An extraordinary assault on US Fiscal Solvency is under way

under the Trump administration and because of all the other crises, this one

gets little play in the media, yet it may be the most damaging of all/

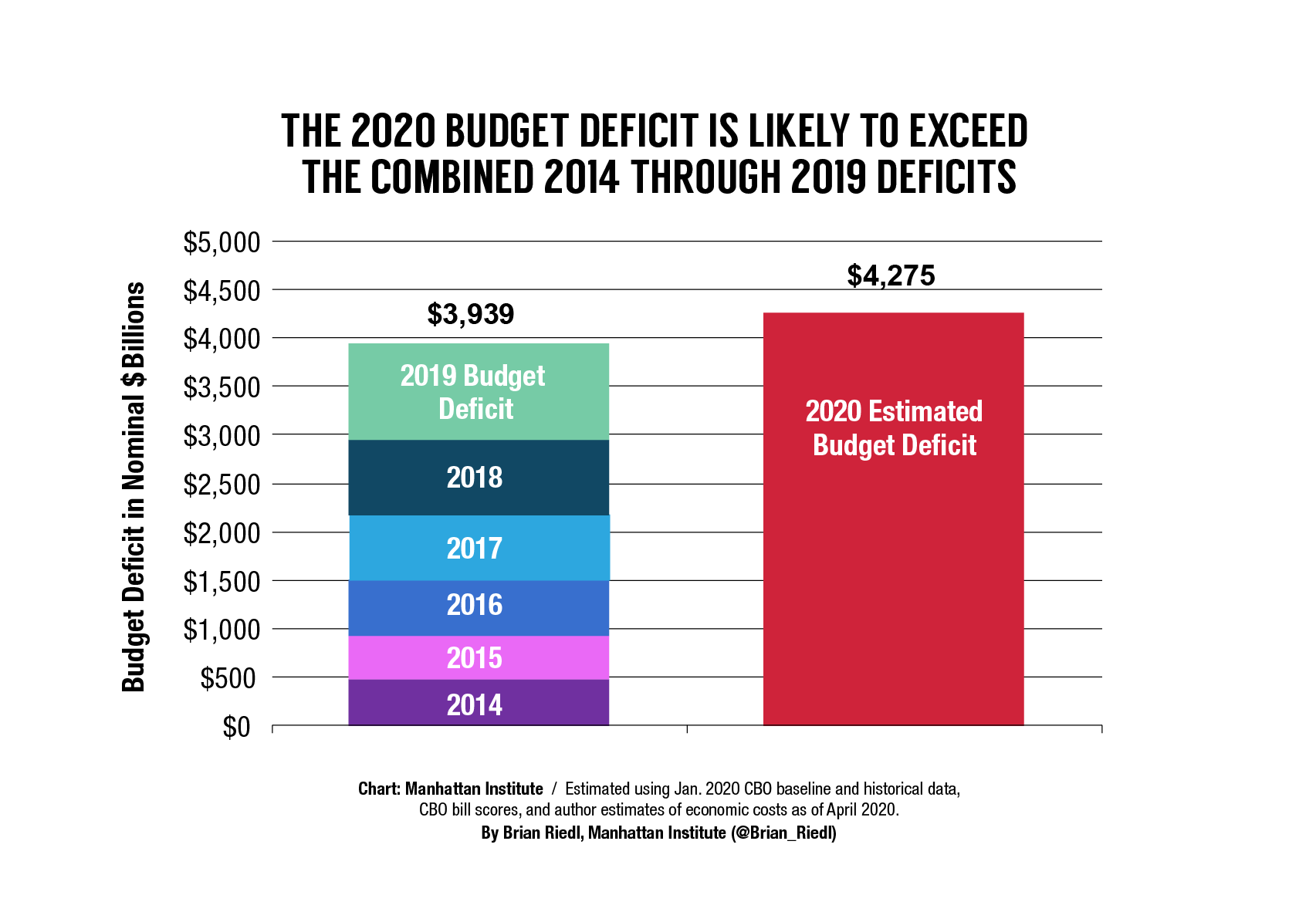

The Federal Government is now running close to a TRILLION

DOLLAR DEFICIT PER MONTH/ Meanwhile the FEDERAL RESERVE BANK OF THE

UNITED STATES OF AMERICA if standard accounting practices applied would be

running a parallel annualized deficit also close to A TRILLION DOLLARS A MONTH

- when you account for the fact that they've taken over 10 trillion dollars of

Bad Debt onto their balance sheet to support this imploding economy.

When the Fed took on Three Trillion Dollars of bad debt

after the crisis of 2008 they promised to "normalize their balance sheet

as soon as appropriate." They briefly tried to do so in 2013. The

stock market immediately began to crash it what was dubbed a TAPER

TANTRUM. The Fed immediately desisted proving once and for all that their

true mandate is to support the risk assets of the very very Rich.

(They've since insisted that much of the bad debt was repaid, without ever

opening their books to back up this claim.)

Where is the talk of a normalized Fed balance sheet

now? There is none, because, frankly, it would be regarded as an absolute

joke.

Where is the talk of fiscal responsibility of the Federal

Government now? There is none. It would be a joke. The only

talk is how many trillions of dollars more do we print up to stave off a

depression?

A Solvency Crisis is looming. And not just in the US

No comments:

Post a Comment