Investors euphoric as US margin debt reaches 'danger' levels

5:39PM BST 13 Aug 2013

Fund managers are around the world are gripped by euphoria, convinced that America is in full recovery and Europe has overcome its debt crisis.

Pandemic of pension woes is plaguing the nation

Published: Monday, 5 Aug 2013 | 6:00 AM ET

By: John W. Schoen | CNBC.com Economics Reporter

Detroit, you're not alone. Across the nation, cities and states are watching Detroit's largest-ever municipal bankruptcy filing with great trepidation. Years of underfunded retirement promises to public sector workers, which helped lay Detroit low, could plunge them into a similar and terrifying financial hole.

A CNBC.com analysis of more than 120 of the nation's largest state and local pension plans finds they face a wide range of burdens as their aging workforces near retirement.

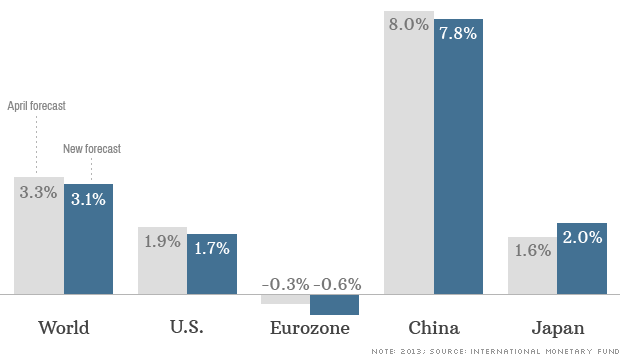

In spite of record money creation, World economy stuck in neutral: IMF

July 9, 2013: 10:37 AM ET

94%

of the $230 Trillion Credit Derivative Market Is Held By Just Four

Banks - See more at:

http://www.classwarfareexists.com/94-of-the-230-trillion-credit-derivative-market-is-held-by-just-four-banks/#sthash.NtAqwXwg.dpuf

94%

of the $230 Trillion Credit Derivative Market Is Held By Just Four

Banks - See more at:

http://www.classwarfareexists.com/94-of-the-230-trillion-credit-derivative-market-is-held-by-just-four-banks/#sthash.NtAqwXwg.dpuf

Ripping Off Young America: The College-Loan Scandal

The federal government has made it easier than ever to borrow money for higher education - saddling a generation with crushing debts and inflating a bubble that could bring down the economy

by Matt Taibbi

AUGUST 15, 2013

On

May 31st, president Barack Obama strolled into the bright sunlight of

the Rose Garden, covered from head to toe in the slime and ooze of the

Benghazi and IRS scandals. In a Karl Rove-ian masterstroke, he simply

pretended they weren't there and changed the subject.US total credit market debt now over 3 times larger than annual GDP.

Wednesday, July 3, 2013 1:12

Worldwide derivatives market could be over $1.2 quadrillion in notional value

We wrote earlier about the recent move by bankers — and the politicians who serve them — to unreform the derivatives market, to return it to its pre–Dodd-Frank, pre–Crash-of-2007 state. This is a serious move by banks and bank lobbyists, and it could well happen soon. The seven bills in the House package of “tweaks” — as the House Agriculture website dishonestly puts it — have cleared the committee with Democratic support and are headed to the House floor. In the meantime, there are companion bills in the Senate.What will happen in the Senate? Well, Dick Durbin (always an Obama surrogate) famously said of the Senate that “the banks own the place.” And of course the White House has been notoriously bank-friendly since day 1. As a friend told me last week, “Bank lobbyists are good; they really earn their money.”

94%

of the $230 Trillion Credit Derivative Market Is Held By Just Four

Banks - See more at:

http://www.classwarfareexists.com/94-of-the-230-trillion-credit-derivative-market-is-held-by-just-four-banks/#sthash.MDOyqeMO.dpuf

No comments:

Post a Comment