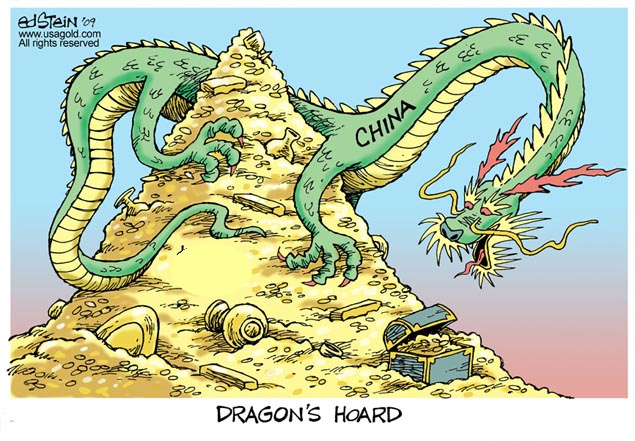

China's gold coup d'etat

What it means for global gold owners

What it means for global gold owners

Special Reportby Michael J. Kosares

China has imported an unprecedented amount of gold bullion in 2013. So much so that, if it were to maintain the current pace, it would import nearly the equivalent of global production for the year.

When the news first filtered out of China on the amounts of gold being mobilized through its Shanghai Gold Exchange, the numbers seemed too large to be believed. The obvious question became "What is the source of this extraordinary amount of gold bullion?" It was only in October when Reuters reported that much of that gold had been shipped from London-based exchange traded funds to Switzerland for refining into smaller Asia-friendly bars and then on to Hong Kong and Shanghai that the full picture came into focus. It was only then that the extraordinary numbers gained credibility.

Part One - The London-Zurich-Hong Kong-Shanghai gold conduitAccording to a recent Reuters report, the United Kingdom's gold exports to Switzerland jumped from 85 tonnes to 1,016 tonnes in the first eight months of 2013 — a twelve times increase. Some bullion market watchers attribute the huge increase to withdrawals or sales from exchange traded funds (ETFs) — an explanation that covers only half the story…….if that. When one learns where this gold ended up and why it went there, the true importance of this unusually large deployment begins to take shape.

Switzerland, according to the Koos Jansen website, has exported over 600 tonnes of gold to Hong Kong through August, 2013. Hong Kong, in turn, has exported over 700 tonnes of gold to the Chinese mainland over the same period through the Shanghai Gold Exchange. Through August, 2013 Koos Jansen puts the totalChinese gold mobilization through the SGE at a stunning 1672 tonnes. Now, with this report of ramped-up exports from the United Kingdom, another piece of the puzzle falls into place and we begin to get a fairly clear picture what these gold mobilizations entail. Switzerland and Hong Kong are acting as a conduit of western gold on its way to China — and probably, at least in part, to Chinese central bank reserves.

To what extent this gold mobilization is the result of some yet-to-be-identified external pressure on London's bullion banks, or simply business as usual, remains to be determined, but gold movements of this size usually do not occur in a vacuum. Hedge funds have been in the gold ETF liquidation mode since April at the behest, it seems, of certain bullion banks that have issued generalized ETF sell recommendations to their clientele (which includes the funds). The ETF selling has been blamed repeatedly for the rapid drop in the price. If all of this has been a ploy to drive down the price on paper and channel substantial amounts of physical gold to China, who is the winner in this game and who is the loser? And why is it being done?

No comments:

Post a Comment