US GDP: 15 trillion dollars:

World GDP: 84 Trillion dollars:

Total number of dollar denominated financial instruments floating around the world economy: 1.3 Quadrillion dollars.

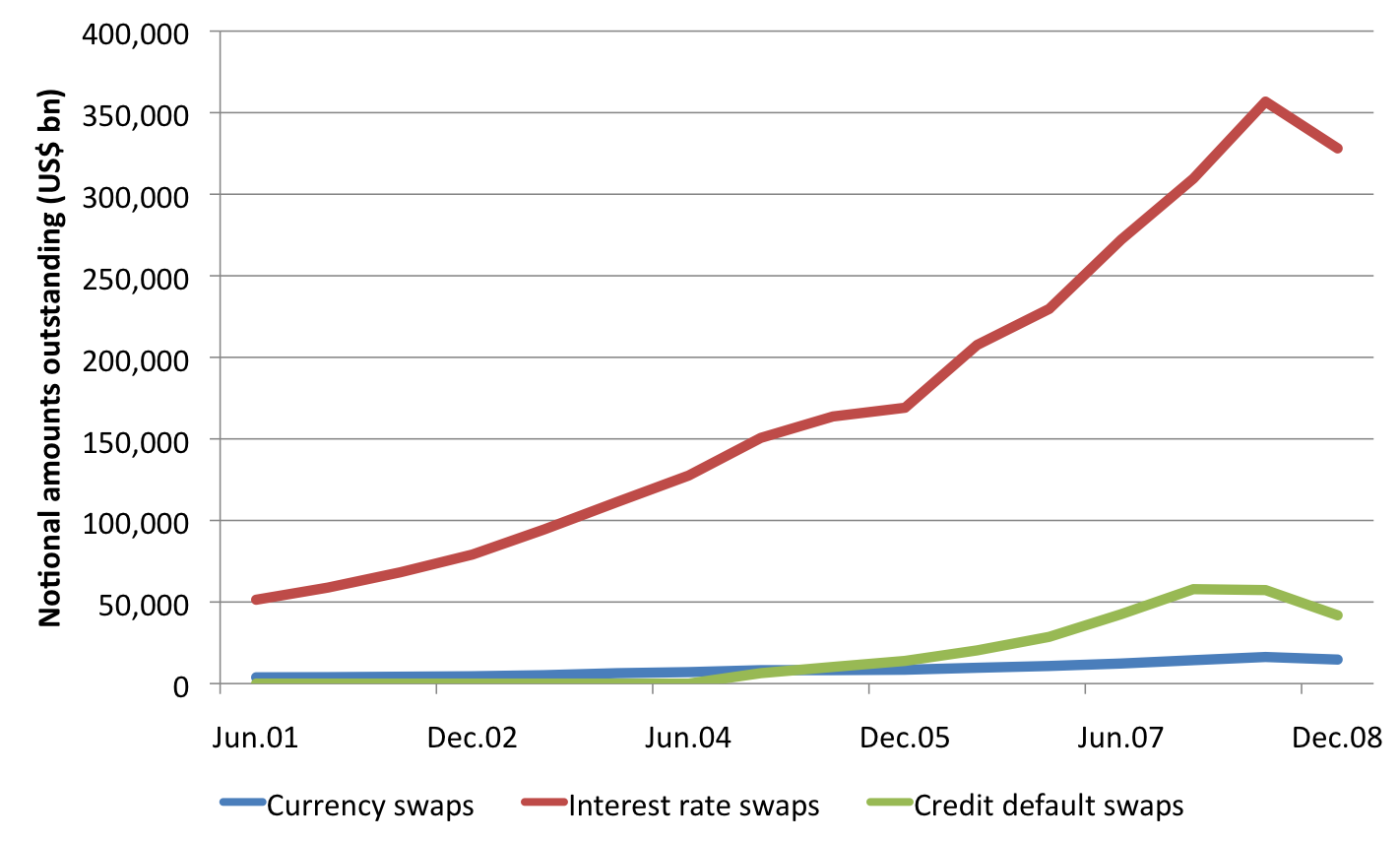

450 Trillion are in Forex Exchange deals.

800 Trillion of those are in unregulated Over the Counter deals.

Nobody anywhere understands where all those dollars are, who owns them, and how sound any of the transactions are. Nobody understands or can quantify in any reasonable way what the COUNTERPARTY RISKS are to all of these dollar denominated transactions.

The last time a major counterparty default occurred was way back in 2008. The world central banks threw 30 to 50 trillion dollars at this problem. Perhaps a drop in the bucket considering the quadrillion dollars floating around.

It certainly has given the world economy the veneer of stability.

Nobody anywhere has any idea what will happen the next time a major counterparty default occurs. Can they print another 30-50 trillion dollars again?

I don't know. Neither does anyone else. But every time they do, the foundation becomes commensurately more unstable.

Total paper dollars in circulation: 2.2 trillion:

Average Forex Trading volume of Dollar Contracts: 5 trillion

Total Forex outstanding US Dollars: 450 Trillion

No comments:

Post a Comment