A rising price of gold does not devalue the dollar, because there is

no official link between gold and the dollar. The world’s monetary and

financial systems have no link to gold. Gold can be any price without

causing any effect upon those systems. We have seen gold at $1900

dollars per ounce, and things were running just as they were when gold

was $300 dollars per ounce.

Gold ManipulationWhy?

However, the rising price of gold is a huge embarrassment to the US

government not because it devalues the dollar (it does not do this) but

because it provokes a loss of confidence in the dollar. When the dollar

is seen as falling in value against gold, its fall causes investors to

exchange dollars and other currencies for gold as a means of protecting

wealth. The rising price of gold is a blot on the prestige of the US

dollar and the prestige of the US itself.

The price of gold in dollars is therefore under strict government

control. This fact, once derided as ridiculous, is increasingly accepted

as truth by those interested in monetary matters around the world.

Gold Manipulation How?

The

means for controlling the price of gold lies in the massive sales of

“paper gold” which take place to suppress its price, as so many

investigators have amply documented.

US monetary policy considers that the dollar is here to stay forever,

and that gold is no longer - and never again will be - the world’s

ultimate money.

The governments of several nations around the world do not share the

same conviction with regard to the permanence of the dollar. China

invented irredeemable paper money – which is what the whole world uses

today – some one thousand years ago, and several dynasties of Chinese

emperors learned to their cost that paper money always degenerates into

simple trash.

Gold Manipulation: So what?

The Chinese government knows that the dollar will not be around

forever. China is purchasing enormous amounts of gold to add to their

huge pile of US Bonds in the reserves of the Bank of China; the

government of China is more enlightened than the government of the US,

because it is encouraging the Chinese to purchase gold and silver.

The US and its allies are allowing the Chinese and Asia in general,

to take possession of huge amounts of gold every year, while the US, the

UK and Europe are drained of gold by shipments to the East.

The US evidently believes that the dollar is here to stay and that gold is just a passing fancy. This is classic hubris or arrogance.

When serious problems for the dollar surface – as they surely will –

and the US has little or no gold to fall back on, the US with its back

to the wall may become a very dangerous entity. The US Standard of Living will certainly degenerate. The questions is, how dramatically for the vast middle class that is already struggling mightily. And then, what will be the response of a government that is suddenly faced with the loss of the ability to simply print their way out of every financial problem?

http://gold-stater.com is now providing daily gold market and gold coin market commentary and updates. Please check in regularly to find the latest developments in gold and gold coins.

Total Pageviews

Monday, March 31, 2014

Sunday, March 30, 2014

Nice finds dept:

The price of peace? Nobel Prize, awarded to Argentina’s foreign minister in 1936 is bought for $1.16 MILLION after being discovered in South American pawn shop

- The Nobel Prize was awarded to Carlos Saavedra Lamas for his work ending the Chaco War

- After Mr Lamas's death in 1959, much of the medal's history is unknown

- It was sold to a pawn shop in 1993 and passed through various collectors before turning up at auction

- It was bought by an Asian collector who asked to remain anonymous

- It is only the second Nobel Peace Prize ever to be sold at auction

A Nobel Peace Prize has sold for a staggering $1.16million after being unearthed in a South American pawn shop - more than 11 times what experts estimated it would fetch.

The gold medal - only the second Nobel Peace Prize ever to be sold at auction and the first in the United States - was originally awarded to Argentina's Foreign Minister Carlos Saavedra Lamas in 1936, for his role in ending the Chaco War between Paraguay and Bolivia.

Brian Kendrella, president of New York-based Stack's Bowers Galleries, which oversaw the medal's sale at the Whitman Expo conference, in Baltimore, yesterday, said the auction drew half a dozen bidders from six countries.

+4

Much of the history of the 1936 Nobel Peace Prize is shrouded in mystery and has sold to an unknown buyer

+4

Carlos Saavedra Lamas was the first Latin American to receive the Nobel Peace Prize

The winning bid, which came in via phone, was from and individual collector from Asia who asked to remain anonymous.

The prize sold for $950,000 but buyer's commission brought the final price to $1.16 million.

This is only the second Nobel Peace Prize to come to auction. This award marked the first time someone from Latin America received the honor. The 1936 recipient was Argentina's foreign minister, Carlos Saavedra Lamas.

Engraved on the side of the medal is the year it was awarded, the recipients name and the words 'Nobel Peace Prize' in French.

The prize sold for far more than the gallery's estimate of $50,000 to $100,000.

Saturday, March 29, 2014

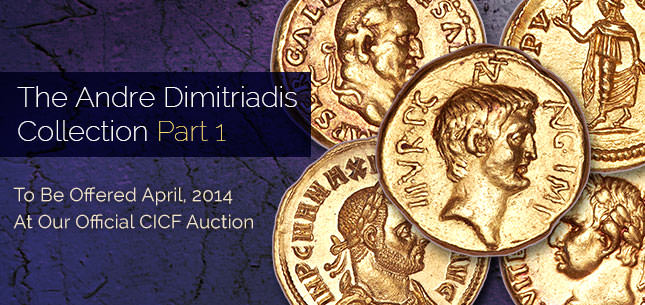

Spring Auctions: Heritage makes a statement for graded ancients

Heritage Auctions will cap the spring auction schedule with a major collection of Roman Gold assembled by Andre Dimitriades. This is combined with selections from another major ancients auction the "Lexington Collection."

These are both collections that undoubtedly would have ended up in with major European houses like Numismatica Ars Classica (NAC) or NGSA in yeas past. Heritage was able to lure these collections away from their European competitors in part because of a state of the art online platform coupled with tremendously effective PR support. But also because the US market has become deep enough with the arrival of a collector base that is moving from US Coins into Ancients with the advent of the NGC grading program.

The fact that all the Roman Gold will be either slabbed or provided with a NGC photo certificate attests to the arrival of graded ancients on the international stage.

The collection includes many rarities such as the beautiful Antony aureus pictured above with what is unquestionably the finest portrait of this seminal historical figure in any medium, as well as spectacularly well preserved Caesar and Cassius aureae and impressive runs from each and every Emperor. The late Roman is particularly amazing as there are as many as ten solidi from many emperors considered scarce like Theodosius the Great.

The auction will be held live in Chicago along with the coin fair, which long has been a locale for mainly US collectors.

