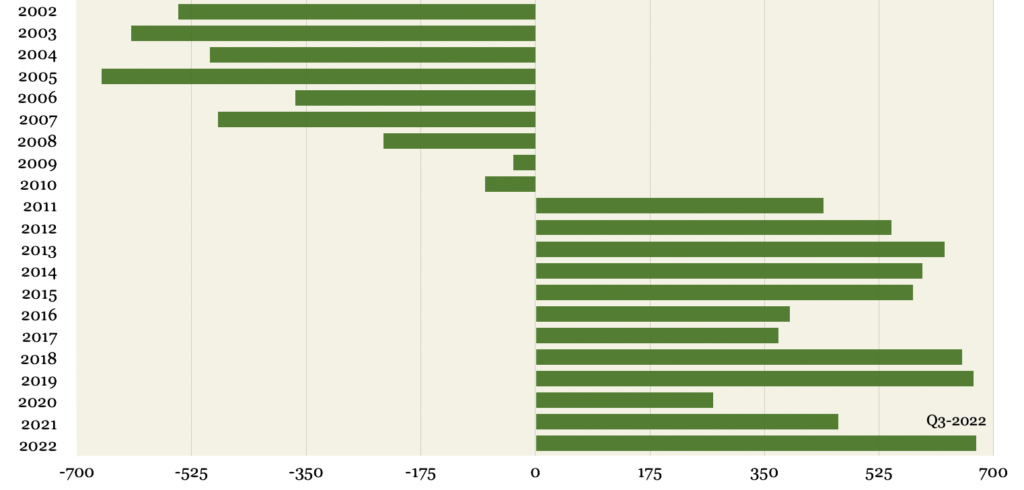

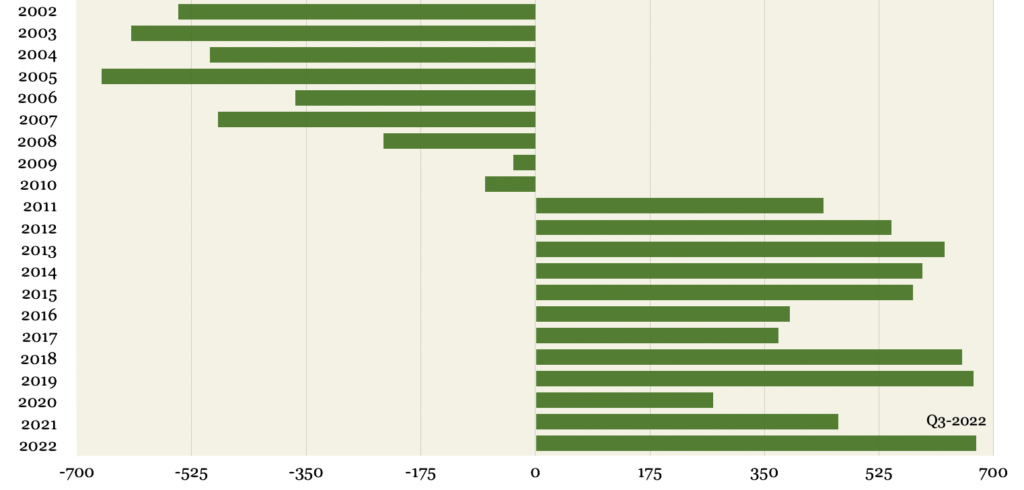

Central Bank Gold Sales and Purchases

2002-2022 (Q3) (net; metric tonnes)

http://gold-stater.com is now providing daily gold market and gold coin market commentary and updates. Please check in regularly to find the latest developments in gold and gold coins.

Central Bank Gold Sales and Purchases

2002-2022 (Q3) (net; metric tonnes)

There are Relentless Inflationary forces in food, energy, housing, health care and education

There are Relentless Defaltionary forces in ;iquidity driven Malinvestment and a societal addiction to debt fueled binging on useless crap with no ultimate resale value.

The inflationary forces in our economy are being driven by Trade War and Populism which has crushed five decades of globalization which kept commodity prices down (Food, Energy, Metals). Now global supply chains have been destroyed and they will take decades to rebuild.

