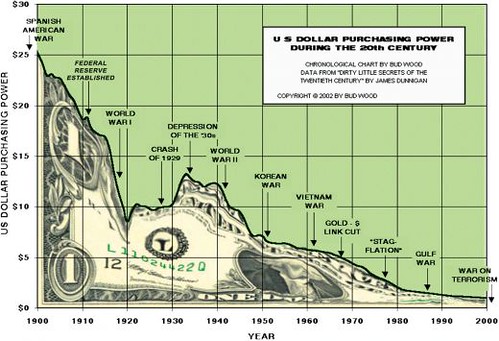

In "normal" times you could easily calculate gold in terms of the purchasing power of the US dollar. Or in terms of total us debt. Many people use these valuation. And they are useful. For example the chart above shows a strong correlation of Gold to US debt. The second chart show gold price moving inversely to the puchasing power of the US dollar.

By both metrics there is no reason to think gold is overvalued. US debt is accumulating at an alarming rate with no sign of moderation even being contemplated, and the purchasing power of the dollar is dropping dramtically while the current Regime has a stated goal of forcing the value of the dollar ever lower.

But Nassim Taleb has shown in his book "The Black Swan" that events we regard as abnormal hit the markets with alarming frequency. They can be any sort of event that was not expected and not built into the models regarding "normal" valuations.

Right now, the gold market is being buffeted with a number Black Swans that are all extremely bullish for gold, and which are, by definition, unaccounted for by the normal methods of gold valuation.

GOLD BLACK SWANS:

1. Tarrifs: Tarrifs on this scale have not been experienced in the global economy since the Great Depression. Tarrifs slow growth and foster inflation. They are stagflationary. However, this is only part of the Tarrif effect on Gold. Tarrifs are also a weaponization of the US Dollar and as such they provide enormous incentive for Global Central Banks to sell dollars and buy Gold - which they are all doing at a record pace. This tail wind for gold is not likely to moderate any time soon.

Tarrifs are also simply the tip of the iceberg in a deglobalization push that is upending 50 years of economic precedent, and the resultant uprooting of supply chains, economic and military alliances, and global trade relationships is necesserily an enormous drag on global growth and highly inflationary.

But if the Global Trade war results in Global Hot wars ( as it did after the Great Depression) that would make gold the most crucial asset for every portfolio.

2. Loss of Independence of the Fed. The Regime take over of the Fed is in progress. The last time a Central Government controlled the central bank in a Western economy was when Hitler took control of the Reichsbank. This was a prelude to World War II. Ir was also a prelude to the theft of 600 million dollars (in 1931 dollars) of gold from European central banks. What this signals for the US, in the short term, is the lowering of rates down to 1 percent, and the resultant inflation, and loss of confidence in the US dollar and US debt. This is terrific for gold.

But the knock on effects of the world's largest economy switching suddenly from a capitalist system to a centrally planned economy controlled by one man are undertermined, but potentially cataclysmicly good for gold.

If this were all, it would still be reason to throw out past valuations and ratchet up all expecatations of Gold's future performance. But a number of other Black Swans could easily occur in the near future. Among them would be a credit crisis (reference Michael Howell and Ray Dalio and David Stockman) a crisis from reversion to the mean in financial assets (reference Jermeny Grantham, Lacy Hunt, Charly Munger among many others) a crisis from the vicious swing in passive investing (Mike Green), a nascent housing crisis (Melody Wright, Gerald Caliente) or the Hot War that occurs in every fourth turning (Neil Howe.)

So high can gold go?

How long can this US and Global instability persist?