To be sure, many old school collectors and dealers still deplore graded coins. Some reasons are valid, as some very skilled and knowledgeable collectors hate to be told by a third party how to value and grade a coin. It's an individual art. Experienced connoisseurs value their own opinion. Other reasons are less noble as unscrupulous dealers will pass off tooled, smoothed and otherwise repaired coins - as well as outright fakes - as genuine and original. Heritage is riding the line by providing NGC photo certs form many of these rarities.

But as these important historical artifacts become more and more expensive it's natural that investors care to know a coin is original and genuine.

The success of the new Heritage Ancients division has prompted the company to add their first auction later this summer for only high value ancients coins.

There is no doubt that that NGC combined with Heritage have cast the first stone on the world stage for graded ancients which unquestionably appeals to US collectors. Eventually many Europeans will come to accept it too.

Thursday, March 27, 2014

Jim Rickards agrees too:

“The last time the system

collapsed in 2008, the Fed rescued it. How did they do that? Well, we

know the Fed printed over $3.5 trillion in new money in the last 5

years.

The Fed’s balance sheet went from $800 billion to over $4 trillion. People understand that.

What’s less well known is the swap lines with Europe . . . European

banks had dollar liabilities because they borrowed money in dollars. . .

.

went from $800 billion to over $4 trillion. People understand that.

What’s less well known is the swap lines with Europe . . . European

banks had dollar liabilities because they borrowed money in dollars. . .

.

Where did the European Central Bank get the dollars they needed to

bail out their own banks?

They got them from the Fed.

They gave us euros and we gave them dollars. So, these dollar/euro

swaps were in the tens of trillions of dollars. . . .

In addition to

that, the Fed guaranteed every money market fund in the United States . .

. and they guaranteed every bank deposit in the United States. Here

you have a massive $60-$100 trillion bailout, not the $4 trillion you

were told. Fast forward to today. When the next collapse comes, it is going to be bigger than the last one.

forward to today. When the next collapse comes, it is going to be bigger than the last one.

It’s going to be exponentially

bigger. The five biggest banks that were too big to fail in 2008, today

they are bigger. They own a larger percentage of the total banking

assets. . . . When you double or triple the scale of the system, you

don’t double or triple the risk. You increase the risk by an exponent

that could be 10 times or 100 times.”

On the Fed engineering another

2008 type bailout, Rickards claims, “The last crisis was barely enough

for the Fed to contain. They have used up all their dry powder. They

can’t take the balance sheet any higher. They are already insolvent. . .

. The Fed is insolvent.

If you mark their assets to

market, they are leveraged 80 to 1, and interest rates have been going

up. So, a very small decline in the market value of their assets and it

wipes out their capital. It’s a very simple math. So, we have an

insolvent central bank.

The next crisis is going to be

bigger. You can see it coming. It is going to be too big for the Fed.

They have taken their balance sheet to $4 trillion. What are they

going to do, take their balance sheet to $8 trillion and leverage 200 to

1? The game is up. This has become very apparent. They are insolvent

on a mark to market basis today, not like next year or the year after.

They are insolvent today.”

Rickards foresees big inflation because the U.S. dollar’s buying power will shrink. Rickards predicts, “Imagine gas at $20 a gallon and bread

at $10. That’s what we’re talking about.” So, if big inflation is

coming, what about gold? Rickards says, “When I say the price of gold

is going to $7,000 or $9,000 per ounce, which I expect it will, what I

am really saying is the dollar is going to collapse 80% or 90% or

more.” It did in the 1970’s. None of this is unprecedented, it all

happened before.”

will shrink. Rickards predicts, “Imagine gas at $20 a gallon and bread

at $10. That’s what we’re talking about.” So, if big inflation is

coming, what about gold? Rickards says, “When I say the price of gold

is going to $7,000 or $9,000 per ounce, which I expect it will, what I

am really saying is the dollar is going to collapse 80% or 90% or

more.” It did in the 1970’s. None of this is unprecedented, it all

happened before.”

Rickards says, “When a collapse

happens, it will happen quickly. You won’t see it coming. There won’t

be time to run out and buy gold, and it probably will not even be

available at that stage. You need to prepare now.”

Wednesday, March 26, 2014

I'm not the only one dept:

March 26 (Bloomberg) -- When Seth Klarman speaks, listen

carefully.

Very few hedge-fund managers are as widely and consistently

acclaimed as is Klarman, the 56-year-old founder of the Boston-

based Baupost Group. The fund has about $27 billion in assets

under management -- after returning $4 billion to investors last

year:

“There’s more than enough to be concerned about.” Klarman

wrote in his latest letter. He sees artificially high prices everywhere

he looks in the stock and bond markets.

“A policy of near-zero short-term interest rates continues to

distort reality with unknown but worrisome long-term

consequences,” he said in his letter. “Even as the Fed begins to

taper, the announced plan is so mild and contingent -- one

pundit called it ‘taper-lite’ -- that we can draw no legitimate

conclusions about the Fed’s ability to end QE without severe

consequences. Fiscal stimulus, in the form of sizable deficits,

has propped up the consumer, thereby inflating corporate

revenues and earnings. But what is the right multiple to pay on

juiced corporate earnings? Pretty clearly, lower than

otherwise.”

He noted that the Nobel-winning economist Robert Shiller

has calculated that the stock market’s price-to-earnings ratio

is more than 25, “a level exceeded only three times before --

prior to the 1929, 2000 and 2007 market crashes. Indeed, on

almost any metric, the U.S. equity market is historically quite

expensive.”

What’s more, Klarman wrote, “a skeptic would have to be

blind not to see bubbles inflating in junk bond issuance, credit

quality, and yields, not to mention the nosebleed stock market

valuations of fashionable companies like Netflix and Tesla. The

overall picture is one of growing risk and inadequate potential

return almost everywhere one looks.”

In “an ominous sign,” he said, there are fewer market bears now

than at any time since 1987. “A paucity of bears is one of the most

reliable reverse indicators of market psychology,” he continued. “In the

financial world, things are hunky dory; in the real world, not

so much.”

There is also wild speculation in the credit markets,

thanks to the Fed’s seemingly endless quantitative easing

program. “Even with yields in the cellar, investors snapped up a

record $1.1 trillion of high-grade corporate debt in 2013,”

Klarman wrote. He pointed out that the issuance of below-

investment-grade leveraged loans (bank loans issued to highly

leveraged companies) reached $683 billion, topping the 2008

record by almost 15 percent, and that more than half of those

were covenant-lite (bank loans with few restrictions on the

borrower).

In addition, $63 billion of dividend-recap issues (in which

companies float bonds to pay shareholder dividends) also set a

record. Junk-bond financings totaled a near-record $324 billion.