That means the end of cheap labor, the end of cheap food (and most goods) and the end of cheap energy.

And five decades of the Fed keeping real rates deeply negative has led to a relentless financialization (Hedge Funds and banks and shadow banks taking Free Money to turn everything necessary to living from housing to education to health care into investment vehicles) that will keep prices so high in these non discretionary areas that even the vast majority of First World Populations can barely afford them.

That means cheap housing, health care and education will never come back.

This will insure that every years the dollars in you bank account will be worth less and less and less.

That is an unstable currency.

Over time that will only benefit the only stable currency: Gold.

On the other hand the Five decades of liquidity fueled Malinvesment in everything from Space Tourism to MetaMasks to Social Networks to Crypto Currencies - none of which have any real Use Value other than to help people waste time and energy - and develope crushing gambling addictions - are creating a massive Deflationary force as they implode. The Negative Wealth effect from the loss of purchasing power will be felt for years to come.

Again that creates a deeply unstable economic/societal condition.

Instability can be hedged only by things which have proven their stability over centuries and millienia: Gold and Hard Assets.

Gold is a stable currency. From the time of Kroisos of Lydia through Alexander the Great, through Julius Caesar through Constantine the Great through to Philip IV and Edward III through to Napoleon and through the First and Second World Wars - Gold was the currency everyone looked to as the one store of value that would get you through tought times.

There are those who think that Financialization is the future and we will never go back to hard currency. But even many of the greatest advocates of this Brave Fiancialized Future store their own assets in gold and Hard Assets. The more you understand the instability inherent in Financialization the more attractive Hard Assets become.

"There should in theory be some agency or law working to prevent this foreseeable nightmare from materializing. But it’s not clear that there is, and it’s also not exactly clear who has oversight. FTX is headquartered in the Bahamas. This scandal involves its international division, but the company also does business in the U.S."

Slate Magazine/blog on the FTX crypto debacle.

This could be written about any of the thousands of financial scams of the last several decades from AIG to ENRON to GE to Tyco to Worldcom to Maddof to Waste Management to Theranos to Lehman Brothers to Freddie Mac to MT Gox to Terra ETC ETC ETC

Crypto is a niche gambling vehicle. But AIG was the largest insurance company in America, It turns out they are equally difficult to vet for oversight agenies.

Oversight is near impossible because of the vast international nature of banking, shadow banking, and now Fintech Banking that makes following the money possible - but extremely labor intensive and time consuming for Oversight Agencies that are undermanned, underfunded, and staffed with people who in many cases were not smart enough to get jobs with Scamming Firms they're chasing.

The problem is magnified 1000 times by massive liquidity which is a compelling incentive for malinvestment from scams to plain old run of the mill stupidity.

Liquidity leads to inflation. Which leads eventually to the necessity to withdraw liquidity. And when the tide goes out, as Warren Buffet has quipped, you see who is swimming naked.

But, unfortunately not before they've taken billions and billions out of the pocket of unsuspecting "Investors" read GAMBLERS.

Investing is gambling unless you have a completely trasnparent access to information. Which in our current system nobody has.

Except, or course, with Commodities and Hard Assets.

Can a mining company or a food processing company lie about its numbers? Of course.

But when estimating wheat harvests and wheat demand or gold ounces mined per year and central bank purchases and sales or petroleum inputs, refining capacity and demand, figures are pretty transparent - or reaonably verifiable. At least enough to make compelling investment decisions as opposed to purerly throwing the dice and hoping for a result.

Because a Nation's food and energy supplies and currency stability and raw input needs for industry are vast and calculable. And though figures can always be manipulated, it's hard to say who would benefit from outright lies about these most important measures required for a nation's or industry's survival.

The same can be said for Hard Assets. For example, we don't know but we can calculate with some certainty how many Da Vinci paintings and drawings exist. And we know what the last one sold for. Or we know about how many gold Staters of Kroisos have come to market over the last twenty years, we can be pretty sure that most available for purvchase have come to market and we know what they sold for. More might by dug up in the future. But it's very doubtful that it would be in quantities that would appreciably affect current values. Especially with modern cultural heritage laws.

