http://gold-stater.com is now providing daily gold market and gold coin market commentary and updates. Please check in regularly to find the latest developments in gold and gold coins.

Total Pageviews

Sunday, March 31, 2013

How long?

The Fed has extended its balance sheet by over 3 trillion printed dollars.

The US government has added 5 trillion printed dollars of printed debt to its balance sheet.

China has printed 3.5 trillion dollars to sterilize its current account surplus with the US and pumped that printed money back into US assets.

The Fed has pumped an addtional 29 trillion printed dollars of liquidity facilities to service the global banking cartel.

The ECB has pumped and additional 2 trillion dollars of printed euros into various European bailout facilities.

ALL THIS PRINTING HAS SUCCEEDED IN A GLOBAL GROWTH RATE OF UNDER 2 PERCENT. AND THAT IS USING ABSURD INFLATION FIGURES. REALISTIC INFLATION FIGURES WOULD DEFLATE GLOBAL GDP INTO NEGATIVE TERRITORY.

The pace of printing money and pumping it into the global banking cartel can and must only accelerate. Global growth is entirely dependent on accelerated credit creation.

The more credit we create the greater the debt. We can not cut back on a cent of debt without crippling global growth prospects. This is the catch 22.

Even government debt can not be cut. In eras past, if you cut government debt rates would drop thus encouraging business investment. With nominal rate at 0 for the past 5 years and real rates negative, cutting government spending will do nothing for business investment.

Furthermore The global banking cartel has accumulated close to 500 trillion dollars of notional value in debt derivative instruments. These appear to be under control because they appear on bank balance sheets at 50 billion in assets and 40 billion in liabilities for example. Yet these may repersent 10 trillion dollars worth of notional value. This makes them appear manageable. However, in a crisis if a large institution goes down holding 10 trillion dollars of notional value debt derivatives, it makes no difference how these are represented on a balance sheet. They will all be worthless if a counterparty goes under.

How long before the next counterparty crisis?

How long before the cumulative debt burden slows even nominal growth back below 0?

Friday, March 29, 2013

A few crazies still see problems ahead:

Financial Analyst Gregory Mannarino says

the banking crisis in Cyprus is a signal of what is coming to the rest

of the world. Mannarino says, “People are now going to start losing

faith in these institutions. This cannot stand, and we may be very,

very close to the pan-global financial collapse that I believe is

coming.” Mannarino contends, “People

do not understand that the debt owed by their nation is their debt.

They own it. They are going to force people to pay one way or another.

Haircuts are coming for everyone.” Mannarino contends, “There is a debt war going on right now.” Think what is happening in Cyprus can’t happen in the U.S? More than $10.8 trillion in deposits are insured by the FDIC with a $33 billion insurance fund. Mannarino says, “That’s pretty scary,” and the best way to protect yourself is to “get into real assets . . . there would be no problem if people in Cyprus would have heeded that advice.”

Economist Dr. Laurence Kotlikoff said “This morning, I moved my money out of the stock market . . . because I’m worried about Cyprus.” Dr. Kotlikoff explained his dire concern by saying, “The rich people are already running on these banks. That’s been going on for a year. . . . The everyday working people could start visibly running on these banks, and that could spread like wildfire throughout Southern Europe and Northern Europe and into the U.S. because we have a banking system that’s built to fail.” Dr. Kotlikoff also says, “It’s going to happen in the form of a crash in the bond market. Interest rates are going to skyrocket, and we’re probably going to have high inflation because the government is printing money out the wazoo.”

Charles Biderman, CEO of Trim Tabs Investment Research, says, “If Europe, the U.S and Japan are all printing money to pay bills, what else is there besides gold?” Everone should be holding physical gold in their portfolio. Biderman thinks Europe is a mess, and tax revenue is “nowhere near enough to pay government expenses.” So, he thinks, “Europe has to implode!” The U.S. will follow Europe. Will the banking system survive? Biderman says, “Probably the big guys won’t, but so what!” In America, Biderman says, “The U.S. government is printing $100 billion a month, and it’s not generating growth.”

Economist Dr. Laurence Kotlikoff said “This morning, I moved my money out of the stock market . . . because I’m worried about Cyprus.” Dr. Kotlikoff explained his dire concern by saying, “The rich people are already running on these banks. That’s been going on for a year. . . . The everyday working people could start visibly running on these banks, and that could spread like wildfire throughout Southern Europe and Northern Europe and into the U.S. because we have a banking system that’s built to fail.” Dr. Kotlikoff also says, “It’s going to happen in the form of a crash in the bond market. Interest rates are going to skyrocket, and we’re probably going to have high inflation because the government is printing money out the wazoo.”