Bond buyers, desperate for return, bid up junk-bond prices to a

record low yield of 4.97 percent, he wrote.

Klarman is eloquent when describing the dangers lurking in

the financial markets. He says giddy investors are living a

“Truman Show”-like existence, where on the surface everything

seems idyllic. In reality, the manufactured calm -- thanks to

the “free-money” policies of Ben Bernanke, Janet Yellen and

Mario Draghi -- anesthetizes us to the looming trouble.

Morphine is like that, I hear. “Inside the giant Plexiglas

dome of modern capital markets, just about everyone is happy,

the few doubters are mocked and jeered, bad news is increasingly

ignored,” he wrote. “The longer QE continues, the more bloated

the Fed balance sheet and the greater the risk from any

unwinding. The artificiality of today’s markets is pure Truman

Show.”

It isn't often that Klarman’s investment letters slip

through his fund's carefully constructed walls of

confidentiality. Because this one did, and it is so uncommonly

wise, mere mortals should stop and take note. “Like a few

glasses of wine with dinner, the usual short-term performance

pressures on most investors to keep up with the market serve to

dull their senses, which makes it a bit easier to forget that

they are being manipulated,” he concluded. “But what is fake

cannot be made real.”

Monday, March 24, 2014

Nice find dept:

Henry VII's bed among England's most valuable furniture

Bought for just $3,500, King Henry VII's bed is now worth $33.3m

A bed created for the marriage of King Henry VII and his wife, Elizabeth of York, is thought to be one of England's most valuable pieces of furniture.

The bed was paraded round the north of England after Henry VIII was born |

The bed was bought at auction for just £2,250 ($3,500), and will now go on display at Auckland Castle in the UK as the only piece of furniture from the Tudor court to have survived.

A report in the Sunday Times indicates the bed is now valued at £20m ($33.3m).

Described as Victorian, Coulson initially believed it was the work of revivalists, but soon noticed the carvings were more in line with those of Henry VII's era.

Contacting Jonathan Foyle, chief executive of World Monuments Fund Britain, the pair have been tracking the bed's history since 2010. It can be traced back to 1495, when Henry VII took the bed on a tour of northern England following the birth of his son, the future Henry VIII.

One of Britain's most iconic monarchs was likely conceived between the bed's sheets.

During the tour, the king is said to have visited Lathom, Lancashire. Here he saw the Stanley family, who had helped him secure victory in the Battle of Bosworth against Richard III.

The battle marked the finale of the War of the Roses, a war that had raged for years between the houses of Lancaster and York.

"This bed belonged to Henry VII. It has to be the most important piece of furniture - and arguably, royal artefact," commented Jonathan Foyle.

"Even the Westminster coronation chair has less to say than this."

Carvings on the bed show Henry VII and his wife depicted as Adam and Eve, evidence of the belief that the Tudors had been appointed by God to save England from civil war.

'It's arguably the cradle of the English Reformation," added Foyle.

"Look how the king and queen represent themselves as manifestations of Christ and Mary; it's Henry VIII's God complex in a nutshell."

An inscription added in 1547, the year of Henry VIII's death and the first of a Protestant monarch in England, reads: "The stinge of death is sinne. The strength of sinne is the lawe".

Sunday, March 23, 2014

Gee: that's 3/7 of the world's population right there:

China, India back President Putin in Crimean reunification with Russia

Vladimir Putin stressed the support China showed during the UN Security Council meeting as the council sought to declare the Crimean referendum illegal. “We are grateful to all those who understood our actions in Crimea,” Putin said. “We are grateful to the people of China, whose leadership sees the situation in Crimea in all its historical and political integrity. We highly appreciate India’s restraint and objectivity.”

Moscow vetoed the resolution, while Beijing abstained.

This

step wasn’t seen by mass media as clear support for the Crimean

reunification and even deemed as a ‘slap in the face’ for Russia by

Western diplomats.

Yet, the step by Beijing was considered as clever and politically far-seeing.

China

wasn’t able to veto the resolution on Crimea alongside Russia as it has

its own domestic issues like Tibet, Xinjiang, Hong Kong and Taiwan. But

it has now deepened its relations with Moscow and gained a potential

ally for the future when Beijing will have to make hard political

decisions.

India also remembers the support Moscow

showed in 1975 when New Delhi had the same situation with Sikkim, a

landlocked state located in the Himalayan Mountains. At that time India

was under heavy diplomatic pressure from the West, especially from the

United States.

Sikkim became 22nd state of India, when 97.5 % of residents voted in favor of reunification with New Delhi.

Argentine

leader Cristina Fernandez de Kirchner also showed her support for the

Russian Federation recalling that “the UN Charter stipulates the right

of people to self-determination, which means that this rule should be

applied to all countries without any exception”.

She

compared the situation in Crimea with the one around the Falkland

Islands, where a referendum was also held a year ago. The UN did not

question the legality of the vote at that time, Kirchner reminded.

The

situation around the Falkland Islands led to a war between the United

Kingdom and Argentina in 1982. The UK saw it as an invasion of territory

that has been British also since the 19th century. Buenos Aires lost in

the conflict, diplomatic relations between the two were restored only

seven years later in 1989 .

Read more: http://voiceofrussia.com/2014_03_19/China-India-back-President-Putin-in-Crimean-reunification-with-Russia-5588/

Read more: http://voiceofrussia.com/2014_03_19/China-India-back-President-Putin-in-Crimean-reunification-with-Russia-5588/

GOOD FINDS DEPT:

Rare Beatles Record Fetches $290,500

Source: WhatSellsBest.com) - A fierce bidding-war skyrocketed the price of a rare Beatles Record to a record-breaking $290,500 (after buyer premium).Perry Cox, a well-known Beatles memorabilia expert (and top-rated eBay seller), was quoted in the Heritage auction listing, saying; "With my being thoroughly immersed in Beatles collectibles for over 30 years, it takes something extraordinarily special to excite me, but I consider this to be one of the top two items of Beatles memorabilia I've ever seen - the other being a signed copy of Meet The Beatles."

|

$33 Million for Golden Egg Found in 'Scrap Buy'

MIDWEST, USA - A scrap dealer who purchased a golden egg at an antiques sale for $13,000, has discovered he bought a Faberge Ornamental egg valued at $33 million (£20 million).

