As gold nears $2000 again, there is much speculation as to a "fair value" and what to expect next.

There are many billionaires like Ray Dalio, Jim Druckenmiller, Paul Tudor Jones, Jim Rogers etc who are still aggressive buyers of gold. Most of these base their decisions on fundamental analysis having to do with expanding money supplies and debt loads in the major economies.

Then there are many technical analysts like Bob Prechter of the Elliot Wave school, and TV personality Jim Cramer's favorite chartist Carley Garner who fee that gold is on the verge of a major bust and has no real intrinsic value at all.

The real difference in analysis comes down to whether you view gold as a currency or a commodity.

Historically gold was the major global currency for at least 3500 years of recorded history. Silver was also used in about at 10 to 1 ratio as a secondary currency.

Paper chits or IOU's were also used insofar as they were convertible into gold..

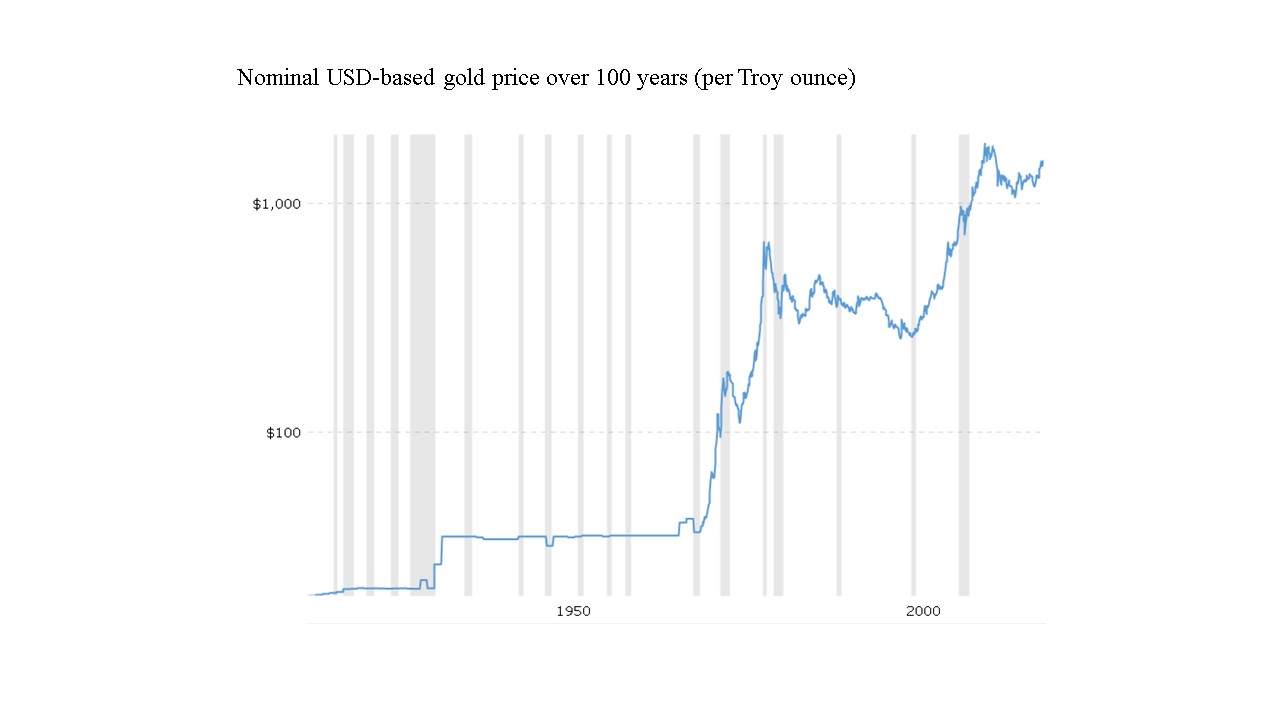

In 1933 The United States had issued so many paper chits they decided to freeze the price of gold and make private ownership illegal because they could no longer honor the conversion of paper into gold.

From this point on the Federal Reserve bank and the US Treasury created a system of floating paper money uncorrelated to anything but the "Good Faith" of the US Government.

All the governments of the world still used Gold as the currency of last resort. All Governments of the world stored gold in their central banks for use as currency of last resort and for large international payments. And all paper was still supposed to be convertible into gold at a controlled price.

In 1971 Richard Nixon closed the gold window for good in the United States. Gold was no longer money available for the settlement of commercial transactions.

The Question is: is it still a currency? If not it's value is purely emotional and sentimental, which is the argument of many technical chartists.

If its value is emotional and sentimental what is it's value? Honestly, I have no idea,

And if it can not be used in the settlement of trade, how can it be a currency?

The answer is: it is a currency because it is held by the central banks of all the major global governments. Why do they hold it? Because it is an asset that as readily convertible into every major currency, it is durable, divisible, immutable, and has a 3500 year track record of holding its value over time. In short, all the conditions that Aristotle laid out for currency in 500 BCE.

And right now Gold is the only asset held by the central banks of the world that are holding many trillions of dollars worth of liabilities in the form of bad debt they've taken onto their balance sheets to bail out the over leveraged banks and corporations of the world.

So if you accept the premise that gold is still a currency then what is the value?

First, you can ask yourself what price would gold have to go to in order to make the central banks of the world solvent? This is not an easy question, but surely the answer is much higher than it is now. And this is the reason many billionaires who are looking at the global economy and seeing great value in gold disagree with many chartists who are looking at their computer screens and computing stochastics and wave counts and relative strength indicators and seeing a commodity trading at perilous levels.

THIS HUNDRED YEAR GOLD CHART SHOWS THE EFFECTS ON

THIS HUNDRED YEAR GOLD CHART SHOWS THE EFFECTS ON