Charles Biderman, CEO of Trim Tabs Investment Research, says, “If Europe, the U.S and Japan are all printing money to pay bills, what else is there besides gold?” Everone should be holding physical gold in their portfolio. Biderman thinks Europe is a mess, and tax revenue is “nowhere near enough to pay government expenses.” So, he thinks, “Europe has to implode!” The U.S. will follow Europe. Will the banking system survive? Biderman says, “Probably the big guys won’t, but so what!” In America, Biderman says, “The U.S. government is printing $100 billion a month, and it’s not generating growth.”

Thursday, March 28, 2013

HUIS CLOS: NOW PLAYING AT THE GLOBAL THEATER:

Ben Bernanke, Mario Draghi, Mark Carney and Li Lihui are sitting in a room with no doors and no windows.

They each have one currency.

Each currency is different.

Their mission is to keep their currency from appreciating.

They each have two tools:

1) print ever greater quantities to weaken the currency to buy up all of their own ever increasing debt burdens and:

2) jawboning about improving conditions and the support for strong currencies.

They can only communicate to each other through policy statements.

They can never leave the room.

They can never let their currency appreciate.

They must continually print greater and greater quantities.

There is no exit strategy.

There is no exit.

Wednesday, March 27, 2013

FUNNY NUMBERS

Durable goods orders yesterday were trumpeted as another sign of a healed economy picking up steam. The headline number was up 5.7% : AWESOME!

95 percent of that rise was due to commercial aircraft orders. Still, that's great they're ordering aircraft. But what does that say about the economy as a whole?

Well the orders for non-defense capital goods excluding aircraft is a better gauge of everyday items such as computers, office and plant equipment etc. Ultimately, this piece is typically seen as a proxy for future business investment so its decline to -2.7% wasn't as encouraging.

Again, take housing where the markets got all excited about the January year over year increase of 8.08%. in the Case Shiller index. Housing is going gangbusters!

Still, Barclays's cautioned: "investors should recognize the market remains clogged, that foreclosures

in many states remain stalled by judicial processes, and that banks are sitting

on thousands of properties that will have to make their way through the sales

channels."

The Case-Shiller data was complemented by February new home sales numbers which fell 4.6% to

411,000.

Prices up. Sales down. And as Robert Shiller was quick to point out on his round of the economic shows: Many of these "hot growth areas" like Phoenix, Miami, Las Vegas are still down 40 percent from the peak. Robert Shiller cautioned that he was still very bearish on real Estate. But what does he know?

Tuesday, March 26, 2013

WHERE'S THE GOLD: ANOTHER BANK CONFISCATION

Dutch Bank Won't Deliver

| By Patrick A. Heller March 25, 2013 |

Other News & Articles

This article was originally printed in Numismatic News.

>> Subscribe today!

In letters received by customers of the large Dutch bank ABN Amro over this past weekend, the bank announced a customer service policy change taking effect on Monday, April 1.

Currently, the bank has stored physical gold, silver, platinum, and palladium for their customers. Beginning next week, the bank will no longer allow customers to take physical delivery of the precious metals that they own and are stored at the bank.

Texas wants its gold back!

Posted by Neil Irwin on March 26, 2013 at 10:58 am

But now some in the state, including Perry, are looking to put their money where their mouths are. Literally.

Gold at the New York Fed. (Federal Reserve Bank of New York)

Perry and some in the Texas legislature want to bring the roughly $1 billion worth gold held by the state university system’s investment fund onto Texas soil, rather than in its current resting pace in a vault in New York.

Netherlands: Hey, Let’s Bring Our Gold Home

Jan. 17, 2013 2:03pm

Becket Adams

Reports are coming in that the Dutch

Christian Democratic Appeal party on Wednesday formally addressed the

issue of repatriating the Netherland’s gold reserves, according to a

(loosely translated) report from rtl.com cited by both Seeking Alpha and noted economist Jim Rickards:

“Part of the Dutch gold stock is now in

the basement of the De Nederlandsche Bank in Amsterdam,” the rtl.com

report explains. “[The] Netherlands has 24 billion in gold. Only 11

percent of it is actually in the Netherlands.”