Of course there are fake coins, and there are plenty of schemes where unscrupulous galleries create a fake demand for more contemporary artists. But fake coins can be easily vetted and pump and dump galleries are only ripping off the extrarodinarily wealthy who fall for the scams voluntarily in order to feel socially validated. They easily could have chosen to invest in old master paintings that have been reasonably vetted.

The point being, that on the whole, in our current environment, "Investing" in fiancialization is really a form of gambling. Whereas, investing in Hard Assets and Commodities is a way of entering an investment arena where information is available, understandable, and easily vetted by the investor who takes the time and effort to do so

The recent crypto implosion of the largest and most trusted Crypto Exchange FTX just wiped out 150 billion dollars in a few days. It turns out nobody involved will ever recoup their losses because the money that was supposed to be held by the exchange isn't there.

This is simply the danger inherent in any form of FINANCIALIZATION - that is not tied or backed by a constant like GOLD.

Financialization has existed along side gold throughout recorded human history. In fact many of the first historical documents going back to Sumerian cunieform were simply recorded transactions - many of which were forms of financialzation in that they were agreements to deliver this for that at some date.

If you trade this for that now you make a record. If for any number of reasons it is most convenient to actualize the transaction at some other date you need a Contract which is the most basic form of financialization.

The key throughought history until 1971 was that in theory you knew exactly how much of this to trade for that because they were both convertible into a certain amount of Gold.

And large entities like governments of cities or city/states or large trading concerns, or lending outfits had to have x amount of gold to legitimize their contracts.

Of course many tiny towns had no gold. So they used other measures of wealth, But they are of no concern on the stage of the history of world finance because they didn't operate there. The ships carrying international goods that sailed the seas from the time of the Sumerians as well as the caravans of traders just didn't stop there.

So there has always been gold. And there has always been financialization. And they have always been tied together.

Until 1971.

At that point all the central banks still held gold. And all their member banks still fiancialized. But the link was broken. So that there was an explosion of financialization that was no longer backed or converted into anything but theoretical currency which is just another type of financialization.

For a time this worked fine. It allowed the global economy to expand. Rapidly. And then Very Rapidly.

The problem with unconvertible financialzation is that it relies entirely on the Good Faith of the actors involved.

When Good Faith comes into question, as is happening in Politics, in the Economy, and in the institutions of Law here and around the globe, Financialzation breaks down.

Or you could say that the rapidity of the expansion created a lot of room - and incentive - for bad actors.

Financialization began to break first with LTCM which required 3.6 billion dollars of Fed bailout money: then the S and L crisis required 150 billion of Fed bailout money. That seemed like a lot at them time.

Then came the subprime crisis in 2008. The entire economy imploded under George Bush and was bailed out with 3 trillion dollars by the Fed!

3 trillion dollars created out of thin air and transferred to the wealthiest 1 percent. And nobody batted an eye!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

That is money they simply created out of thin air. Backed by nothing. The fed claims it was "repaid." Yet it stayed in the economy - in the pockets of the very wealthy.

Then in 2018 the economy collapsed again with covid under Trump and this time the Fed bailed it out with 10 trillion dollars that they created out of thin air to buy up the illiquid assets of the very wealthy.

It's all still on their balance sheet in spite of their regime of "tightening" which is sending a global economy dependent on Fed easy money into a tailspin.

Those two Fed injections amount to thirteen trillion dollars made up out of thin air and given all to the very wealthy - in ten years. On top of that the government runs a trillion dollar a year deficit (three trillion one year under Trump) and then doles out periodic stimulus to the middle class to the tune of 2 trillion under Trump and another 2 trillion under Biden.

This is all possible because financialized assets are no longer convertible into gold.

Pure and Simple.

So what is gold - and why hasn't it soared during this period?

Gold is what is has always been. The Wealth Constant. Pure money - in other words a pure measure of stability of worth of anything that can be traded. Pure in the sense that it has no counterparty risk. It's value is entirely intrinsic. If someone will trade you x amount of gold for y - that is y's ultimate value..

Short term, you can trade anything for anthing.

Long term you can only measure value by the value of a constant. Gold has been that constant for over 5000 years of recorded history.

