As gold rockets ever higher, fueled by central bank buying, (though it is in a very temporary holding pattern through until the Asian buying season kicks in in August). There has been a lot of interest developing in other monetary metals. Especially Silver and Platinum.

There's been an extraordinary amount of chatter about silver's imminent breakout. Wealthy entities have been standing for comex delivery on silver as they have been on gold.

But silver has a drawback for those buying 1 ounce coins rather than tonnes. And that is the fact that hundreds of millions of ounces here in the US (and all around the world) have been minted over the last few centuries and all that silver is still available on the open market. So if you go out and look at "structural imbalances" of what being mined and global demand it just doesn't take into account the fact that all the silver that been used as money of the last several centuries is still out there on the open market for the retail buyer. Morgans, thalers, 5 fancs, crowns, and more recently: liberties, maples, philharmonics etc etc

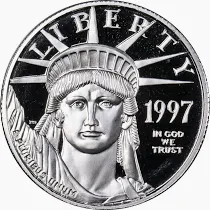

Platinum, on the other hand, has only been minted as coinage for the last couple of decades. And even so, in very small quantities. It is also very expensive to mine and only occurs naturally in a few areas globally, most of which is in Politically-challenged South Africa. And as retail inerest ramps up it will take at least a decade to get new mines on line. It is genuinely scarce in the retail arena.

The other interesting thing about Platinum is that, like gold, it is inert. It doesn't tarnish or oxidize. So it holds its value over time. And, like gold, it is divisible, durable, malleable and it is considered beautiful by the wealthy classes who appreciate platinum jewerlry. All the Platonic characteristics of Money but with an historical scarcity that made it impractical as Money.

And its industrial use is in the growth industries of the future: as a catalyst in various advanced chemical and electrical processes: fuel cells, catalytic converters etc.

In the recent past, before the massive central bank accumulation, platinum was more expensive than gold. Now, it trades at about a third the price of gold. It may never again be nearly as valuable as gold, because it does not have the same reserve currency use. But, for my money, it is a far better bet as a secondary monetary metal than silver.

No comments:

Post a Comment