“The rest [was moved] just before the

Second World War,” the report adds, noting that since being moved in

1938, 18 percent of the Netherland’s gold has been kept in London, 20

percent in Ottawa, and over half (51 keep) “deep under Manhattan in New

York City.”

And for those of you who didn’t know, the Dutch actually have quite a bit of gold to their name:

Germans Want Gold at Home

| By Patrick A. Heller January 22, 2013 |

Last Wednesday, the Bundesbank, Germany’s central bank, confirmed reports that it would recall some of its gold reserves now held outside its borders. Of the total 109 million ounces of reported physical gold reserves, the highest of any central bank other than the Federal Reserve, only 31 percent are currently in the Bundesbank vaults in Frankfurt am Main.

Monday, March 25, 2013

So what's the big deal? was the message on CNBC, FOX etc, as talking heads crowded the air to explain that Cyprus is a tiny island nobody cares about anyway in the middle of nowhere, where lots of folk don't even speak English, and the bank depositors being robbed were all probably just Russian Mobsters who are laundering money anyway.

But what if folk in Spain, Italy, France, Portugal, Greece - whose banks are in similar straights - get the idea that they might be next? What would you think if you were a depositor in those countries? What would you do?

Thanks god it can't happen here in the good old US of A - right? Right?

Saving Cyprus Means Nobody Safe as Europe Breaks More Taboos

By Simon Kennedy -

Mar 25, 2013 8:01 PM ET

Customers line up to withdraw

cash from an automated teller machine (ATM) operated by OAO Sberbank in

Moscow, Russia, on March 22, 2013. Russian lenders with Cypriot units

include OAO Sberbank and OAO Gazprombank, both state-controlled,

Otkritie Capital, part-owned by VTB, as well as Aton Capital, UralSib

Financial Corp. OAO Promsvyazbank and BCS Financial Group. Photographer:

Alexander Zemlianichenko Jr/Bloomberg

The island nation’s rescue sets precedents for the euro zone that may stick in the memory of depositors and bondholders alike as investors debate who will next fall victim to the debt crisis. Under the terms of the agreement struck yesterday in Brussels, senior Cypriot bank bond holders will take losses

and uninsured depositors will be largely wiped out.

The message that stakeholders of all stripes can be coerced into helping a cash-strapped nation may make investors more skittish they’ll be targeted if Slovenia, Italy, Spain or even Greece again is next in line to need help. The risk is that bank runs and bond market selloffs become more likely the moment a country applies for a new rescue, said economists and academics from Nicosia to New York.

Friday, March 22, 2013

America: home of the lower middle class millionaire

We all know that since the creation of the Fed, the US dollar has lost 98% of its buying power. And we all know that then Bernanke Fed is on a mission to cut the buying power of the dollar down as quickly and violently as possible. It's not his fault - how else can he inflate away a hundred trillion dollars of debt obligations?

But what does that mean for the middle class?

Let's say you live in New York City, capital of the world. It's a great place to live. Let's say you're a two working parent family with four kids in one of the many many neighborhoods that has not so great public schools.

It will cost you 1 million dollars to send four kids to private school - through high school.

It will cost another million to send them to college.

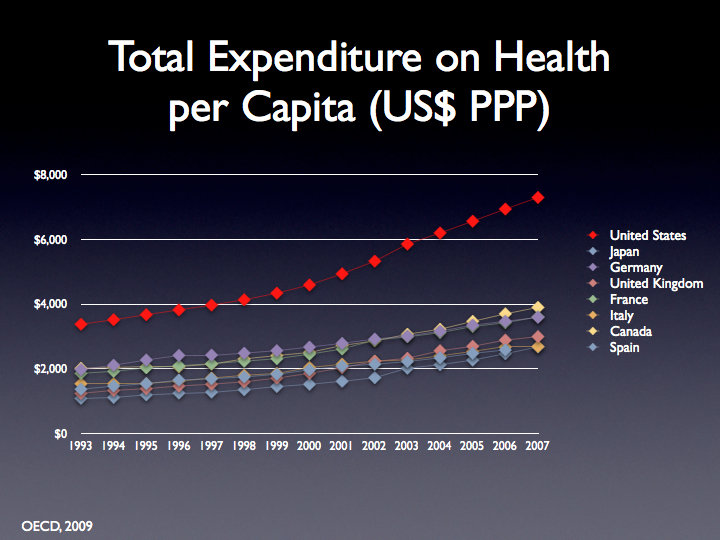

It will cost another $500,000 dollars to pay for health care through college - that is if none of them get really sick or have some terrible accident.

