http://gold-stater.com is now providing daily gold market and gold coin market commentary and updates. Please check in regularly to find the latest developments in gold and gold coins.

Total Pageviews

Saturday, July 27, 2019

Thursday, July 18, 2019

WSJ weighs in on easing cycle

Global Easing Cycle Gains Momentum as Central Banks Cut Rates

With Fed and ECB expected to cut rates soon, central banks in South Korea, Indonesia and South Africa move first

By

Brian Blackstone

ZURICH—Central banks in Asia and South Africa lowered their interest rates Thursday, joining a global easing bandwagon that started earlier this year in the Asia-Pacific region and is expected to include the U.S. and Europe within weeks.

The latest moves, by central banks in South Korea, Indonesia and South Africa, underscore the global nature of the brewing rate-cutting cycle, as policy makers attempt to ward off signs of weaker economic growth. With economies and financial markets interconnected, expectations of lower interest rates by the Federal Reserve and European Central Bank have given central banks in emerging markets scope to lower rates and prop up their economies.

“I think this will provide further impetus for Asian central banks in their easing cycle ahead,” said Prakash Sakpal, an economist at ING Bank.

Since April, New Zealand, India, Malaysia and the Philippines have lowered rates. China’s central bank has taken a number of measures to encourage lending to small businesses, and investors expect it to reduce benchmark rates if the Fed lowers its rates.

The Bank of Korea unexpectedly lowered interest rates for the first time in three years Thursday, responding to pressure to ease policy as economic growth slows. It lowered the base rate by a quarter percentage point to 1.5%.The move took analysts by surprise.

Of the 19 analysts polled by The Wall Street Journal ahead of the decision, 12 had forecast the central bank would stand pat this month and cut the rate in August.The central bank signaled more rate cuts may be coming, downgrading its growth and inflation forecasts for 2019.

Of the 19 analysts polled by The Wall Street Journal ahead of the decision, 12 had forecast the central bank would stand pat this month and cut the rate in August.The central bank signaled more rate cuts may be coming, downgrading its growth and inflation forecasts for 2019.

Monday, July 15, 2019

GOLD AND THE COMPLACENCY BUBBLE

We are living through perhaps the greatest complacency bubble of all time.

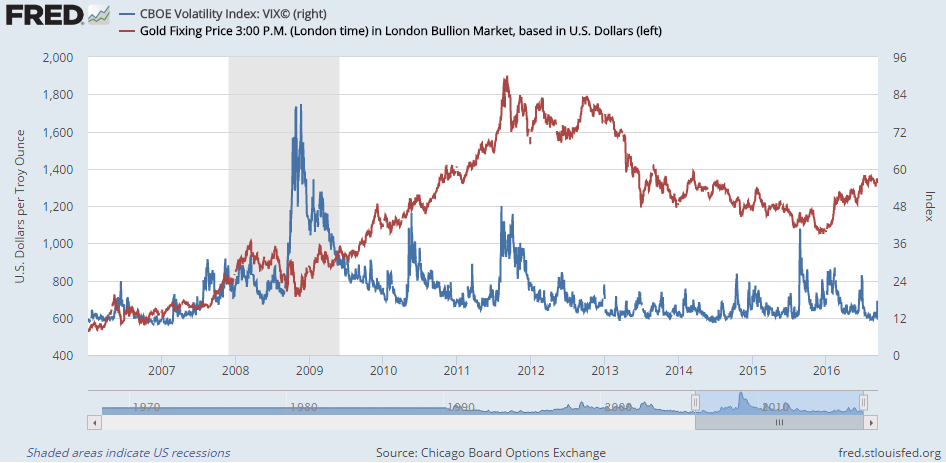

The vix, a measure of stock market volatility is at 12. During the panic in 2008 it was at 60.

Yet debt levels - government, corporate and private are all higher than they were before the crash of 2008. And they are currently exploding higher.

The wealth gap in this country - and around the world - is so serious that the vast middle class is going broke simply attempting to educate, feed and house and care for their children.

We have an openly racist president and a political party that tacitly supports this open racism; who regularly demonize large swaths of the population; who separate children from parents of asylum seekers and keep the children in cages, because it plays well with their base.

And we have a global regime of deeply negative real rates that transfers money out of the pockets of middle class savers and into the pockets of wealthy speculators in the risk markets.

Sure, there is a certain amount of media concern for all these problems. But overwhelmingly people seem to yawn and say "Sure it's sad but things could be a lot worse for me and most of my friends."

This spectacular bubble complacency will end like all bubbles.

The most interesting gauge of the end of the complacency bubble is the price of gold.

Gold is a hedge against instability.

And though gold peaked after the crash of 2008 and the peaking of the vix, it never came back down to where it was before the last complacency bubble. Defensive money was in gold early and held its position through the correction. The price drifted downward as complacency rose. But if you look at the chart below you see an interesting divergence beginning right now.

The vix is still falling but gold is rising. Markedly so. Somebody out there is seeing the end to complacency and loading up before the bubble bursts.

These somebodies have names like Stanley Druckenmiller, Ray Dalio, Paul Tudor Jones and David Einhorn. The paper gold market where these billionaire hedge fund managers load up, is quite thin compared to say the bond market or the stock market. When are few billionaires - along with a few governments like those of Russia, Turkey, Poland and Hungary, start buying, it can move the markets.

But the general complacency has left most retail buyers completely out of this gold rise. In fact, most media commentators believe this to be just another gold blip, that will surely deflate soon.

Maybe.

But to me it looks like some very smart money is beginning to sense the end of the Complacency Bubble.

And when it bursts, gold will be a reliable measure of the instability sure to follow.

Subscribe to:

Posts (Atom)