HENRY VII'S BED bought unattributed at auction:

$3,500-Paid for Royal Bed valued at $33 Million CHESTER, UK - An antique bed that was purchased for $3,500 at auction, has been identified as once belonging to King Henry VII, and is now valued at $33 million (£20 million). |

$75 Million for da Vinci Painting found at Estate Sale

$75 Million for da Vinci Painting found at Estate SaleLONDON, UK - A Leonardo da Vinci painting found by a dealer attending an American estate sale, has sold in a private transaction for more than $75 million.

$20,000 Marvin Gaye Passport Found in 50¢ Record

$20,000 Marvin Gaye Passport Found in 50¢ RecordDETROIT, MICHIGAN, USA - Marvin Gaye's 1964 Passport was found tucked away in a 50¢ record that was bought by a man at an estate sale. The passport has been valued at $20,000.

$15 Necklace from Flea Market may fetch $300,000

$15 Necklace from Flea Market may fetch $300,000PHILADELPHIA, PENNSYLVANIA, USA - A rare Alexander Calder Necklace that was purchased at a flea market for $15, is expected to fetch as much as $300,000.

|

$48,000 Gold Coin Discovered with Metal Detector

SOUTH WILTSHIRE, UK - A 1,700-year-old Roman gold coin found with a metal detector in a field, is expected to fetch $48,000 (£30,000) at auction. |

$700-Painting Purchase, Valued at $700,000

$700-Painting Purchase, Valued at $700,000CHESHIRE, UK - A painting purchased for $700 (£400) at an antiques shop has been identified by Antiques Roadshow as a Van Dyck portrait worth $700,000 (£400,000).

|

$5.9 Million for Rare Carved Figure Found in Attic

HUDSON, NEW YORK, USA - A carved Fabergé Imperial figure discovered in a Rhinebeck New York attic, has sold for $5.2 million. The sale far exceeded its pre-sale estimate of $500,000 - $800,000. |

Thursday, March 20, 2014

The Fed's Pyrrhic victory.

Pyrrhus of Epirus was an extraordinarily skilled general who bested the Romans in a series of battles in about 280 BCE. However, the farther he drove his troops into Magna Graecia (Italy) the farther his supply lines were stretched and the more precarious his strategic position. At the battle of Asculum his troops killed 6000 Romans while suffering less than 3000 casualties. Yet after the battle, Pyhrrus famously commented that were he to win one more battle against the Romans, he would be utterly ruined. He quickly withdrew back to Epirus and lived to become master of Sicily.

This story recalls the joke about the guy who jumps off the Empire State building and remarks, in contradistinction to Pyhrrus, as he passes the 50th floor: "So far so good..."

The Fed is now in its 6th year in a war against excessive debt. It is fighting the war by creating trillions upon trillions of new debt which it uses to retire "bad debt" which weighs on the balance sheet of the big banks. The casualties in this war are the middle class whose lives depend on yield and savings. There is no more yield, so savings are being confiscated to help keep the banks and the risk markets afloat.

Despite all the big talk about "normalization" there will never ever be any yield. Never. Because with 17 trillion of government debt ant another 70 trillion of unfunded liabilities the government couldn't survivive a positive rate environment.

The banks - and the government (is there a difference?) use all the new money (debt) to gamble in the risk markets - especially the stock market which is floating ever higher on this wave of margin-debt gambling. The high stock market and low rates give the appearance of Victory.

The question is: do we say that the cost of this victory will be utter ruin. Or do we say "so far so good"?

The answer, sad to say, is pretty obvious.

Yet, if all is well, after six years of victorious battle, why then is the ten year mired at 2 1/2 percent? Why is the real unemployment rate at 15 percent? Why is capital expenditure growth slowing to the lowest rate since 2010? Why does the velocity of money look like this:

The velocity of money is the very definition of money turning over in a productive economy. It's not happening. Because risk market gambling is a zero sum activity. Risk market gambling creates no jobs. Risk market gambling mis-allocates capital. Risk market gambling is neither capitalist nor socialist. Risk market gambling is a disease the eats at the fabric and the soul of the economy.

At what point does the new Fed Head Janet Yellen look out over the battlefield as say: if we win won more battle in this war on debt we'll be utterly ruined?

Wednesday, March 19, 2014

Spring Auctions: Caveat Emptor

Lot: Lot: |

| 246 | Estimate: 15'000 EUR | Starting price: 12'000 EUR |

A/ Tête d'Apollon à droite.

R/ ΦΙΛΙΠΠΟY. Bige à droite.

RR FDC. GC.6663

Au ; 8.63 gr ; 18 mm

Collection LIM. Monnaie d'une qualité remarquable. Vente Maison Palombo 8 lot 5.

Starting Price: 12000 EUR

Estimate: 15000 EUR

Here's a perfect example of why slabbed coins are becoming so important to the ancients market. The above coin on sale this month in a major French auction, is fake. Someone may pay the estimate which all in will cost him or her about $26,000. That's reasonable for this coin in this condition - were it real. That's a lot of money to pay for a fake coin. Especially when the coin has a provenance - from another major French auction house. It may well be that both auction houses consider this to be real. It's a good fake - if it's a fake. Yet, I'm pretty sure it is.

Now I haven't seen it in person. Maybe I'm wrong. But there are many fakes of this issue, and this one just looks wrong. If you can't tell why, it might be better for you to bid on slabbed coins.

Tuesday, March 18, 2014

Spring Auctions: Gorny and Mosch

The big surprise in the Gorny sale was the ferocious bidding for late Roman and Byzantine pieces of very high quality, and this in the face of a very large recent horde.

The rumor was the Russians who had previously confined their bidding to earlier Roman gold have now branched out into later issues like these below, that were once available for $2000 US dollars all day long. Of course, it's never been easy to find them in the condition they are seen below. Yet by ancients standards, with a little effort they have been quite available. They are still. But at 3-5 times the price. It goes to show how a very few wealthy bidders can skew a market.

And now the US bidders are entering the market because of the NGC slabbing phenomenon, one can only wonder where prices will be once they discover these slightly more arcane areas of ancients collecting:

Honorius:

Estimate: 1000 EUR

Price realized: 3400 EUR

Price realized: 3400 EUR

all in: $6,100

Theodosius I

Estimate: 2500 EUR

Price realized: 5500 EUR

Price realized: 5500 EUR

All in: $9,900

Even the Byzantine issues which a short time ago were available for under $1000 caught a bid in the same auction:

Heraclius:

Estimate: 1500 EUR

Price realized: 3400 EUR

Price realized: 3400 EUR

all in: $6,100

Basil II

Estimate: 750 EUR

Price realized: 3000 EUR

all in: $5400

Price realized: 3000 EUR

all in: $5400

Nice coins, no doubt, but at these prices, everyone must recalibrate. Of course, there's a danger of reading too much into any one auction. Auctions tend to be very unpredictable - and often times they can be poor predictors.

