If you follow the brilliant Youtube WEALTHION series you may have noticed more than one anyalyst has remarked on how Japan's extroardinary forray into unconventional financial innovation has been at first mocked, then accepted, then followed by other Western Economies. They were first to go to ZERO rates. Absurd! cried other Western Economies. Soon Everyone was at Zero rates. Then Negative Rates. Then Quantitative Easing. Everyone has followed every step of the way.

Now Japan has adopted yeild curve control. Something that certainly can't work without destroying the currency, right? Well yesterday Great Britain entered the yeild curve control club with a policy of buying unlimited amounts of long dated gilts. Can the ECB be far behind? I doubt it.

And in the end the US will be there too. It is inevitable. It's that or let rates rise above the real inflation rate and try to service the massive debt at 10 percent or higher.

What does that mean for you investments?

Well, if we look at Japan as the model for the financialization, let's also look at Japan's investment model.

For many years now Japan's wealthy investing class has been scouring the world for High End Hard Asset Collectibles. They invest in evetrything from high end fine art to Original French Dadaist first edition books to Chinese porcelains to Ancient Gold coins and to Gold Historical Medallions.

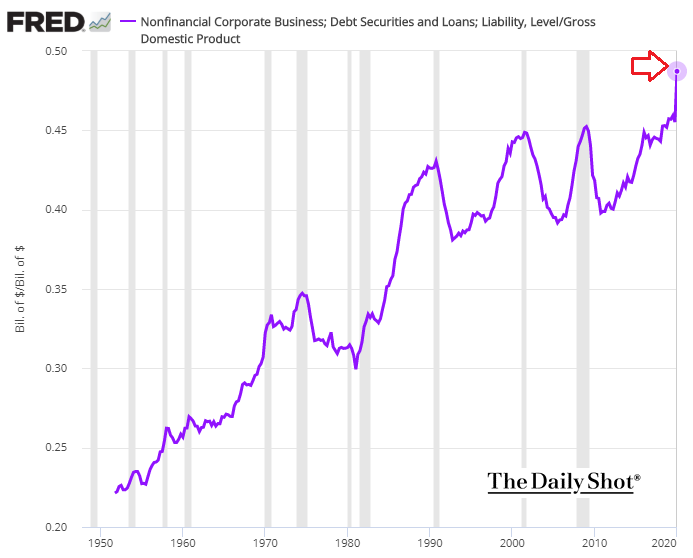

Americans have been slow to enter this field of investment because Stocks and Bonds have been hammered into the general consciousness. But the value of all paper assets is now finally collapsing under the deluge of Credit/debt where Global Debt to GDP is now about 400 percent, not including another 10,000 percent in Debt Derivatives.

The collapse will not occur all at once. There will be counter rallies - some be violent and lengthy. But the collapse is inevitable because the Disenflationary Globalization Movement that worked to keep inflation under control for the last 40 years has reversed into a vicious DEGLOBALIZATION which is now working to magnify the inflationary impulse of unchecked money printing.

So what can you do? I say follow the economy that has been leading the way all along. Invest in Hard Assets. They will keep you safe.

Major Hedge Funds like Black Rock and Blackstone have already developed Alternative Investment funds to exploit these areas. But Hard Asset investing (It used to be called Collectibles - but that sounds so childish!) is really in its infancy.

How to start? Find something in which you have some expertise and then start collecting . Hot areas now include Sports Cards and memorabilia, Entertainment Memorabilia, Coins, Stamps, Medallions, Cars, Waches, Wines, Historical Documents, Jewlery, Sneakers (!) First Edtion Books.

Real Things. Not imaginary paper - or electronic tokens.

If you're thinking crypto or E-tokens or NFTs - I know it sounds cool. It sounds like the future. It's not. Don't get fooled by words like decentralized. Everything electronic is subject to government control and ultimate government confiscation. If you don't think the government is lurking in every corner of the dark web, you're a fool.

You can't hide your cryptos in a hole in your backyard.

The future is back to the REAL.