The recent crypto implosion of the largest and most trusted Crypto Exchange FTX just wiped out 150 billion dollars in a few days. It turns out nobody involved will ever recoup their losses because the money that was supposed to be held by the exchange isn't there.

This is simply the danger inherent in any form of FINANCIALIZATION - that is not tied or backed by a constant like GOLD.

Financialization has existed along side gold throughout recorded human history. In fact many of the first historical documents going back to Sumerian cunieform were simply recorded transactions - many of which were forms of financialzation in that they were agreements to deliver this for that at some date.

If you trade this for that now you make a record. If for any number of reasons it is most convenient to actualize the transaction at some other date you need a Contract which is the most basic form of financialization.

The key throughought history until 1971 was that in theory you knew exactly how much of this to trade for that because they were both convertible into a certain amount of Gold.

And large entities like governments of cities or city/states or large trading concerns, or lending outfits had to have x amount of gold to legitimize their contracts.

Of course many tiny towns had no gold. So they used other measures of wealth, But they are of no concern on the stage of the history of world finance because they didn't operate there. The ships carrying international goods that sailed the seas from the time of the Sumerians as well as the caravans of traders just didn't stop there.

So there has always been gold. And there has always been financialization. And they have always been tied together.

Until 1971.

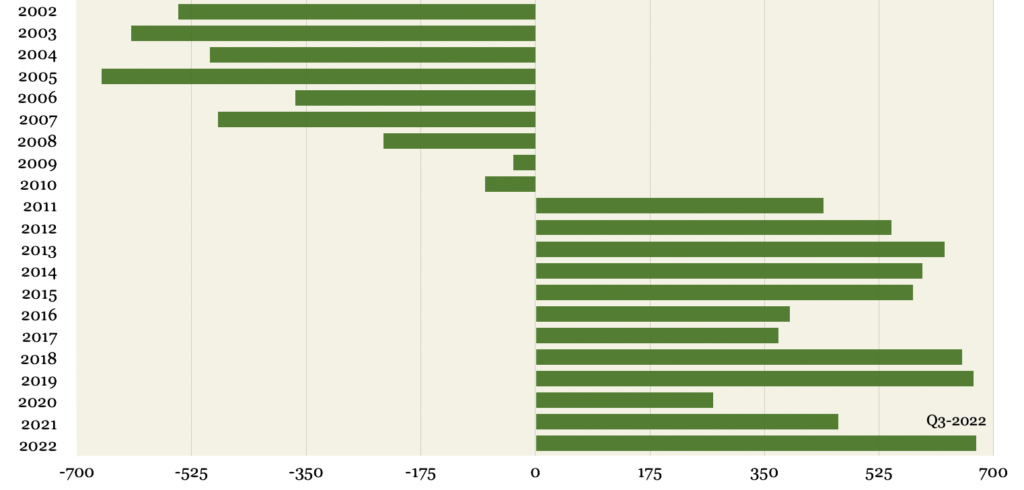

At that point all the central banks still held gold. And all their member banks still fiancialized. But the link was broken. So that there was an explosion of financialization that was no longer backed or converted into anything but theoretical currency which is just another type of financialization.

For a time this worked fine. It allowed the global economy to expand. Rapidly. And then Very Rapidly.

The problem with unconvertible financialzation is that it relies entirely on the Good Faith of the actors involved.

When Good Faith comes into question, as is happening in Politics, in the Economy, and in the institutions of Law here and around the globe, Financialzation breaks down.

Or you could say that the rapidity of the expansion created a lot of room - and incentive - for bad actors.

Financialization began to break first with LTCM which required 3.6 billion dollars of Fed bailout money: then the S and L crisis required 150 billion of Fed bailout money. That seemed like a lot at them time.

Then came the subprime crisis in 2008. The entire economy imploded under George Bush and was bailed out with 3 trillion dollars by the Fed!

3 trillion dollars created out of thin air and transferred to the wealthiest 1 percent. And nobody batted an eye!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

That is money they simply created out of thin air. Backed by nothing. The fed claims it was "repaid." Yet it stayed in the economy - in the pockets of the very wealthy.

Then in 2018 the economy collapsed again with covid under Trump and this time the Fed bailed it out with 10 trillion dollars that they created out of thin air to buy up the illiquid assets of the very wealthy.

It's all still on their balance sheet in spite of their regime of "tightening" which is sending a global economy dependent on Fed easy money into a tailspin.

Those two Fed injections amount to thirteen trillion dollars made up out of thin air and given all to the very wealthy - in ten years. On top of that the government runs a trillion dollar a year deficit (three trillion one year under Trump) and then doles out periodic stimulus to the middle class to the tune of 2 trillion under Trump and another 2 trillion under Biden.

This is all possible because financialized assets are no longer convertible into gold.

Pure and Simple.

So what is gold - and why hasn't it soared during this period?

Gold is what is has always been. The Wealth Constant. Pure money - in other words a pure measure of stability of worth of anything that can be traded. Pure in the sense that it has no counterparty risk. It's value is entirely intrinsic. If someone will trade you x amount of gold for y - that is y's ultimate value..

Short term, you can trade anything for anthing.

Long term you can only measure value by the value of a constant. Gold has been that constant for over 5000 years of recorded history.

Why hasn't it soared then as our institutions, laws, become the objects of scorn and ridicule and financialzation has carreened out of control?

Because it takes a while to shake the faith of the vast public in financialization.

It is only through massive faith that so many people could put their money into opaque crypto exchanges. Imagine the leap of faith that takes. It can't be wiped out in a minute. Your're wealth can. But faith can linger.

It's tough to shake because their faith in financialization is very pure - as most people have no idea what financialization really is. They just believe it must work. After all it created so much wealth - for so few. Maybe it can do the same for you. Everyone hopes so.

But as bit coin exchanges collapse, and governments stop working, social security goes broke, and costs sprial out of control, and all the created-out-of-thin air assets go only to a very few at the very top of society - faith is beginning to crack.

You see it in the corrupt populism overtaking world politics. You see it in the anger, the violence and the scapegoating of the left-behind world populations. And you see it in the scandals and the imploding zombie coroporations that are revealed daily, as liquidity tightens.

And ultimately as hundreds of billions of currency units keep being lost in the void of bad faith, the general attention will return to the constant.

Gold.