Yet, the same action was very much evident in the last NAC auction of Late Roman. This April, Heritage will be running a huge late Roman section of mostly slabbed coins. There are many pieces from each emperor. It will be very interesting to see how those pieces fare in the US market.

Saturday, March 15, 2014

The unloved medal gets a little love:

Kuenker Georg Baums medals auction:

Lot 5027

Gold Medal to 16 ducats 1646, by j. Höhn, on the second marriage of Władysław IV. with Ludovica Maria Gonzaga (* 1611, d. 1667), Princess of Mantua. SISTE GRADU.MP3 BELLONA IUBET NUNC JUNO QUIETEM. EN FACIAM TIBI SIT DULCIS AMORE QUIES. The crowned King with coat the to and sceptre and the Queen in robes sit in armchairs opposite each other under the richly decorated throne sky and range to the right hand, weapons lying on the ground...

This marriage medal struck in 1611, to commemorate Wadislav IV's marriage to Maria Gonzaga realized $75,000 with hammer fees in the latest Kuenker auction. It is difficult to compare the price to past auctions, as there are no other recent records of this medal changing hands. Clearly there were several wealthy bidders competing for Russian and East European medals, as pieces in those categories were very expensive indeed. For the Russians, at least, medals have become as interesting as coins.

In all 1090 medals were auctioned off from the Georg Baum collection, which included many rarities from all periods and countries.

Yet the very strength of the sheer number and variety guaranteed tremendous opportunity for medals collectors. In the arena of ancient coins, collections tend to center around broad themes that will attract specific collectors and foster tremendous competition for rare issues. But when an auction is so broad that it spans various continents and eras, it's easy for collectors to miss out on hidden gems.

In some cases, like a rare British Indian silver medal depicting Clive's seige of Pondicherry the piece realized 7000 dollars which was several thousand more than this medal had ever realized before;

But in other cases, extremely rare and beautiful pieces went for absolute baragain prices, like this Hamerani portrait of pope Innocence XI, which slipped through for an incredible $2500, when pieces in similar condition and rarity were auctioned off last year in an auction devoted to papal medals and coins for 10 to 20 times that amount:

Likewise, certain British and French rarities brought a tiny fraction of the price they would have cost in auctions devoted specifically to coins and medals of those countries. The same dynamic tends to hold true for coin auctions: when the auctions are sufficiently large and diverse rarities tend much more readily to slip through the cracks. But with medals, this tendency is certainly magnified as the collector base is still so much smaller.

In all there continues to be tremendous opportunity in the medals arena for collectors who have discovered this most unloved numismatic area.

Thursday, March 13, 2014

Does a 100 Trillion Debt

Total Matter?

Debt is everywhere but it just does not

seem to matter. Thanks to the folks at Zero Hedge, you get the account Global Debt Crosses $100

Trillion, Rises By $30 Trillion Since 2007; $27 Trillion Is "Foreign-Held"

– "Total global debt has

exploded by 40% in just 6 short years from 2007 to 2013, from "only" $70

trillion to over $100 trillion as of

mid-2013, according to the BIS' just-released quarterly review". They make

this assessment: "Not surprisingly, given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers (Graph C, left-hand panel). They mostly issue debt in domestic markets, where amounts outstanding reached $43 trillion in June 2013, about 80% higher than in mid-2007 (as indicated by the yellow area in Graph C, left-hand panel). Debt issuance by non-financial corporates has grown at a similar rate (albeit from a lower base)."There seems only one valid conclusion drawing upon these figures. Whatever economic activity exists is based upon government expenditures and that corporations have lowered their interest rates on their outstanding debt. The former is most disturbing, while the latter, under normal circumstances, would offer a promise of an expanding economy.

Since the former middle class has endured the greatest loss of income and experiences a distinct lowering in their standard of living since the financial meltdown, the prospects of main street prosperity seems remote at best. Corporations, as a whole, have improved their balance sheets as they lower their debt service, accompanied with cost efficiencies and reduction in employee costs. The day of the upward mobility career looks like a distant memory for the working class.

Government employment is growing, but such a public sector economy never produces actual wealth. Only a disturbing burden of welfare obligations of all kinds and an increase in state debt comes out of this pattern of a false and unsustainable economy.

On the contrary, is that ultimate collapse inevitable when the paper financial system just keeps churning out a rise in the stated 40% increase in debt in just 6 years? Why not just continue the quantitative easing influx of funds to roll over past debt and purchase the new bonds needed to run the State/Corporate economy. If this irrational strategy is not working, why has the bottom not dropped out of the world economy?

This is a very sobering viewpoint that defies the normal predictability of mathematical consequences. Surely, there can be no debate that this 100 Trillion indebtedness will never be paid off. However, the political accommodations always seem to invent another rescue plan that prevents the wheels of commerce from stopping.

The reason why the elites are able to get away with this practice of delaying the inescapable is that they make the rules of how to elude the last constrains that would impose accountability. The financial game is like a moving target that never flies out of range. The quarry just changes direction and speed. Requirements for default are rewritten and the next imposition of austerity packages demands even more harsh burdens for the taxpayers. Net result from this tactic is that the purchasing power of all paper currencies loses value.

Possessing a monopoly on money means that this alarming world indebtedness only requires a periodic company bankruptcy that liquidates the stockholder equity or a governmental devaluation of its currency, which further impoverishes its citizen’s wealth.

Remember that the Bank of International Settlement is the central bank for all the other banksters’ own fiat fractional reserve branches. The essential question to investigate is why does every readjustment of national borders with the creation or demise of a particular country, immediately establish a national bank that conforms to the standards of the banksters’ financial system?

The obvious reason lies within the control of debt created currency. Not until every facet or deed of possessions is encumbered with a property lien, will the debt total be modified to superimpose a new financial order.

The uber-rich are not a function of amassing wealth alone. Titans of financial oppression are manipulators of the political banking system. Being part of the decisions that expropriate from the common-man and consolidates greater control under the auspicious of an evil elite, is the chart that needs to be tracked.

Never underestimate the creative criminal wizardry of the central banksters to sell their next round of thievery or the gullibility of the masses to obey the dictates of outlaw governments.

