The system is completely broken, it can’t sustain itself without the Fed’s ever more monumental interventions.

These interventions are absolutely necessary or the system collapses under its own broken facade. And this conflict, a Fed poisoning the economy’s growth prospects on the one hand, and its needed presence and actions to keep the broken system afloat on the other, has the economy and society on a mission to circle a perpetual drain.

So how does the Fed poison everything?

Let’s start with the Fed actual process of working towards its stated mission: Full employment and price stability.

How does it do that? Well, for the last 20 years mainly by extremely low interest rates and balance sheet expansion sprinkled with an enormous amount of jawboning. The principle effect: Asset price inflation.

It’s not a side effect, it’s the true mission. The Fed has been managing the economy via asset prices even though Jay Powell again insisted on saying the Fed is not targeting asset prices.

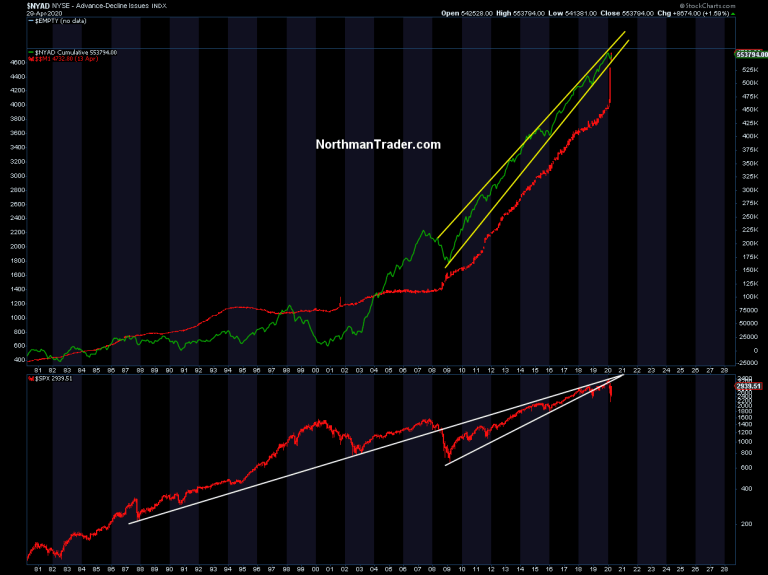

This is a lie. And I can prove it with one chart. Cumulative $NYAD, the flow into stocks versus M1 money supply:

And guess what? They just saved the $NYAD trend again by going vertical on M1 in a fashion never seen before. All this despite $SPX clearly breaking its long term trend. So yes the Fed is targeting asset prices and Powell is lying when he says the Fed isn’t.

Recklessly widening the wealth inequality equation in the process.

What happens when you have a slow growth recovery for 10 years and all the wealth benefits going disproportionally to the top 1% who own most of the assets that are targeted while real wage growth stagnates?

For one you have a sizable portion of society that doesn’t have a pot to piss in, behind in bills, struggling to pay rent, little to no savings or retirement, taking on multiple low paying jobs with no benefits while real estate prices keep rising as the wealthy keep squeezing people out of neighborhoods. What? You think it’s a coincidence that people have to commute farther and farther to their jobs because they can’t afford housing in the areas where they work? Check San Francisco and Silicon Valley housing prices and commute stories. It’s a horror story.

And so what happens when we have a crisis such as this?

Millions needing help immediately, food banks lined up with thousands in line waiting for help and food. A population not able to sustain itself for lack of savings and resources exposing the structural weakness of our broken system.

No comments:

Post a Comment