There's a lot of analysts who believe the 'inflation is transitory' theory. "It has always come right back down, It will this time too." Especially with the Fed and governments tightenting,

Sounds reasonable. And it would be too if the inflation were caused by rising demand.

But it's not.

Yes, politicians and political hack economists are all harping on the stimulus.

Like we haven't had 50 trillion dollars of stimulus over the last 20 years - just counting Federal deficit spending and Fed balance sheet expansion. (If you add in all the rest of the stimulus that comes in the forms of other types of debt creation the number is astronomical.)

The fact is, for the first time in 50 years we are now experiencing Cost-push inflation or Supply Side inflation. This means that no matter what you do to crush demand it will only have the slightest affect on the inflation. In fact it makes it worse because it depresses real wages at the same time as real cost of living is soaring.

How did we get here?

America First. It sounds great. More jobs for Americans! (It didn't create any.) And maybe it sounds good to you. But moving jobs from overseas means higher labor costs, and sourcing inputs from America rather than the cheapest countries means higher input costs. And slapping tarrifs on anyone we don't like means higher costs on goods. And of course everyone follows suit. That's DEGLOBALIZATION. Maybe politically you like the idea. But is comes with massive INFLATION. That's just an economic fact.

Then with Deglobalization comes TRADE WARS, CURRENCY WARS and most disruptive of all HOT WAR as we have now between Russia and Ukraine withe the EU and the US as proxies for Ukraine, and China and Saudi Arabia and Iran as proxies for Russia. This is massively infaltionary. Food costs soar. Energy costs soar. And military spending is massively inflationary.

And there's nothing that domestic economic policy can do about it.

Nada.

But we can blame each other loudly and wrongly. Or blame the immigrants. That creates a lot of hatred. It doesn't solve any problems.

So what to do?

You know what I think. Nothing will change until we diagnose the problem properly. And politically the chances of that happening are nil.

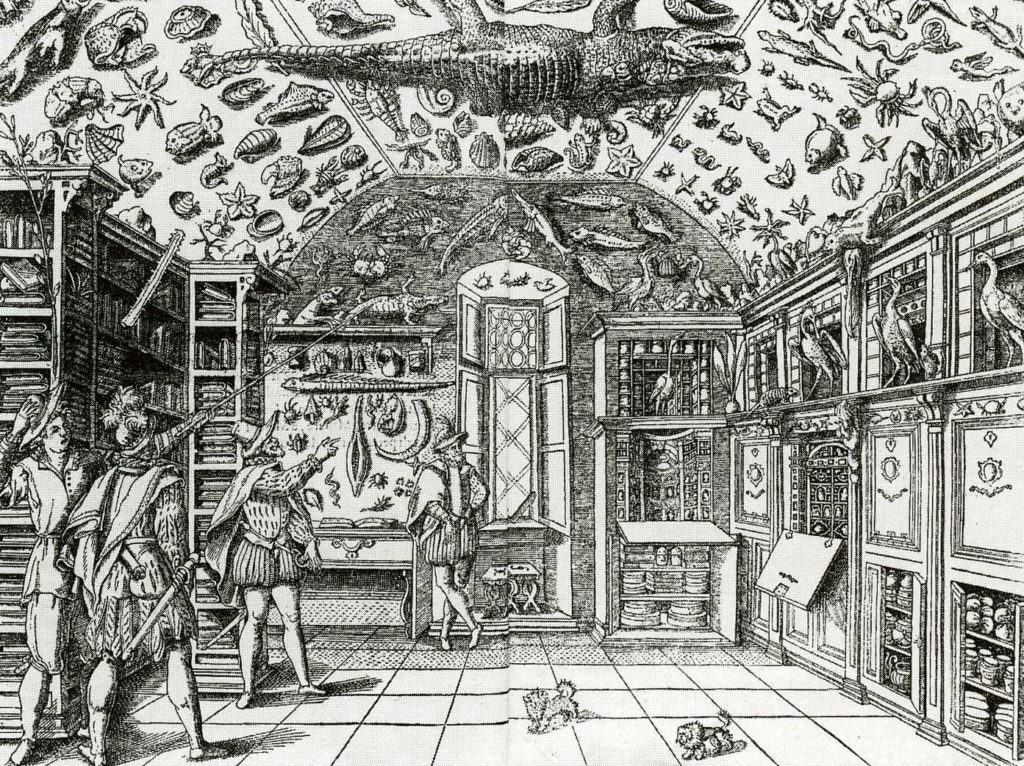

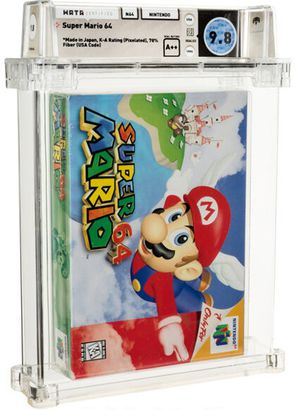

So protect yourself. As economic conditions devolve, only real things - Hard Assets - will thrive.

space flown medallion: 2 million dollars

space flown medallion: 2 million dollars

red wine 1971: $92k

red wine 1971: $92k r2 d2 from star wars 2.7 million

r2 d2 from star wars 2.7 million