The difference between genius and stupidity is

that genius has its limits.

– Albert Einstein

You can almost feel it in the air. The froth and foam on markets of all

shapes and sizes all over the world. It’s exhilarating, and the pundits who

populate the media outlets are bubbling over. There’s nothing like a rising

market to lift our moods. Unless of course, as Prof. Kindleberger famously

cautioned (see below), we are not participating in that rising market. Then we

feel like losers. But what if the rising market is … a bubble? Are we smart

enough to ride it high and then bail out before it bursts? Research says we all

think that we are, yet we rarely demonstrate the actual ability.

My friend Grant Williams thinks the biggest bubble around is in complacency.

I agree that is a large one, but I think even larger bubbles, still building,

are those of government debt and government promises. When these latter two

burst, and probably simultaneously, that will mark the true bottom for this

cycle now pushing 90 years old.

So, this week we'll think about bubbles. Specifically, we'll have a look at

part of the chapter on bubbles from

Code Red, my latest book,

coauthored with Jonathan Tepper, which we launched late last year. I was putting

this chapter together about this time last year while in Montana, and so in a

lazy August it is good to remind ourselves of the problems that will face us

when everyone returns to their desks in a few weeks. And note, this is not the

whole chapter, but at the end of the letter is a link to the entire chapter,

should you desire more.

As I wrote earlier this week, I am NOT calling a top, but I am pointing out

that our risk antennae should be up. You should have a well-designed risk

program for your investments. I understand you have to be in the markets to get

those gains, and I encourage that, but you have to have a discipline in place

for cutting your losses and getting back in after a market drop.

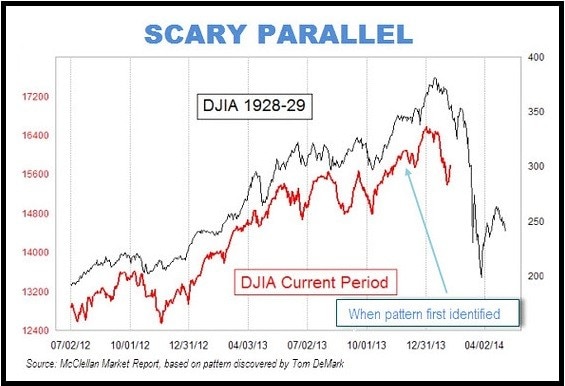

There is enough data out there to suggest that the market is toppy and the

upside is not evenly balanced. Take a look at these four charts. I offer these

updated charts and note that some charts in the letter below are from last year,

but the levels have only increased. The direction is the same. What they show is

that by many metrics the market is at levels that are highly risky; but as 2000

proved, high-risk markets can go higher. The graphs speak for themselves. Let’s

look at the Q-ratio, corporate equities to GDP (the Buffett Indicator), the

Shiller CAPE, and margin debt.

We make the case in

Code Red that central banks are inflating

bubbles everywhere, and that even though bubbles are unpredictable almost by

definition, there are ways to benefit from them. So, without further ado, let’s

look at what co-author Jonathan Tepper and I have to say about bubbles in

Chapter 9.

Easy Money Will Lead to Bubbles and How to Profit

from Them

Every year, the Darwin Awards are given out to honor fools who kill

themselves accidentally and remove themselves from the human gene pool. The 2009

Award went to two bank robbers. The robbers figured they would use dynamite to

get into a bank. They packed large quantities of dynamite by the ATM machine at

a bank in Dinant, Belgium. Unhappy with merely putting dynamite in the ATM, they

pumped lots of gas through the letterbox to make the explosion bigger. And then

they detonated the explosives. Unfortunately for them, they were standing right

next to the bank. The entire bank was blown to pieces. When police arrived, they

found one robber with severe injuries. They took him to the hospital, but he

died quickly. After they searched through the rubble, they found his accomplice.

It reminds you a bit of the immortal line from the film

The Italian Job

where robbers led by Sir Michael Caine, after totally demolishing a van in a

spectacular explosion, shouted at th em, “You’re only supposed to blow the

bloody doors off!”

Central banks are trying to make stock prices and house prices go up, but

much like the winners of the 2009 Darwin Awards, they will likely get a lot more

bang for their buck than they bargained for. All Code Red tools are intended to

generate spillovers to other financial markets. For example, quantitative easing

(QE) and large-scale asset purchases (LSAPs) are meant to boost stock prices and

weaken the dollar, lower bonds yields, and chase investors into higher-risk

assets. Central bankers hope they can find the right amount of dynamite to blow

open the bank doors, b

ut it is highly unlikely that they’ll be able to find just

the right amount of money printing, interest rate manipulation, and currency

debasement to not damage anything but the doors. We’ll likely see more booms and

busts in all sorts of markets because of the Code Red policies of central banks,

just as we have in the past. They don’t seem to learn the right lessons.

