Central banks, mainly those of emerging or the BRIC countries, bought more gold in 2012 than at any time in the past 50 years, a net 536 tonnes. This trend of central banks buying gold instead of selling gold, which started in 2009, is a 180-degree reversal from the original intention of the Washington Agreement whereby central banks gold disposals were coordinated to ensure orderly price forming.

The main buyers in 2012 were the central banks of Russia, China and Turkey.

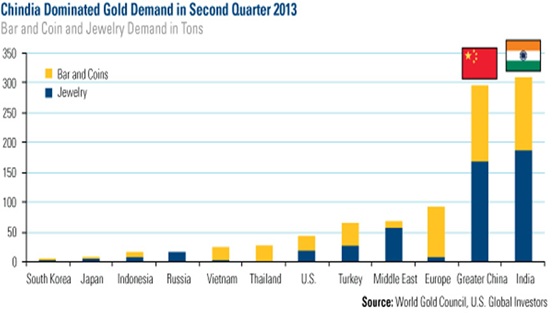

China continues to hoard gold en masse, which is starting to have a dramatic impact on the gold price. Chinese gold consumption is up 50% to 706 metric tons (hereafter tonnes) in the first six months of 2013 -- and is most likely to overtake India as the largest gold consumer in 2013.

The way that China can significantly increase its gold reserves without driving the price of gold sky-high is through buying up its entire domestic production. What is the more remarkable is that China has been able to dramatically increase its gold production, while all the other major gold-producers are reporting flat or declining production.

Russia, world’s largest oil producer, also is one of world’s largest gold buyers. Russia’s central bank has added 570 metric tonnes of the metal in the past decade, now totaling some 1,000 tonnes. During 2012, the Russian central bank increased its holdings by 8.5% or 75 tonnes to 958 tonnes.

One should wonder why these central banks are so eager to purchase “a barbaric relic” which is the opposite of their own creation, paper money. You know why! Because people are finally waking up that physical gold is the only currency with real value that can’t be printed whenever it suits politicians.

While Putin and China are leading the gold rush in emerging markets, developed nations are liquidating

No comments:

Post a Comment