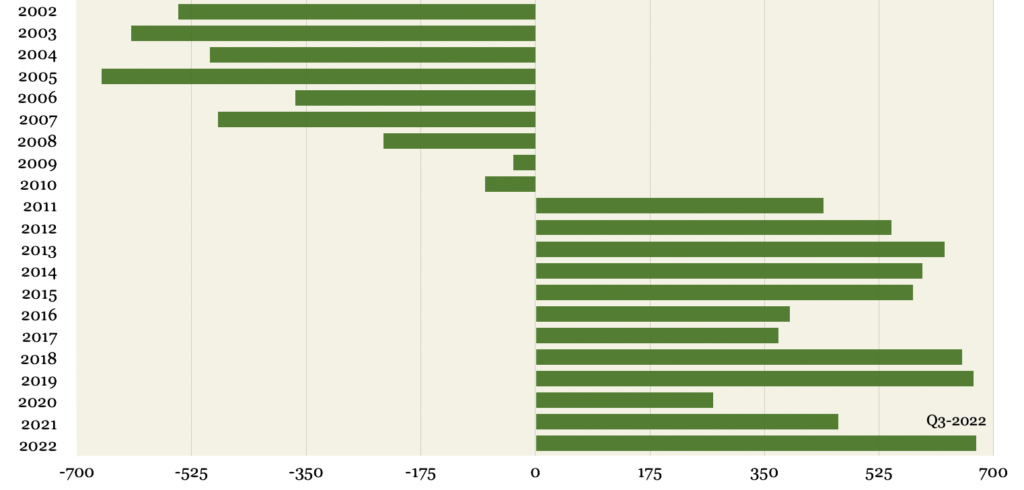

Central Bank Gold Sales and Purchases

2002-2022 (Q3) (net; metric tonnes)

The problem with Fiat Currency is that there is nothing to check its issuance. Everywhere and always those who own the printing press succumb to the power of being able to run it until the currency loses all value.

The process, as Hemingway once quipped, occcurs in two stages: Gradually and then Suddenly.

We have been in the Gradual stage since 1971. Paul Volcker did a major reset in 1980, that convinced most around the world that the dollar would be an exception. Those in control were willing to risk recession or even depression to insure its stability.

Then came Reagan and Greenspan. The lull to power was too much for them and they began the gradual debasement of the currency that has lasted for forty years.

We are still in the Gradual phase. The dollar is still the world's reserve currency. The US markets are still the world's deepest and most stable markets, both debt and equity,

But debt levels are the highest by any standard in modern history. Debt derivative levels are off the charts. Equity valuations are at historic highs. Home values are at historic highs. All this while inflation globally his received a jolt through the disruption of supply chains and a global trade war has permanently disrupted the massive deflationary force of globalization.

So an economy addicted to - and dependent on - a massive flow of money printing - has to readjust to an inflationary impulse that makes the uninterupted printing impossible.

Nobody knows what the withdrawal process will look like. But cracks in the stability of the system are already apparant to all the governments of the world. So they are dumping dollars and buying gold.

The process began after the crisis of 2008. It's been accelerating ever since even though a veneer of order was restored by the Massive QE that followed.

Now that this QE is no longer possible without bankrupting the vast middle class, the central banks of the world are dumping dollars and buying gold.

Supposedly they are run by a bunch of dopes who are always behind the curve. At least according to smart hedge fund managers who have been on this track for years themselves. The thing that is certain is that the Reddit crowd, the vast retail market is always the last to understand the big trend. They are always trading the last trend.

And when it Suddenly becomes apparant that Gold is the currency of choice it will be too late.

Because gold will be at $3000. Suddenly. And then everyone who didn't stock up at $1700, $1800, $2000. $2200 etc will be scrambling to protect themselves from a global competitive currency debasement after the fact.

No comments:

Post a Comment