Sunday, March 9, 2014

Nothing to worry about, totally manageable:

Global Debt Exceeds $100 Trillion as Governments Binge, BIS Says

By John Glover

Mar 9, 2014 7:00 AM ET

The amount of debt globally has soared more than 40 percent to $100 trillion since the first signs of the financial crisis as governments borrowed to pull their economies out of recession and companies took advantage of record low interest rates, according to the Bank for International Settlements.

The $30 trillion increase from $70 trillion between mid-2007 and mid-2013 compares with a $3.86 trillion decline in the value of equities to $53.8 trillion in the same period, according to data compiled by Bloomberg. The jump in debt as measured by the Basel, Switzerland-based BIS in its quarterly review is almost twice the U.S.’s gross domestic product.

Borrowing has soared as central banks suppress benchmark interest rates to spur growth after the U.S. subprime mortgage market collapsed and Lehman Brothers Holdings Inc.’s bankruptcy sent the world into its worst financial crisis since the Great Depression. Yields on all types of bonds, from governments to corporates and mortgages, average about 2 percent, down from more than 4.8 percent in 2007, according to the Bank of America Merrill Lynch Global Broad Market Index.

“Given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers,” according to Branimir Gruic, an analyst, and Andreas Schrimpf, an economist at the BIS. The organization is owned by 60 central banks and hosts the Basel Committee on Banking Supervision, a group of regulators and central bankers that sets global capital standards.

Saturday, March 8, 2014

Coins, stamps, scripts. instruments, paintings - and, oh,yeah, FOOD

Director Jean-Luc Goddard's handwritten script for his 1963 film "Contempt," which starred Brigitte Bardot, sold this week at Paris-based Artcuriel for $186,800, well over its $77,500-$103,000 estimate.

Ultra-rare Stamp May Realize $20m

February 21, 2014 What’s the rarest stamp in the world? It could be the 1856 British Guiana One-Cent Magenta. Three times since its issue, the example from Britain’s 19th century South American colony has broken the auction record for a single stamp. This time around, when it comes up for sale again on June 17th at Sotheby’s, the rarity is expected to sell for $10m-$20m.Three Rockwells Sell For $58.7m At Sotheby’s

Ali’s Gloves Knock Out Record

February 24, 2014 Boxing great Muhammad Ali’s boxing gloves have packed another wallop. At a Heritage sale in New York this past weekend, the pair that Ali wore in his first world championship win against Sonny Liston in 1964 sold for $837,000, setting a new auction record for boxing memorabilia.Gene Kelly’s “Singin’ In The Rain” Suit Sells For $106,000

The upright piano from the 1942 classic film "Casablanca"--the one on which Sam plays "As Times Goes By"-- sold for $602,500 at Sotheby's in New York.Auction of Rare 15th Century Torah to Fetch Up to $2.1 Million

6 hrs ago

| Posted by:

roboblogger

|

Full story: The Washington Post

A rare 15th century Torah volume, the first

printed version to unite all five books of the Hebrew Bible, is coming

to the auction block next month in Paris.

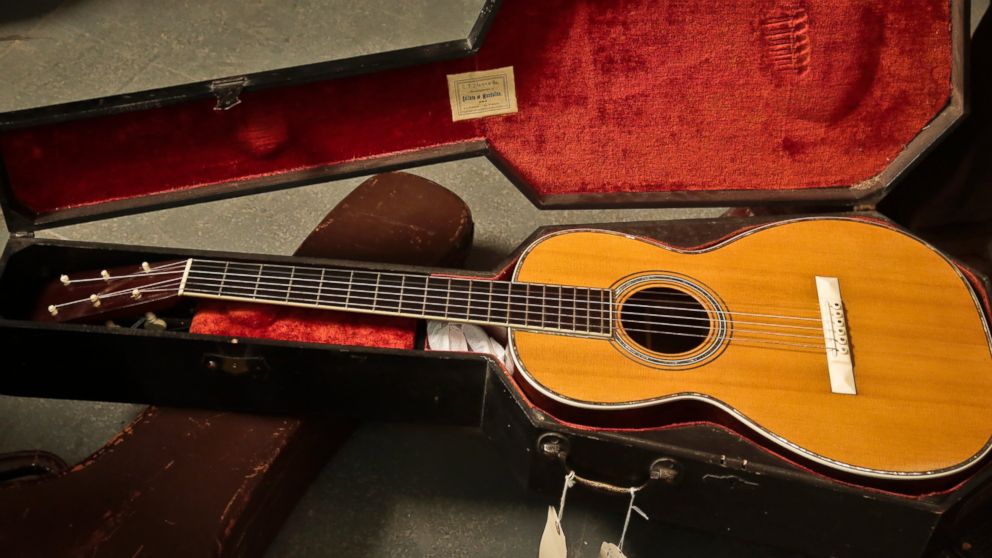

'Holy Grail of Guitars' Among Those Up for Auction

NEW YORK March 7, 2014 (AP)

By ULA ILNYTZKY Associated Press

A 1893 Martin guitar in a "coffin" case is

unveiled during a press preview, March 5, 2014 in New York. The guitar

is among a collection of 265 extremely rare guitars from a single

individual that will auction at Guernsey'??s on April 2 and 3.

Bebeto Matthews/AP Photo

The "holy grail of guitars" is among the hundreds of rare and vintage

acoustic guitars going on the auction block in New York next month.

California collector Hank Risan is offering some of his musical

instruments for auction by Guernsey's on April 2 and April 3. The 265

pieces from his collection are considered among the finest of vintage

guitars to come to auction in terms of rarity, original construction and

condition, the auction house says.

A wide range of makers are represented, including Gibson, Gretsch, Washburn, Stromberg and D'Angelico.

The earliest instrument in Risan's collection dates to 1840; the newest

is a 2000 re-creation of a 1930 Martin masterpiece, an OM-45 Deluxe.

Both the re-creation and the original will be in the auction.

"The OM-45 Deluxe is the holy grail of guitars," Guernsey's President Arlan Ettinger said. Only 14 were ever made.

Among other highlights are a 1900 Manuel Ramirez Flamenco and a 1939 D'Angelico New Yorker.

John D'Angelico was a guitar maker with a studio in Greenwich Village

during the first half of the 20th century; his guitars have been

described by some "as the Stradivarius of guitars," Ettinger said.

Pre-sale estimates of the instruments were still being worked out Friday.

Several previously celebrity-owned guitars also will be auctioned off: a

1941 Gibson SJ-200 played by Stephen Stills of Crosby, Stills, Nash

& Young; a 1967 Gibson SJN Country Western used by Mick Jagger on

his 1987 album "Primitive Cool"; and a 1959 Gibson J-200 that Eric

Clapton once owned.