Then you have to feed them and clothe them. Oh let's say you're really cheap - mostly macaron and pizza and hand me downs - you can get away with another $300,000 through college.

Closing in fast on 3 million dollars.

This doesn't count of course, rent/maintenance/common charges/ housing costs. Who knows? Does a million sound reasonable in NYC for a family of 6 for 25 years (to get them all through school.)

Probably not. Maybe 2 million?

Gee, middle class life in New York City costs a family of 6 somewhere around 5-6 millions dollars just for the basics. Don't mention baby sitters, tutors, vacations, toys, sports, entertainment, computers, phones, air conditioners, dish washer, washing machines - maybe a car - etc etc.

Of course, you don't really have to be a millionaire, just as long as both parents work full time and make at least $200,000 each before taxes - and aren't saddled with too much student loan debt and mortgage debt.

And don't mind an old age of humiliating poverty.

Yeah, sure, you don't need to have 4 kids. That's pretty extravagant. Yeah sure, you don't need to live in New York. You can live in Sioux City Iowa, and it's surely cheaper - not for health care and college, gas and food and heating oil. And then in Sioux City you'll probably need 2 cars and have to pay for all the more gas. But maybe you'll pay less for grade school and housing. I'll bet a family of 6 there could get away with 3 million dollars through college.

If they're very very careful. And very lucky. No bad accidents. No fires, floods, tornadoes - no break ins, no getting cheated by scam artists in the markets.

And with the Fed trashing cash and punishing savers you better have excellent investing instincts.

Then again you can have no kids at all and spend that excess cash on yourselves. But then the county dies - like Japan.

But we're not Japan, damn it.

We're the US OF A and this is a great country. If you're a millionaire. And you have a lot of luck and foresight managing to stretch those few millions.

If you're really lucky with a few million dollars and a few kids and two working parents you can maintain a nice lower middle class lifestyle.

If not, say hello to the working poor.

Thursday, March 21, 2013

US GDP NOT COUNTING REAL INFLATION AND COUNTING REAL INFLATION:

GDP is barely growing by official US accounting. But even that anemic number doesn't deflate GDP for gas, education, health care and food costs. Counting those in - as you can clearly see from the graphs below - and the US has been in a depression for 8 years. Why doesn't it seem like that? Well maybe because you're employed - whereas 40 percent of the population is not.

Wednesday, March 20, 2013

behind the numbers:

Retail sales: are higher retail sales the result of more expensive necessities: food, gas, heating, gas-based products, health costs, education related costs, car repairs etc?

or are they discretionary?

Employment: are very slightly lower unemployment claims the result of good paying jobs that can support a family,

or are they reflective of low paying part time work?

The stock Market: is the high dow and sp reflective of a strong economy?

or is it reflective of printed money given by the Fed to the banks who are then gambling in the risk markets?

The Vix: is a record low vix relective of a strong economy that is getting stronger by the day?

or is it reflective of massive complacency in the face of unsolved problems?

Housing: is an improving housing market reflective of a mending consumer balance sheets?

Or is it reflective of artificially negative rates guaranteed indefinitely causing new mis-allocations of capital?

Thursday, March 14, 2013

MONEY SUPPLY IS EXPLODING:

Because like all government statistics the Money Supply Figures are constructed to exclude a huge portion of government created Money.

The Ausatrian School has constructed a TRUE MONEY SUPPLY figure that show the TMS posted another double digit year-over-year rate increase in March, this one coming in at 14.5%.

That makes 40 consecutive months of double digit year-over-year rate increases. To state the obvious, we are in the midst of a monetary explosion.

So what is the True Money Supply. It includes what the Fed calls: "Other Memorandum items" that they exclude from M2. These are defined below, and they are comprised of most of the Fed's trillions upon trillions of dollars of LIQUIDITY FACILITIES that are settled between the fed, the international banking system and the US Government. See below:

TMS1. A narrow

definition of the money supply based largely on Shostak’s AMS

formulation of money – excluding savings deposits but adding back bank

deposit sweep programs (those monies banks “sweep” out of demand

deposit accounts and into savings and MMDAs to lower effective reserve

requirements). (1) (2)

TMS2. A broad definition

of the money supply based on Rothbard-Salerno’s TMS formulation of

money, brought current in accordance with the conclusions presented in

this essay, and the most complete and most correct measure of the money

supply.