Why hasn't it soared then as our institutions, laws, become the objects of scorn and ridicule and financialzation has carreened out of control?

Because it takes a while to shake the faith of the vast public in financialization.

It is only through massive faith that so many people could put their money into opaque crypto exchanges. Imagine the leap of faith that takes. It can't be wiped out in a minute. Your're wealth can. But faith can linger.

It's tough to shake because their faith in financialization is very pure - as most people have no idea what financialization really is. They just believe it must work. After all it created so much wealth - for so few. Maybe it can do the same for you. Everyone hopes so.

But as bit coin exchanges collapse, and governments stop working, social security goes broke, and costs sprial out of control, and all the created-out-of-thin air assets go only to a very few at the very top of society - faith is beginning to crack.

You see it in the corrupt populism overtaking world politics. You see it in the anger, the violence and the scapegoating of the left-behind world populations. And you see it in the scandals and the imploding zombie coroporations that are revealed daily, as liquidity tightens.

And ultimately as hundreds of billions of currency units keep being lost in the void of bad faith, the general attention will return to the constant.

Gold.

If you concentrated on the paper price of gold you'd think gold was in a huge funk, neglected, a useless relic of a bygone age. In fact there are many who will tell you gold is not really money - not any longer - since you can't use it to buy a quart of milk at the super market.

However, if you look at the central bank activity - those who issue, regulate, and proclaim what is and isn't money you get an entirely different story.

Central Banks are accumulating gold are record rates. They have bought 399 tonnes worth 20 billion dollars in the third quarter alone. The largest buyers are Turkey, Uzbekistan, Qater, and India. Retail buying in these countries is up 300 percent year over year - as these goverments encourage their populations to buy gold

This is the fastest pace of accumulation since the dollar was convertible into gold back in 1972.

Interesting.

But this is only half the story. Russia and China are engaged in a furious gold accumulation - but the figures don't show up because they mine the gold themselves and the gold goes straight from domestic miners into the Russian and Chineses Central Banks. Gold analysts like Simon Hunt estimate the CHina has now accumulated 30,000 tonnes of gold as opposed to the 2000 tonnes they admit officially.

The Chinese government also actively encourages the Chinese population to buy gold.

It is widely known that many other central banks are also purchasing gold without reporting their purchases

It is interesting that the countries that don't mine gold but are buying at furious rates are all countries that China and Russia seek to include in their sphere of trade influence.

And many analysts believe (again like Simon Hunt) this furious accumulation of gold is prelude to a new gold/commodity backed currency to challenge the US dollar.

Meanwhile the paper price of gold is controlled by the Fed and a few bullion banks here in the US - most notably JP Morgan - who keeps getting slap on the wrist fines for their illegal manipulation.

So if your gold accumulation is in paper gold - it's really not clear how that will hold up under future crisis scenarios.

The only real portfolio protection is in Real Assets. Real Gold amongst them.

SO how has the affected ancient coins?

Top coins in top conditions continue to climb. Everything else has softened - albeit from very high levels. For example the coin above a very rare:

Claudius II (AD 268-270). AV medallion of 8 aurei (37mm, 39.09 gm, 12h). NGC Choice VF 4/5 - 2/5, Fine Style.

sold for $63,000. A year ago it sold for $77,500. Not a huge difference, but to the seller who only collected $52,000 that's quite a loss in one year. But then the coin itself is not attractive. Impressive, yes, Attractive, no. The coin is not easy on the eye. The surfaces ar rough, the portrait uninspired and the reverse is standard. But at 8 aurii the coins is really large and impressive. Finally, Claudius II is an interesting character, but he's not a Julian, or even an emperor from a period that is relatively well appreciated in Roman history. So the question is how badly does a buyer want to persue something that is impressive for the size and a relative rarity as opposed to buying something really beautiful and historically fascinating?

For example, in the same auction a really nice looking daric, clearly of wonderful late style with flowing robes and a well detailed face sold for $27,600

Certain coins are hot at certain times, and chasing up the price while the economy is hot is not always rewarded when the economy cools. Buying great beauty, especially when underappreciated though seems to insulate you from market drops.

