Retirement savings gap widens between rich and poor

September 18, 2014: 7:06 PM ET

NEW YORK (CNNMoney)

When it comes to retirement savings, the gap between the rich and poor is growing dramatically.

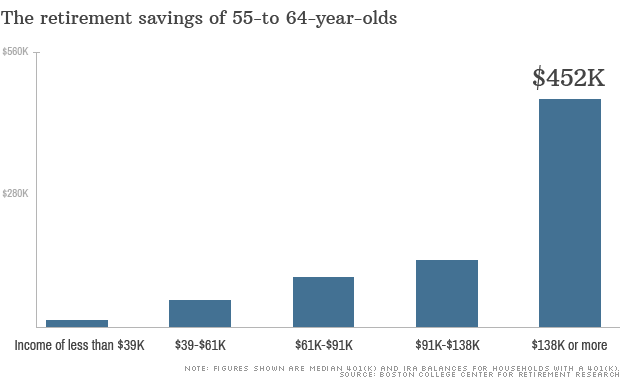

Last year, the typical 55- to 64-year-old household had just $111,000 saved in their 401(k)s and IRAs, which would translate into just $500 a month in retirement income, according to a report from Boston College's Center for Retirement Research that analyzed recent Federal Reserve data.But when you break down the savings by income brackets, the numbers look even bleaker.

Households in the lowest income bracket -- those earning less than $39,000 a year -- had a median savings balance of just $13,000. Meanwhile, those in the top income bracket -- those earning $138,000 or more a year -- had a median of $452,000 saved.

And that's a gap that has widened significantly over the past decade.

America's wealthiest saw the value of their median retirement savings grow by 24% between 2004 and 2013, while low-income households couldn't even keep up with inflation as they watched their savings shrink by nearly 20%, according to the Federal Reserve's inflation-adjusted data.

No comments:

Post a Comment