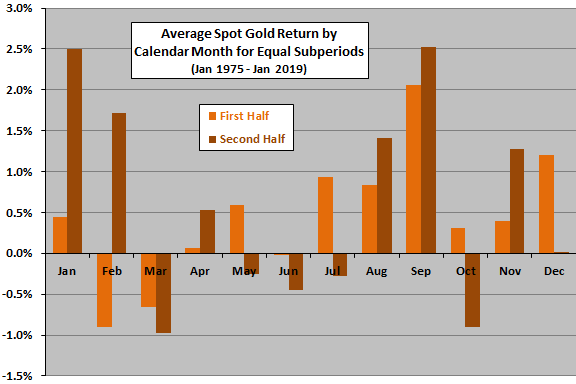

May June is when gold normally sells off seasonally. It tried for a day or two, Then Gold's Best Friend on successive days launched a new vicious round of his Trade War on China, and lashed out at his enemies "on the left" who are "stoking riots across America", vowing to unleash "Vicious Dogs and Ominous Weapons."

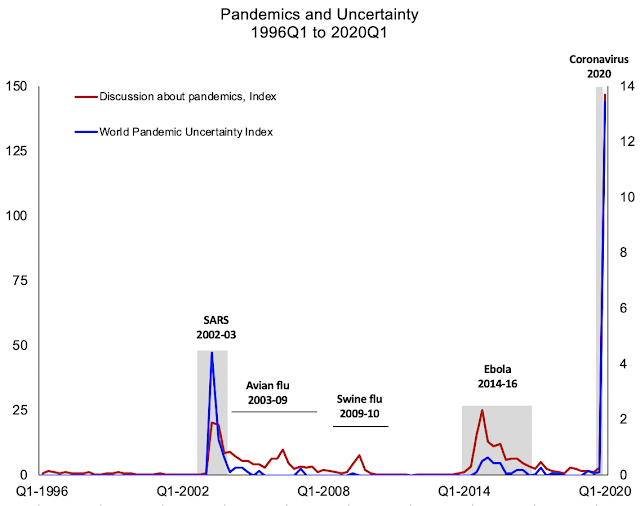

Never missing on opportunity to fan the flames of hatred and discord, while steadfastly refusing to do any actual work of preparing for eminent disaster such as pandemic, or laying the groundwork for healing in the wake of tragedy he is making the Yellow Metal into the most valuable commodity anyone can own.

His government is a shell, having fired everyone who is not a yes man, filling crucial posts with donors, lackeys and half witted family members, it will take years to reassemble a working government even if he loses the next election.

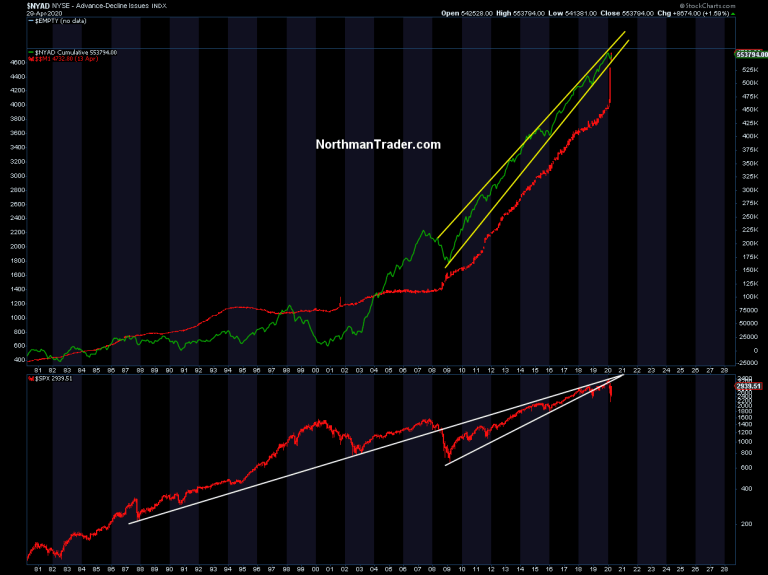

And the damage from the mishandled covid crisis coupled with a response that shovels trillions in the pockets of the wealthiest Americans while leaving the working middle class to fend for itself as the unemployment rolls top 40 million will also not be reparable for many years.

So load up on gold, while you can. Because the yellow metal has never had a better friend than Ttump, and there's plenty of time for him to do much more damage before November.