M2. Federal Reserve Board’s broad money supply measure.

The composition of each series is presented below:

Wednesday, March 13, 2013

We're Here

The fortune tellers are out in force predicting away everything from where the Dow will be in a year to where Gold will be in a year, to where Europe will be in a year to where US GDP will be in a year.

ETC ETC BLAH BLAH BLAH.

I can predict the present:

We're here: Gold is hovering around $1600 an ounce: solidly in its long term uptrend.

We're here: The Dow is back exactly to where it was 5 years ago before the banking crisis hit.

We're here: The Fed's balance sheet has ballooned out with 3 Trillion dollars of new debt, the Federal Government's balance sheet has ballooned out with 5 Trillion dollars of new debt, Unfunded Liabilities have ballooned by tens of Trillions of dollars of new debt, and the consumer balance sheet is pretty well unchanged.

We're here: Official Unemployment has dropped to about 7.7 percent while the broad unemployment rate (the one used in 1980) has dropped to 14.5 percent. Teen unemployment is at 24 percent.

We're here: Everyone is predicting that the economy has healed and the European crisis is contained.

We're here; Rates here and in Europeare still at ZERO for the fifth straight year. In Japan they are at ZERO for the 20th straight year. There is no way to increase rates without creating an impossible debt service burden.

We're here: Everyone is predicting the Fed will start its exit strategy soon.

We're here: Bernanke has said that NO EXIT STRATEGY WILL EVER BE NECESSARY.

We're here: Employment gains of just under 200,000 for the last three months has everyone predicting the economy is healing.

We're here: 200,000 is the number of new entrants into the job market every month.

In other words: The World Wide Debt Crisis has stabilized at the moment through the central bank issuance of Tens of Trillions of New Debt.

There is no exit strategy.

There is no way to bring down debt without disrupting the temporary stabilization.

How long can this equilibrium be maintianed?

Saturday, March 9, 2013

the last bubble

Since going off the gold standard in 1971:

Reagan realized that you can juice the economy by running huge federal deficits, thus creating the first stock market bubble since the depression.

Greenspan realized you can juice the economy by destroying price discovery of interest rates and dropping real rates negative indefinitely, thus creating the greatest housing bubble since the Japanese bubble destroyed Japan's economy.

With the deficit ballooned out of control and nominal rates at zero, Bernanke realized that you can juice the economy by printing unlimited amounts of money for ever and just giving to the banks to prop up the risk markets. This has created the dual bond and stock market bubble of 2012.

With deficits permanently out of control, rates at zero, the printing presses cranked to full throttle, when this bubble finally pops what's next?

Think of something.

I can't think of anything but gold.

Reagan realized that you can juice the economy by running huge federal deficits, thus creating the first stock market bubble since the depression.

Greenspan realized you can juice the economy by destroying price discovery of interest rates and dropping real rates negative indefinitely, thus creating the greatest housing bubble since the Japanese bubble destroyed Japan's economy.

With the deficit ballooned out of control and nominal rates at zero, Bernanke realized that you can juice the economy by printing unlimited amounts of money for ever and just giving to the banks to prop up the risk markets. This has created the dual bond and stock market bubble of 2012.

With deficits permanently out of control, rates at zero, the printing presses cranked to full throttle, when this bubble finally pops what's next?

Think of something.

I can't think of anything but gold.

Wednesday, March 6, 2013

according to Jim SInclair and DR Schoon:

Darryl Robert Schoon

Posted Mar 6, 2013

Regarding what is currently happening in the gold and silver markets, long-time and highly regarded gold analyst Jim Sinclair appears to be a soothsayer. Four months ago, on October 21, 2012, ArabianMoney.net noted that Jim Sinclair had warned subscribers the bullion banks were going to push gold prices lower.

Because central banks had become net accumulators of gold, Sinclair said to make money in the new environment the bullion banks - Goldman Sachs, JPMorgan, Deutsche Bank, HSBC - were going to change their strategy regarding precious metals.

