We are living through perhaps the greatest complacency bubble of all time.

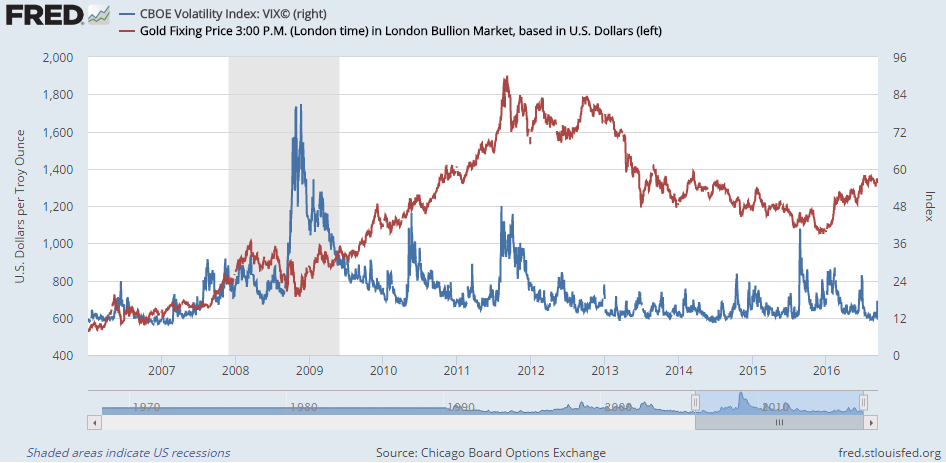

The vix, a measure of stock market volatility is at 12. During the panic in 2008 it was at 60.

Yet debt levels - government, corporate and private are all higher than they were before the crash of 2008. And they are currently exploding higher.

The wealth gap in this country - and around the world - is so serious that the vast middle class is going broke simply attempting to educate, feed and house and care for their children.

We have an openly racist president and a political party that tacitly supports this open racism; who regularly demonize large swaths of the population; who separate children from parents of asylum seekers and keep the children in cages, because it plays well with their base.

And we have a global regime of deeply negative real rates that transfers money out of the pockets of middle class savers and into the pockets of wealthy speculators in the risk markets.

Sure, there is a certain amount of media concern for all these problems. But overwhelmingly people seem to yawn and say "Sure it's sad but things could be a lot worse for me and most of my friends."

This spectacular bubble complacency will end like all bubbles.

The most interesting gauge of the end of the complacency bubble is the price of gold.

Gold is a hedge against instability.

And though gold peaked after the crash of 2008 and the peaking of the vix, it never came back down to where it was before the last complacency bubble. Defensive money was in gold early and held its position through the correction. The price drifted downward as complacency rose. But if you look at the chart below you see an interesting divergence beginning right now.

The vix is still falling but gold is rising. Markedly so. Somebody out there is seeing the end to complacency and loading up before the bubble bursts.

These somebodies have names like Stanley Druckenmiller, Ray Dalio, Paul Tudor Jones and David Einhorn. The paper gold market where these billionaire hedge fund managers load up, is quite thin compared to say the bond market or the stock market. When are few billionaires - along with a few governments like those of Russia, Turkey, Poland and Hungary, start buying, it can move the markets.

But the general complacency has left most retail buyers completely out of this gold rise. In fact, most media commentators believe this to be just another gold blip, that will surely deflate soon.

Maybe.

But to me it looks like some very smart money is beginning to sense the end of the Complacency Bubble.

And when it bursts, gold will be a reliable measure of the instability sure to follow.

No comments:

Post a Comment