Friday, March 7, 2014

Bitcoin: A medium of exchange? perhaps. A store of value? Not so much:

Another bitcoin bank bites the dust, Flexcoin blames losses on hackers

05/03 14:36 CET

After the collapse of Mt. Gox, now Canada-based virtual currency exchange Flexcoin has been forced to close down.

Flexcoin said flaws in its software code enabled hackers to make off with bitcoins worth around 440,000 euros.

“As Flexcoin does not have the resources, assets, or otherwise to come back from this loss, we are closing our doors immediately,” it said in a statement.

A message posted on its website explained that the attack had exploited a flaw in its code on transfers between users and involved inundating the system with simultaneous requests to move coins between accounts.

“Flexcoin has made every attempt to keep our servers as secure as possible, including regular testing,” it said, adding it had repelled thousands of attacks over the past few years. “But in the end, this was simply not enough.”

The firm said it is working with law enforcement agencies to trace the source of the hack.

Mt. Gox, once the world’s dominant bitcoin exchange, also blamed hacking for its losses. It has filed for bankruptcy protection in Japan and said it may have lost some 850,000 bitcoins due to hacking.

One bitcoin was valued at about $658 (480 euros) on Wednesday, according to Bitstamp, one of the largest exchanges for trading bitcoins.

Japan looks at bitcoin regulation

Japan will this week set out rules on how to handle bitcoins. It is the first sign that the government is taking action on regulating the virtual currency after the collapse last week of Tokyo-based Mt. Gox.

The cabinet will decide on Friday how to treat bitcoins under existing laws, people familiar with the matter told Reuters.

The sources said banks and securities firms will not be able to handle bitcoin as part of their main business, suggesting the virtual currency will be treated more as a commodity, like gold.

Japan has struggled to define its approach to bitcoin since the collapse of Mt. Gox.

The authorities there are also looking at possibly taxing bitcoin transactions, but it remains unclear how they could do this, given that one of the attractions of using bitcoin is that transactions are largely anonymous.

‘Consumer protection legislations needed’

“We haven’t yet thoroughly grasped the situation, but some kind of regulation is needed from the perspective of consumer protection, and we will also discuss (bitcoin) from the perspective of imposing an asset tax,” said Takuya Hirai, head of an IT panel in the ruling Liberal Democratic Party.

The panel heard on Wednesday from consultant Deloitte about bitcoin and from officials of the Consumer Affairs Agency, the Financial Services Agency (FSA) the Finance Ministry, central bank, Cabinet Office and the National Police Agency about the Mt. Gox collapse, Hirai told reporters.

The FSA and the Finance Ministry have said bitcoin is not a currency and doesn’t fall under their purview, while the Bank of Japan has said it was studying the bitcoin phenomenon with interest.

Hiroshi Mikitani, a prominent Japanese e-commerce billionaire and CEO of Rakuten Inc, expressed caution about trying to regulate the virtual currency. “They should not act hastily,” he said, according to Kyodo News. “As for whether we need regulations, they should first examine the situation a bit more and discuss it in depth.”

with Reuters

Flexcoin said flaws in its software code enabled hackers to make off with bitcoins worth around 440,000 euros.

“As Flexcoin does not have the resources, assets, or otherwise to come back from this loss, we are closing our doors immediately,” it said in a statement.

A message posted on its website explained that the attack had exploited a flaw in its code on transfers between users and involved inundating the system with simultaneous requests to move coins between accounts.

“Flexcoin has made every attempt to keep our servers as secure as possible, including regular testing,” it said, adding it had repelled thousands of attacks over the past few years. “But in the end, this was simply not enough.”

The firm said it is working with law enforcement agencies to trace the source of the hack.

Mt. Gox, once the world’s dominant bitcoin exchange, also blamed hacking for its losses. It has filed for bankruptcy protection in Japan and said it may have lost some 850,000 bitcoins due to hacking.

One bitcoin was valued at about $658 (480 euros) on Wednesday, according to Bitstamp, one of the largest exchanges for trading bitcoins.

Japan looks at bitcoin regulation

Japan will this week set out rules on how to handle bitcoins. It is the first sign that the government is taking action on regulating the virtual currency after the collapse last week of Tokyo-based Mt. Gox.

The cabinet will decide on Friday how to treat bitcoins under existing laws, people familiar with the matter told Reuters.

The sources said banks and securities firms will not be able to handle bitcoin as part of their main business, suggesting the virtual currency will be treated more as a commodity, like gold.

Japan has struggled to define its approach to bitcoin since the collapse of Mt. Gox.

The authorities there are also looking at possibly taxing bitcoin transactions, but it remains unclear how they could do this, given that one of the attractions of using bitcoin is that transactions are largely anonymous.

‘Consumer protection legislations needed’

“We haven’t yet thoroughly grasped the situation, but some kind of regulation is needed from the perspective of consumer protection, and we will also discuss (bitcoin) from the perspective of imposing an asset tax,” said Takuya Hirai, head of an IT panel in the ruling Liberal Democratic Party.

The panel heard on Wednesday from consultant Deloitte about bitcoin and from officials of the Consumer Affairs Agency, the Financial Services Agency (FSA) the Finance Ministry, central bank, Cabinet Office and the National Police Agency about the Mt. Gox collapse, Hirai told reporters.

The FSA and the Finance Ministry have said bitcoin is not a currency and doesn’t fall under their purview, while the Bank of Japan has said it was studying the bitcoin phenomenon with interest.

Hiroshi Mikitani, a prominent Japanese e-commerce billionaire and CEO of Rakuten Inc, expressed caution about trying to regulate the virtual currency. “They should not act hastily,” he said, according to Kyodo News. “As for whether we need regulations, they should first examine the situation a bit more and discuss it in depth.”

with Reuters

Thursday, March 6, 2014

Gee, Gold manipulation conspiracy nuts don't seem so crazy now:

London gold-fix banks accused of manipulation in U.S. lawsuit

LONDON

Wed Mar 5, 2014 9:38am EST

In the filing with the U.S. District Court in Manhattan dated March 3, New York resident Kevin Maher, who says he bought and sold gold and gold futures and options, alleged the banks overseeing the benchmark - Societe Generale (SOGN.PA), Deutsche Bank (DBKGn.DE), Barclays (BARC.L), Bank of Nova Scotia (BNS.TO) and HSBC (HSBA.L) - colluded to manipulate it.