Targeting stock prices is par for the course in a Code Red world. Officially,

the Fed receives its marching orders from Congress and has a dual mandate:

stable prices and high employment. But in the past few years, by embarking on

Code Red policies,

Bernanke and his colleagues have unilaterally added a third

mandate: higher stock prices. The chairman himself pointed out that stock

markets had risen strongly since he signaled the Fed would likely do more QE

during a speech in Jackson Hole, Wyoming, in 2010. “I do think that our policies

have contributed to a stronger stock market, just as they did in March of 2009,

when we did the last iteration [of QE]. The S&P 500 is up about 20 percent

plus and the Russell 2000 is up 30 percent plus.” It is not hard to see why

stock markets rally when investors believe the most powerful central banker in

the world wants to print money and see stock markets go up.

Investors are thrilled. As Mohamed El-Erian, chief executive officer at

Pacific Investment Management Company, said,

“Central banks are our best friends

not because they like markets, but because they can only get to their macro

objectives by going through the markets.”

Properly reflected on, this is staggering in its implications. A supposedly

neutral central bank has decided that it can engineer a recovery by inflating

asset prices. The objective is to create a “wealth effect” that will make those

who invest in stocks feel wealthier and then decide to spend money and invest in

new projects. This will eventually be felt throughout the economy.

This

“trickle-down” monetary policy has been successful in creating wealth for those

who were already rich (and for the banks and investment management firms who

service them) but has been spectacularly a failure in creating good jobs and a

high-growth economy. The latest quarter as we write this letter will be in the 1

percent gross domestic product (GDP) range.

And to listen to the speeches from the majority of members of the Federal

Reserve Open Market Committee, their prescription is more of the same. Indeed,

when Bernanke merely hinted this summer that QE might end at some point,

something that everyone already knows, the market swooned and a half-a-dozen of

his fellow committee members felt compelled to issue statements and speeches the

next week, saying, “Not really, guys, we really are going to keep it up for a

bit longer.”

We’ve seen this movie before. In the book

When Money Dies, Adam

Fergusson quotes from the diary of Anna Eisenmenger, an Austrian widow. In early

1920 Eisenmenger wrote, “Speculation on the stock exchange has spread to all

ranks of the population and shares rise like air balloons to limitless heights.

... My banker congratulates me on every new rise, but he does not dispel the

secret uneasiness which my growing wealth arouses in me ... it already amounts

to millions.” Much like after the initial Nixon Shock in the 1970s, stock prices

rise rapidly when a currency weakens and money supply grows. Not surprisingly,

the 1970s led to bubbles in commodities.

Excess Liquidity Creating Bubbles

One area that stands out as particularly bubbly is the corporate bond market.

Investors are barely being compensated for the risks they’re taking. In 2007, a

three-month certificate of deposit yielded more than junk bonds do today.

Average yields on investment-grade debt worldwide dropped to a record low 2.45

percent as we write this from 3.4 percent a year ago, according to Bank of

America Merrill Lynch’s Global Corporate Index. Veteran investors in high-yield

bonds and bank debt see a bubble forming. Wilbur L. Ross Jr., chairman and CEO

of WL Ross & Co. has pointed to a “ticking time bomb” in the debt markets.

Ross noted that one third of first-time issuers had CCC or lower credit ratings

and in the past year more than 60 percent of the high-yield bonds were

refinancings. None of the capital was to be used for expansion or working

capital, just refinancing balance sheets. Some people think it is good there is

no new leveraging, but it is much worse.

This means that many companies had no

cash on hand to pay off old debt and had to refinance.

One day, all the debt will come due, and it will end with a bang. “We are

building a bigger time bomb” with $500 billion a year in debt coming due between

2018 and 2020, at a point in time when the bonds might not be able to be

refinanced as easily as they are today, Mr. Ross said. Government bonds are not

even safe because if they revert to the average yield seen between 2000 and

2010, ten year treasuries would be down 23 percent. “If there is so much

downside risk in normal treasuries,” riskier high yield is even more mispriced,

Mr. Ross said. “We may look back and say the real bubble is debt.”

Then

Merkel is telling France it has to reform. The French economic

implosion cannot be dealt with by increasing the scope of socialism.

Hollande also is in his empire building role where socialism would work

if he could only stop people from leaving and transform the country into

a dictatorial communistic state. He cannot see that his ideas are

fundamentally flawed and have been attempted both in China and Russia

with failure. France will be forced to either let go, as did China, or

hand it all to an oligarchy, as did Russia.

Then

Merkel is telling France it has to reform. The French economic

implosion cannot be dealt with by increasing the scope of socialism.

Hollande also is in his empire building role where socialism would work

if he could only stop people from leaving and transform the country into

a dictatorial communistic state. He cannot see that his ideas are

fundamentally flawed and have been attempted both in China and Russia

with failure. France will be forced to either let go, as did China, or

hand it all to an oligarchy, as did Russia.

'A watershed moment in literary history' - the first printed book in English.

'A watershed moment in literary history' - the first printed book in English.