Where is the Gold price headed?

To know this you have to understand the basic elements of the two principles at play: Gold price, and Time.

Both are elastic.

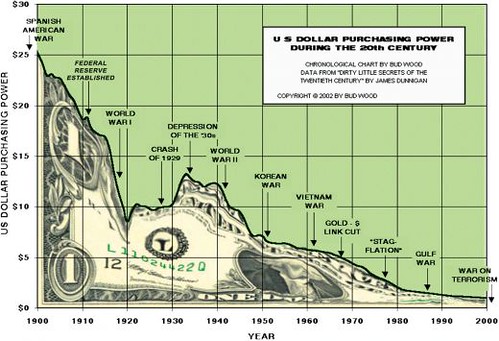

The Gold price is elastic, but in a surprising way: the more expensive it gets, the higher the demand. This is because it becomes expensive when other currencies erode and then begin to fail. And as they erode you need more and more gold to protect yourself. And since gold price is primarily central bank driven there is no limit to the amount a central bank will buy to protect its economic viability, thus driving the price ever higher.

But as it gets ever more expensive it becomes ever more necessary for the retail investor but they never realize this until their paper currencies become extremely compromised and by then they have to buy smaller and smaller quantities, fractions of ounces. But as gold is divisible this is never a problem for gold. The premium on quarter ounces and tenth ounces simply blow out.

But figuring out what price it will reach at what time is not possible when you take into account the elasticity of time.

For example we know there are cycles, like the 8 year cycle, or the 13 month cycle. Or the ellliot wave cycles. All of these can by instructive to some degree or other. But none of them take into account the elasticity of TIme itself. One year can whip by. Another drags on forever. This is not merely an illusion of subjectivity. Rather our measurement of time is the illusion of subjectivity.

Just as our prediciton of price at a certain time is an illusion of subjectivity.

What this means for price discovery is that the conditions that create a Gold bull market are the determining factor for price. And the various methods of measurning the time of a gold bull market tend to be useless. You just have to accumulate and let the price unfold as it will. As long as the paper currencies are being eroded, gold tends higher.

That is why bullion is the only sensible way to accumulate gold. Because you will not be tempted to trade gold bullion. And trading a gold bull is the fastest way to lose all your assets. Because it is impossible to measure the elasticity of Time.