Maher is bringing the suit as a class action, on behalf of himself and other investors who held or traded gold and gold derivatives that were settled based on the gold fix, or who held or traded COMEX gold futures or options, from 2004 to now.

In a statement, Deutsche said it believed the suit was without merit and that the bank "will vigorously defend against it".

A spokesperson for Societe Generale said: "Societe Generale appears to have been named as a defendant in these proceedings together with other members of the London Gold Market Fixing Ltd. The claims are unsubstantiated and Societe Generale will defend these proceedings."

Barclays and HSBC declined to comment, while Bank of Nova Scotia could not immediately be reached.

The suit is seeking unspecified damages.

Gold fixing happens twice a day in a teleconference between banks. At the start of each fixing, the chairman announces an opening price to the other members, who relay that to their customers and, based on orders received from them, instruct their representatives to declare themselves buyers or sellers at that price.

The price is adjusted up and down until demand and supply are matched, at which point the price is declared "fixed". The fixings are used to help determine prices globally.

Regulators including Germany's Bafin are looking more closely at how banks set benchmarks such as the gold fix after the Libor rigging scandal exposed widespread interest-rate manipulation. Britain's Financial Conduct Authority also said it was broadly looking at gold as part of an investigation into commodity benchmarks.

In January, Deutsche Bank said it was quitting the process after withdrawing from the bulk of its commodities business.

South Africa's Standard Bank (SBKJ.J), now selling a controlling stake in its markets unit to China's ICBC (601398.SS), is emerging as a front-runner to buy Deutsche's place in the global gold price-setting process, sources familiar with the matter told Reuters last month.

Tuesday, March 4, 2014

A Skeptic's guide to Market action:

A Skeptic's guide to the Markets:

An idealist (or a shill) might opine that the markets went down yesterday on bad news about the Ukraine and up today on the good news about Ukraine.

Maybe.

A Skeptic might say that yesterday the Ukraine news was an excuse for the market pros to run everybody's stops and create a mini panic with the tailwinds of the Ukraine news to fuel the fear.

Immediately several "experts" weighed in with the unanimous opinion that Putin had painted himself into a corner, and could never back off, while Obama was weak and ineffectual with no good options.

Everybody (all the amateurs) shorted the market.

Today, Putin issued a vague statement suggesting he could well back off if he felt like it, while Obama issued some vague threats, which gave the pros an excuse for a massive short squeeze of all the amateurs who rushed in to short the market.

What will happen tomorrow?

Sure, the news will serve as a backdrop. But the action at the rigged casino will have nothing at all to do with the news, either political or financial or economic.

The market is its own sucker fleecing machine. If you happen to be at a big bank with hundreds of billions or dollars at your disposal to push everyone's else's positions around, good for you.

If not, ask yourself this: what in God's name are you doing in the market?

What's that? Oh yeah, I forgot, you're really smart.

As grandpa used to say: that and fifty cents will buy you a cup of coffee.

Of course, now, that and six fifty will buy you a grande latte.

And all thanks to the same folks who will eventually get all you money in the markets.

Sunday, March 2, 2014

China's move to a gold backed currency?

Call Sherlock Holmes: 500 Tons Of Gold Goes Missing In China

Last year, China imported and mined far more gold than its citizens and businesses purchased. Some

think there was substantial back-channel hoarding of the metal due to

uneasiness over the economy while others speculate that the People’s Bank of China , the central bank, secretly acquired the metal for its foreign reserves. A few believers of the second scenario argue that Beijing will attack the dollar by soon announcing a new gold-backed currency.

This month, the China Gold Association released

data showing that the country’s consumption of the yellow metal in 2013

reached 1,176.4 metric tons, an increase of 41.4% over 2012. Yet that tonnage is far less than the total of mine production—428.2 tons—and imports from Hong Kong, 1,158.2 tons. The discrepancy: 410.0 tons.

As large as that number is, the real gap was undoubtedly bigger. Beijing

does not publish gold trade statistics, and there are substantial

volumes entering the country unrecorded, through Shanghai and gray

routes, with both the government and the wealthy bypassing established channels. Analysts, in short, believe China’s “apparent gold consumption” last year was over 1,700 tons, making the unaccounted gold more than 500 tons.

So where did all that metal go? Some was used for jewelry that was exported. Bars may have been delivered to Iran to surreptitiously pay for oil and gas. Gold could have been lost in the complicated and opaque accounting system maintained by the Shanghai Gold Exchange. A small amount was acquired by wealthy—and nervous—Chinese in off-the-books transactions. Banks were buying for their own accounts.

And then there is the possibility of secret central bank purchases. Zhang Jianhua, a PBOC official, in December 2011 talked about the institution buying on price dips. Despite Zhang’s public words, there were reasons to believe the central bank was not in the market then, at least not in a big way.

In 2013, however, the PBOC may have changed its stance and become a large purchaser. The

price of gold, which had steadily climbed from 2001 to 2012, plunged

last year, falling about 28% and creating a buying opportunity for the

cashed-up central bank. China’s gold reserves now stand at

1,054 tons, an official number not updated since April 2009, and most

analysts suspect there has been unannounced buying.

Speculation about secret gold purchases gives

credence to recent rumors, circulating in big financial houses in New

York, that Beijing will soon move to full convertibility of its currency

and adopt the gold standard. The rumors got a boost when Freya Beamish of Lombard Street Research issued a note on February 12 referring to the issue. “The

massive flow of gold into the country does make it seem plausible that

they could be moving in the direction of using gold in the effort to

internationalize the currency and escape what is seen as a domineering

dollar,” she wrote.

The yuan, as the renminbi is informally known, became convertible on the current account in December 1996. Since

then, Beijing has failed, despite official promises to do so, to take

the next big step, to make it convertible on the capital account. Yet there are now compelling reasons for Chinese authorities, in some dramatic fashion, to restructure the country’s money.

Beijing wants its money—not America’s—to be the world’s medium of exchange and store of value. To

achieve these goals, Chinese technocrats have been engaged in a

“significant and coordinated promotion” of the use of the renminbi since

July 2009, according to Chris Dixon of the Global Policy Institute, and they have in fact made progress. For

instance, the Society for Worldwide Interbank Financial

Telecommunication, better known as SWIFT, announced that the renminbi

was ranked No. 8 for global payments in December.

Beijing has, through some cost to itself, pushed

use of the renminbi, but there is only so much progress it can make

until the currency becomes fully convertible.

Subscribe to:

Posts (Atom)