You can't. Because there's no demand.

By Peter Robison -

Oct 2, 2012 8:53 AM ET

The 1.2 million households whose incomes put them in the top 1 percent of the U.S. saw their earnings increase 5.5 percent last year, according to estimates released last month by the U.S. Census Bureau. Earnings fell 1.7 percent for the 96 million households in the bottom 80 percent -- those that made less than $101,583.

The income gap between rural households in China under a commonly used gauge known as the Gini coefficient reached 0.3949 last year, nearing a “danger level” of 0.40 set by the United Nations for potential social unrest. The figure was 0.47 in the U.S. last year.

America’s Growing Income Gap Shows Two Recoveries in Action

Since the Great Recession ended in June 2009, one measure of income inequality has reached its widest point in more than 40 years. The Gini index, which measures how income is distributed, was 0.47 in 2011 – a 1.6 percent increase from 2010 and the first statistically significant annual increase since 1993. A score of 0 would indicate perfectly equal distribution, while a score of 1 would reflect a population in which one individual received all the income.

Read the full story here.

Meanwhile: Real Inflation is crushing what little the middle class retains:

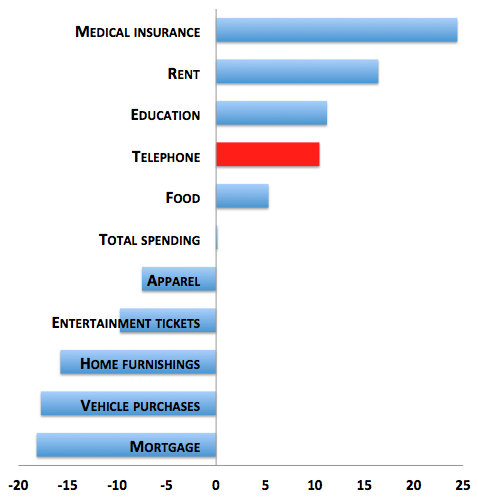

Change in Family Spending: 2007 – 2011

Medical Insurance, Rent, Food, Education: Not counted in CPI Inflation statistics. Neither is Fuel for your car and house.

In other words everything you need is way more expensive. And none of it is counted into official inflation figures. There is no inflation according to all economic advisers. That's because economic advisers are in that top 1 percent.

No comments:

Post a Comment