At the same time, gold medals, of historical value and fine style engraving continued to rise through the economic malaise.

The items that suffered most - not surprisingly - were the most readily available types in middling grades. THough coins that had a most pleasing eye appeal sometimes made surprisingly high prices

Draw your own conclusions.

There are so many people writing on line letters, posting videos, and polluting social media with ways that you can pay them for their wisdom. Don't do it.

They come in all shapes and forms. Here are a few major scams:

The INSIDER. This person will tout all their amazing credentials: they've been advisors to industry. the CIA, Government, International Agencies, whatever and they're here to let you know of some incredible Government/International Conspiracy that will take all your money unless you SUBSCRIBE to their Newsletter or blog Read their book, that reveals the conspiracy and what to do about it.

The ADVISOR. This person will tell you about their amazing credentials of running a major wall street firm or deparment or trading desk or whatever. They have magical powers from their Wall Street experience to Read the Market Sentiment and feel how the market is turning before anyone else because they're CONTRARIANS and if you pay for their newsletter or Blog or Book you'll be able to beat the markets too.

The GURU also has Wall Street Credentials but this person has developed a TECHNICAL SYSTEM that nobody else has been able to discover. They count waves and draw retracement lines that show HIDDEN PIVOTS and TURNING POINTS that work like magic. If you pay them they'll show you the secret that all the quants at all the hedge funds haven't been able to figure out.

The Advocate. This person has no credentials. And very little education. They're on all the major cable shows, youtube channels, social media sites. They have millions of followers. They're just loud and bullying and willing to trash anyone and anything that you perceive as an ENEMY. And if you send them money they'll help you destroy your ENEMIES too.

Save your money. Really. Save it and put it to good use.

Put it to use buying things that are real. Hard Assets that you can hold in your hand. That you can see and feel and know that they're real. And know why they're useful, and beautiful, and historically important. It's a better use of your money. And it's much more satisfying.

The world if filled with financial advisors. If you're super high net worth and you can afford somebody like Felix Zulauf you'd probably do well over time. But if you're super high net worth you're probably fine no matter what happens.

If you're an average investor the last thing you need is someone to take money from you to give you advice on how to beat a 100 percent correlated world of paper investments. If the Fed is tightening they all go down together. If the Fed is easing they all go up together. Until there's so much debt financialization dies. We may be about there.

If the advisor is a proffessional advice letter writer you have to ask yourself why in world, if they know anything about anything, aren't they making money for themselves in the markets, instead of trying to dupe you into giving them your money.

Oh, because they want to help. I see. Help themselves to your money.

So what do you do?

You take control of your own finances and invest in something you understand. If you don't understand anything at all, you're a lost cause anyway. Stop reading, But if you're a dancer, you know dance: if you're a musician, you know music - and musical instruments - and probably records and maybe even music memorabilia. That's where you start building a valuable collection of real hard assets that you love and understand.

Over time these will become valuable if you indeed have an understanding of what you're buying.

I love history. I love music too. But I started out buying artifacts that have a direct bearing on some of the historical periods and figures I find fascinating. Coins and Medallions. It has provided a wonderful living which I find endlessly fascinating. It's not work for me. It's fun.

If you're fascinated by death, for example, that sounds morbid. But each to his own. There are so many diffeerent type of death related artifacts that people collect. Skulls, bones, taxidermy, shrunken heads, hair lockets, books of spells, death masks, death medallions... If they're historically important they will appreciate over time.

If you're a scientist, there are collectors of scientific instruments, of rare minerals and gems, of space rocks and space memorabilia, of award medallions and notebooks with hand written notations from breakthough discoveries.

If you're fascinated by food or wine or sports - gosh - there must be some area you can study to the point where you know more than most. If you're not able to do that - stop reading. But if you are, start reading. And never stop.

Ultimately everything you need to make a fortune is to be found in BOOKS. Maybe you can supplement that a bit on line. But if it's on line - everyone already knows it, and it's probably innaccurate.

In fact, Books themselves are a wonderful investments. If you happen to know everyting there is to know about books.

So get reading. It's fun, and it just may help you accumulate hard assets that will make and save your fortune.