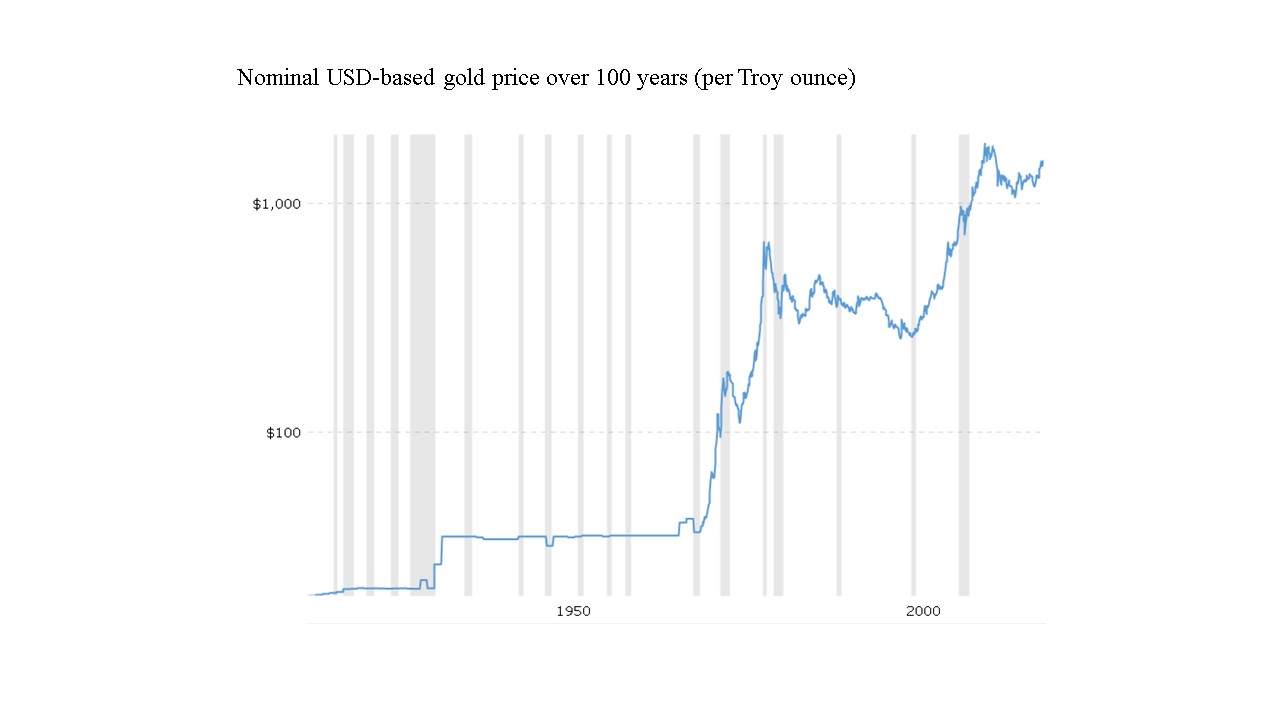

THIS HUNDRED YEAR GOLD CHART SHOWS THE EFFECTS ON

THIS HUNDRED YEAR GOLD CHART SHOWS THE EFFECTS ONTHE GOLD PRICE OF A MASSIVE INFLATION SUPERCYCLE. YOU

CAN SEE THE CYCLE GO BALLISTIC STARTING WITH THE

CLOSING OF THE GOLD WINDOW IN 197O,

IN THE CHART BELOW YOU CAN SEE THAT AT THE SAME TIME WAGES AND SALARY AS A PERCENT OF GDP STARTED TO DROP PRECIPITOUSLY.

THE CHART BELOW ONLY SHOWS THIS PERCENTAGE THROUGH 2012.

IT DROPPED OFF A CLIFF IN TH LAST 3 MONTHS.

THE CHART BELOW ONLY SHOWS THIS PERCENTAGE THROUGH 2012.

IT DROPPED OFF A CLIFF IN TH LAST 3 MONTHS.

COINCIDENCE?

THE QUESTION IS: HOW CAN ONE BEST PROTECT ONESELF FROM THE MALIGNANT CONSEQUENCES OF THIS CYCLE?

STOCKS? PERHAPS. BUT STOCKS ARE AT THE MERCY OF THE EFFICACY OF THE FEDERAL RESERVE BANK TO ENDLESSLY SUPPORT THEM. MAYBE THEY CAN. MAYBE THEY CAN'T.

REAL ESTATE? PERHAPS. BUT REAL ESTATE IS SUBJECT TO THE VICISSITUDES OF OVERCAPACITY AND THE MORTGAGE MARKET.

THAT LEAVES REAL ASSETS: GEMS, OLD MASTERS ARTWORK, HISTORICAL ARTIFACTS, GOLD.

No comments:

Post a Comment