Unsustainable is a word that describes so much of the current economic environment. The Fed raising rates into a slowdown for example. They can do it for so long but as they do several obviously unsustainable things happen at once.

For one the interest payments on the ballooning federal debt (which soared an astonishing 25 percent during Trump's 4 years) become obviously unsustainable. Receipts are declining as payments are rapidly rising.

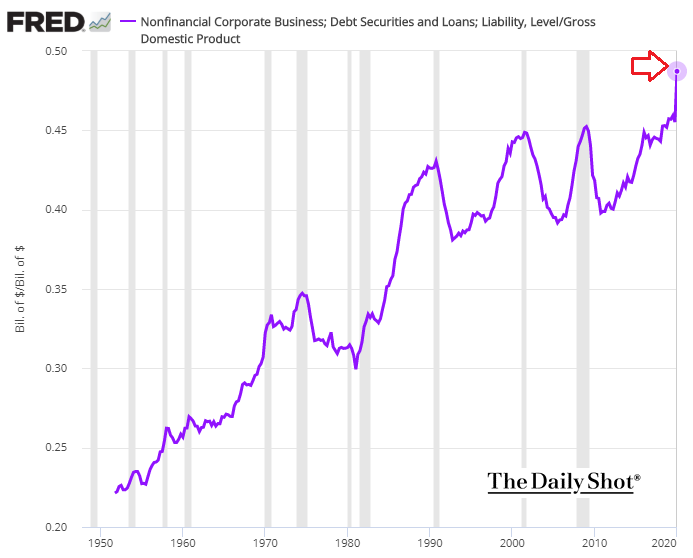

And corporations are in the same boat.

To make matters much worse, these are cumulative numbers. The trouble comes when you strip out the healthiest One percent. The vast majority of households, and corporations are in poor shape. The wealth - and market share of the one percenters make the numbers seem far better than they really are.

Just because Walmart is still doing well. And Blackrock is doing well, and Chase Bank is doing okay doesn't mean that when JC Penny and Archegos and Washington Federal go under the ripples won't be felt across the economy.

As the Fed keeps tightening into weakness eventually someone big and unexpected will go under.

Or the Fed will realize its course is unsustainable and there will be a pivot that sends inflation spiraling back up.

I'm afraid those are the the two outcomes.

And when we get to either one, you'll want to own hard assets.

No comments:

Post a Comment