. After Donald Trump’s tarrif tweet on May 5, Stanley Druckenmiller dumped his other investments and piled into Treasuries, which he suggests along with gold in this environment.

These guys made their billions by being right in an environment where a very few wrong decisions will bankrupt you.

But if you only understand one thing about gold understand this: GOLD IS A HEDGE AGAINST INSTABILITY. It doesn't really rise or fall much in value, It just falls out of favor when the global economy appears stable, and falls back into favor when the global economy is unstable.

The Global economy had never been more unstable. Debt is exploding. Real Rates are deeply negative. Nominal rates are negative in much of the world and will be so here too soon. Wealth Gaps are enormous and ever increasing.. And all these problems are accelerating.

BUT - HASN"T THIS BEEN THE CASE FOR THE LAST 40 years?

Yes it has. Good point. The difference now is that nobody is even giving lip service to trying to solve these problems. Those in power are milking the system to get every last penny out of it before it collapses. Those out of power who seek power are looking to tear it all down and start over.

Most in the middle are just bewildered.

If your attitude is SO FAR SO GOOD - WHY WORRY - you're like the guy who jumped off the Empire State Building and said that as they passed the window on the 40th floor.

If you, like so many others, see instability, maybe hedge against it a bit with gold.

Wednesday, June 12, 2019

GOLD VERSUS BITCOIN

There is a current debate as to the relative merits of Gold versus Bitcoin as an alternate currency. In fact, many serious analysts track the relative trading movement of these two vehicles and have noticed they tend to move inversely as one ore the other gains more popularity.

Yet, to me, this is a terribly confused debate. Though both Gold and Bitcoin can be described as "alternate curencies," the similarities end there.

The whole point of Gold is that it is a currency that resides in the possession of the private citizen. Not in a third party regulated exchange or facility. You keep your gold where you will. In this way you have total and direct control of this source of wealth. This protects from any and all outside interference. And because gold is perfectly inert and never degrades or tarnishes your source of wealth is perfectly stable and always within your control

Bitcoin is stored in virtual reality. During a blackout Bitcoin ceases to exist. Your wealth is gone.

Bitcoin can be and has been hacked. Your wealth is gone. And you have no recourse against hackers. You can not defend yourself against them with force of arms, force of will, ingenuity. It is completely out of your control.

Bitcoin is at the mercy of the integrity of a particular bitcoin exchange. Unless you're a terrorist or a tax cheat then what's the point of putting your faith in some unknown exchange entity as opposed to putting your faith in the government currency?

They say Bitcoin has a finite supply - Unless the protocol is changed. That's like buying a limited edition print numbered out of no more than 100 - unless the artist decides to do a new edition. How naive can you be?

Finally Gold is eternal. When you die you can leave your gold to your family. When people who own Bitcoin die, unless the code has been passed on to others - which defeats the point of owning Bitcoin - the Bitcoin ceases to exist.

Gold never ceases to exist.

Friday, June 7, 2019

COINS AND MEDALS: VALUE INVESTING VERSUS MOMENTUM TRADING

COINS AND MEDALS: VALUE INVESTING VERSUS MOMENTUM TRADING

As in any type of investing there are those who seek value and are happy to hold to such a time where the market realizes and rewards value.

Then there are those who seek to acquire items that are "hot" and turn them over as they are rising.

Most traders trade momentum. Most traders eventually go broke. Some super financial traders like George Soros and Stanley Druckenmiller make billions. This is the very rare exception.

In the world of Hard Assets there are also many traders with short term horizons who seek to flip assets. Television infomercials are filled with them.

In the coin world, momentum trading most often has to do with Grades assigned by grading companies. Trading on grades like all types of momentum trading is a good way to eventually go broke.

The discipline of investing, on the other hand has to do with identifying value and having the conviction of your vision and then holding until the market rewards you conviction.

In the financial world identifying value has to do with finding good honest management, competitive advantage for products that serve consumers need, and the ability of companies to produce products efficiently so that margins can support profits.

In Hard Assets identifying value has to do with finding assets that because of some Intrinsic Value will appeal to many consumers over long periods of time.

This leads to the question of What is Intriinsic Value?

In all Art two qualities are always appreciated above all others. 1) Beauty. 2)Historical Importance.

And then the third quality to take into account is State of Preservation.

Obviously State of Preservation is easiest to assess so for many unimaginative and uninformed art investors it becomes paramount.

Beauty is the toughest quality to assess for most because there are always sharp debates as to what constitutes beauty. One thing is sure though: Beauty can only be fully appreciated in person as it will evoke emotion. Photographs that accurately portray art created in other mediums rarely if ever convey the emotion evoked by the beauty of the object.