According to ArabianMoney.net, Sinclair predicted the banks’ new strategy would involve a change in ‘spread management’:

Spread management is rather technical for non-industry specialists. This is the profit per ounce when gold is sold, and the bullion banks juice this profit by taking both long and short positions in the marketplace to improve their real profit…What Mr. Sinclair foretells is an upcoming move by the bullion banks to dump their short positions and go fully long…

Sinclair said the bullion banks would look to pull gold down one last time to allow them cover to reverse their own huge short positions in the market. Once this is safely accomplished they will go fully long in their own positions and take the gold price far higher.

Regarding the timing of this move by the bullion banks, ArabianMoney.net wrote:

Right now the preoccupation in the bullion market is over a short-term correction, and the more alarming potential for a repeat of the 30 per cent price crash of 2008-9. Mr. Sinclair seems to be hinting that this will provide precisely the environment for the shedding of shorts and the creation of long-only positions in the market.

“WE MAKE MONEY ON THE SPREAD”

DRS cartoon, p. 87, Time of the Vulture, How to Survive the Crisis and Prosper in the Process, Darryl Robert Schoon, 3rd ed. 2012

DRS cartoon, p. 87, Time of the Vulture, How to Survive the Crisis and Prosper in the Process, Darryl Robert Schoon, 3rd ed. 2012

…all that is required is a change in spread management by the gold banks and you will have whatever price the gold banks want from $3,500 to $12,400. -Jim Sinclair, October 2012

GOLDMAN SACHS TALKS GOLD LOWER

Six weeks after Sinclair’s warning, the bullion banks set the stage for a drop in the price of gold as Reuters reported Goldman Sachs predicts turn in gold bull market. In December 2012, Goldman Sachs lowered its three, six and 12-month forecasts for gold and predicted the gold cycle would turn lower in 2013.

Absent additional easing in late 2013, we expect gold prices to decline at a faster pace in 2014 and to reach $1,625 an ounce by year-end. -Goldman Sachs, December 5, 2012

On December 6th, AabianMoney.net reported: Goldman Sachs has put out a negative call on gold saying that the bull market is over, exactly the sort of market maneuver predicted six weeks ago by ‘Mr. Gold’ Jim Sinclair…

On January 16th, Goldman analysts whipped up even more fear among gold investors by predicting a long-term price of gold of $1200:

…we expect that gold prices will continue to trend lower over the coming five years and introduce our long-term gold price of $1,200/oz from 2018 forward.

THE CHINESE NEW YEAR GOLD MASSACRE (February 11th to February 22nd)

To put their strategy into play, the bullion banks waited for Asian demand to slow during the two week Chinese New Year celebration; and when the Chinese New Year began on February 11th the bullion banks began forcing gold and silver lower.

On Monday February 11th, gold was at $1660. On Friday, gold closed at $1610. The following week, gold reached a low of $1,558 on Thursday, Feb 21st before finishing Friday at $1,581.

The strategy worked. The Chinese New Year’s route of gold had caused nervous investors to sell and investment funds to exit their long positions and instead go short allowing the bullion banks to exit their positions on the short side.

On Friday February 22nd, gold trader Andrew Maguire noted: The paper market longs have been tricked into selling. Obviously the managed money and the specs are now being tricked into short selling. Who do you think is on the long side of those trades?

These bullion banks have actually successfully transferred massive short positions into very weak hands. And this next week is going to provide large short fuel above the market. As soon as this leveraged selling is insufficient to meet the bullion bank buying, which will happen, if not today it will be early next week.

The record number of gold shorts held by speculators usually presages a rally in gold prices.

The gross short position held by speculative traders in US gold futures and options has neared or exceeded 60,000 contracts only 5 times before in the last 8 years… The average 6-month change in gold prices, according to analysis by BullionVault today, has then been +28%.

A 28% rally in gold at today’s [February 27, 2013] price of $1,598 would take gold to $2,045.

GOLD LIFTOFF SOON? MAYBE SO, MAYBE NOT

Now that bullion banks have exited their short positions and are long gold, the bankers are still going to protect their highly profitable paper money scheme and are not going to roll over and cede victory to gold unless forced by circumstances to do so.

Exiting their short positions removed the possibility the bullion banks would suffer catastrophic losses if gold prices exploded upwards. Now, the banks will instead be able to profit by being on the long side of the trade leaving the managed funds and speculators to bear the losses.

This does not mean, however, the bullion banks will abandon the credit and debt paper money cartel in their battle against gold. What it does mean is that the cartel has suffered a significant loss and gold’s victory is now one significant step closer.