However, one thing to keep in mind is appreciation of Beauty can be learned. Even if you don't react the way you'd hope to something others find beautiful you can learn to understand why something is beautiful in another culture or simply another intellectual milieu. That doesn't mean you have to agree, but in developing your understanding and expanding your horizons you do yourself an enormous favor as an investor in Art.

Historical Importance usually has to do with A) the Events coincident to the artistic creation and B) the Innovation associated to the Artistic Creation itself. These are ideas that can be learned and appreciated by anyone.

For example Da Vinci created beautiful works of art. But even if you happen not to be moved by them, nobody can dispute the importance of the fantastic Innovation of his artistic output in terms of the materials and how he manufactured and applied them, as well as the manner he applied them in terms of perspective, proportion and his advanced understanding of how things are constructed. And no one can dispute the historical importance of his scientific discoveries and inventions that were conveyed in his art but transcended art. Add to all this the fact that Da Vinci epitomised Humanism at the height of the Enlightenment and you have a figure of towering Historical Importance.

This is the art investing trifecta.

Bringing this all back to Coins and Medals. My point is this: Educate yourself to understand the Histocial Importance of the the objects, and to appreciate their Beauty and you will be developing the tools for value investing.

Then buy what you like.

Tuesday, March 26, 2019

Gold and the debt bomb

Massive debt is probably gold best friend.

The Governemnt/Coroporate/household debt levels in our economy are now higher than they were when the economy crashed in 2008

Massive debt is only possible with a government policy of negative real rates. The low/negative rates encourage, in fact, demand, a massive build up of debt.

That is the purpose. Not to argue whether the debt is good or bad. That's irrelevant.

The salient fact about the super low rates is that the massive debt ensures the rates must stay low forever, and the low rates ensure the build up of debt is perpetual.

That is a mathematically inviolate perpetual motion machine that stops only when the entire system collapses.Inevitable (As the preposterous architect from matrix would say)

People have noticed the correlations between debt / rates/ gold price.

The truth is that isn't the debt or the rates per se that affect the gold price but the massive instability in the low rare / massive debt environment we are in that ensures the gold price must rise.

Because gold rises with instability.

Thursday, March 7, 2019

Why do some coin types suddenly disappear from the Market? Scarcity, Rarity in a Demand Driven market.

Scarcity, Rarity in a Demand Driven market.

The truth is that all markets are essentially demand driven.

If everyone suddenly realized their I phone 37 was essentially exactly the same as their I phone 3 Apple profits would disappear.

If everyone suddenly realized commodities-trader turned "artist" Jeff Koons was essentially making fun of his own clients a Balloon Dog would suddenly have no value at all.

Demand for drugs is why no policy directed at curbing the supply of drugs is ever effective.

Demand for capital in a debt ridden economy is why Supply Side Economics is suddenly impotent.

The coin market is another Demand Driven market. Take the "rare and valuable Mint State flowing hair large cent. "Only" 1200 1793 lots have been auctioned with the high hammer having gone at close to a million dollars.

Now, in other areas of the coin market, say Ancients, or Medieval coinage, if any particular piece had come up for auction 1000 times, it would be considered the most common coin available, and even coins of excessive beauty, and historical interest would have trouble breaking the $5,000 dollar mark were they that common.

For example, a particularly nice mint state Daric of exceptional style, might have come up for auction 10 to 20 times, while run of the mill mint state daric probably has come up for auction 100-200 times (85 have been graded mint state or better - which seems like a tremendous amount in the current ancient coin market) Still, a Gem daric only hammered at $25,000 and nicest fines style mints state Darics only make slightly more that $15,000

This is because the Ancient and Medieval markets are tiny compared to the US market. But as demand shifts, coins and medals that were at one time readily available are suddenly impossible to find.

This is where supply comes in. In very tight markets small shifts in demand can cause large price bumps, and pieces that once seemed available can disappear off the market

The most difficult thing for a collector coming from US coins to get their head around, is how relatively tiny (compared to the US markets) these markets are - in many areas.

For example, about five years ago a horde of 20 shooting darics hit the ancient coin market.

I use Darics as examples because these were from 500 BCE to about 336 BCE the reserve currency of the Eastern Ancient world - while Athenian Owls and Kyzykian Staters were the reserve currency of the Western Ancient world.

As such, the Darics are easily the most common Ancient Gold pieces along with the Alexandrine Gold Staters that replaced them after Alexander the Great.

But the fact is there are many more MS 1793 Flowing Hair Dollars floating around than there are MS Darics.

There was a relatively large and recent horde of Darics which has still not been fully absorbed by the Ancient Coin Market. But for new collectors, wait about 2-3 years and as the market grows and the horde is absorbed, my guess is that mint state Darics will become quite difficult to find at auction or in dealer inventories.

You can extend that logic to other areas of the Ancient Coin market that aren't nearly as plentiful.

Subscribe to:

Posts (Atom)