Supply and demand in the battle between gold and paper money has been offset by the use of credit and debt by the paper money cartel. Up until 2001, the paper money cartel had the momentum. After 2001, gold did. It still does today.

GOLD IS A MOMENTUM TRADE

GOLD IS A MOMENTUM TRADE

The truth about geopolitics as well as finance is distorted by the media to serve those in power. This does not change the truth although it does change what people believe.

Perhaps a squeeze on gold shorts will soon take gold to $3,500 to $12,400 as predicted by Jim Sinclair or, it may come later. Have faith, it will come.

Buy gold, buy silver, have faith.

Posted Mar 6, 2013

Regarding what is currently happening in the gold and silver markets, long-time and highly regarded gold analyst Jim Sinclair appears to be a soothsayer. Four months ago, on October 21, 2012, ArabianMoney.net noted that Jim Sinclair had warned subscribers the bullion banks were going to push gold prices lower.

Because central banks had become net accumulators of gold, Sinclair said to make money in the new environment the bullion banks - Goldman Sachs, JPMorgan, Deutsche Bank, HSBC - were going to change their strategy regarding precious metals.

According to ArabianMoney.net, Sinclair predicted the banks’ new strategy would involve a change in ‘spread management’:

Spread management is rather technical for non-industry specialists. This is the profit per ounce when gold is sold, and the bullion banks juice this profit by taking both long and short positions in the marketplace to improve their real profit…What Mr. Sinclair foretells is an upcoming move by the bullion banks to dump their short positions and go fully long…

Sinclair said the bullion banks would look to pull gold down one last time to allow them cover to reverse their own huge short positions in the market. Once this is safely accomplished they will go fully long in their own positions and take the gold price far higher.

Regarding the timing of this move by the bullion banks, ArabianMoney.net wrote:

Right now the preoccupation in the bullion market is over a short-term correction, and the more alarming potential for a repeat of the 30 per cent price crash of 2008-9. Mr. Sinclair seems to be hinting that this will provide precisely the environment for the shedding of shorts and the creation of long-only positions in the market.

“WE MAKE MONEY ON THE SPREAD”

…all that is required is a change in spread management by the gold banks and you will have whatever price the gold banks want from $3,500 to $12,400. -Jim Sinclair, October 2012

GOLDMAN SACHS TALKS GOLD LOWER

Six weeks after Sinclair’s warning, the bullion banks set the stage for a drop in the price of gold as Reuters reported Goldman Sachs predicts turn in gold bull market. In December 2012, Goldman Sachs lowered its three, six and 12-month forecasts for gold and predicted the gold cycle would turn lower in 2013.

Absent additional easing in late 2013, we expect gold prices to decline at a faster pace in 2014 and to reach $1,625 an ounce by year-end. -Goldman Sachs, December 5, 2012

On December 6th, AabianMoney.net reported: Goldman Sachs has put out a negative call on gold saying that the bull market is over, exactly the sort of market maneuver predicted six weeks ago by ‘Mr. Gold’ Jim Sinclair…

On January 16th, Goldman analysts whipped up even more fear among gold investors by predicting a long-term price of gold of $1200:

…we expect that gold prices will continue to trend lower over the coming five years and introduce our long-term gold price of $1,200/oz from 2018 forward.

THE CHINESE NEW YEAR GOLD MASSACRE (February 11th to February 22nd)

To put their strategy into play, the bullion banks waited for Asian demand to slow during the two week Chinese New Year celebration; and when the Chinese New Year began on February 11th the bullion banks began forcing gold and silver lower.

On Monday February 11th, gold was at $1660. On Friday, gold closed at $1610. The following week, gold reached a low of $1,558 on Thursday, Feb 21st before finishing Friday at $1,581.

The strategy worked. The Chinese New Year’s route of gold had caused nervous investors to sell and investment funds to exit their long positions and instead go short allowing the bullion banks to exit their positions on the short side.

On Friday February 22nd, gold trader Andrew Maguire noted: The paper market longs have been tricked into selling. Obviously the managed money and the specs are now being tricked into short selling. Who do you think is on the long side of those trades?

These bullion banks have actually successfully transferred massive short positions into very weak hands. And this next week is going to provide large short fuel above the market. As soon as this leveraged selling is insufficient to meet the bullion bank buying, which will happen, if not today it will be early next week.

The record number of gold shorts held by speculators usually presages a rally in gold prices.

The gross short position held by speculative traders in US gold futures and options has neared or exceeded 60,000 contracts only 5 times before in the last 8 years… The average 6-month change in gold prices, according to analysis by BullionVault today, has then been +28%.

A 28% rally in gold at today’s [February 27, 2013] price of $1,598 would take gold to $2,045.

GOLD LIFTOFF SOON? MAYBE SO, MAYBE NOT

Now that bullion banks have exited their short positions and are long gold, the bankers are still going to protect their highly profitable paper money scheme and are not going to roll over and cede victory to gold unless forced by circumstances to do so.

Exiting their short positions removed the possibility the bullion banks would suffer catastrophic losses if gold prices exploded upwards. Now, the banks will instead be able to profit by being on the long side of the trade leaving the managed funds and speculators to bear the losses.

This does not mean, however, the bullion banks will abandon the credit and debt paper money cartel in their battle against gold. What it does mean is that the cartel has suffered a significant loss and gold’s victory is now one significant step closer.

Supply and demand in the battle between gold and paper money has been offset by the use of credit and debt by the paper money cartel. Up until 2001, the paper money cartel had the momentum. After 2001, gold did. It still does today.

The truth about geopolitics as well as finance is distorted by the media to serve those in power. This does not change the truth although it does change what people believe.

Perhaps a squeeze on gold shorts will soon take gold to $3,500 to $12,400 as predicted by Jim Sinclair or, it may come later. Have faith, it will come.

Buy gold, buy silver, have faith.

Tuesday, March 5, 2013

not just me

john Hussman, a renowned thinker with an extremely practical approach to investing, also sees trouble looming:

(FT): These conditions represent a syndrome of overvalued, overbought, overbullish, rising yield conditions that has emerged near the most significant market peaks — and preceded the most severe market declines — in history:

1.S&P 500 Index overvalued, with the Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) greater than 18. The present multiple is actually 22.6.

2.S&P 500 Index overbought, with the index more than 7% above its 52-week smoothing, at least 50% above its 4-year low, and within 3% of its upper Bollinger bands (2 standard deviations above the 20-period moving average) at daily, weekly, and monthly resolutions. Presently, the S&P 500 is either at or slightly through each of those bands.

3.Investor sentiment overbullish (Investors Intelligence), with the 2-week average of advisory bulls greater than 52% and bearishness below 28%. The most recent weekly figures were 54.3% vs. 22.3%. The sentiment figures we use for 1929 are imputed using the extent and volatility of prior market movements, which explains a significant amount of variation in investor sentiment over time.

4.Yields rising, with the 10-year Treasury yield higher than 6 months earlier.

Monday, March 4, 2013

Why Gold?

As analyst after analyst turns on gold, now well into the second year of correction, those who came to this currency relatively late are probably losing conviction. It certainly is disheartening to see every upward thrust countered by a torrent of selling on the comex.

Keep in mind that while there is a limited amount of real gold in the world, there is an infinite number of paper contracts that can be traded on the futures exchange. Any government that can print its own money can pour an unlimited number of sell contracts onto any rally.

So how will gold ever rise?

Because there is a gold market that is operating out of sight of the small investor. This is the gold market operating on the level of Central Banks.

Central Banks are buying and hoarding gold. Central Banks are settling huge oil and gas transactions in gold bullion.

None of that affects the paper price of gold traded on the futures exchange.

And the paper price has very little effect on the gold price in the negotiated agreements between Central Banks.

The US Central Bank is certainly the world's most powerful. Right now. So they can control the paper price of gold. Right now. Because they can print as much money as they want. Right now. And they can settle any amount of debt in printed dollars. Right now.

But with 120 Trillion in notional debt obligations, with forty cents of every dollar spent simply printed, and with the Fed buying 90 Percent of all newly issued US debt, the game is obviously unsustainable.

Yes, the euro, and the yen are in no better shape.

That's why whenever the game unravels - and nobody knows when that will be - it will unravel quickly.

Why quickly? Because disastrous events are unexpected. And with interest rates at zero and real rates negative, and debt levels astronomical, whenever the next disaster hits, there will be no financial amnunition left to combat it.

And then the paper price of everything will reset before anybody has time to react.

That's why you buy gold - real gold bullion - now, and hold it. Even if it takes a long time for the game to unravel. Because nobody (except maybe George Soros) can time it.

Subscribe to:

Posts (Atom)