New G20 Rules: Cyprus-style Bail-ins to Hit Depositors AND Pensioners

Posted on December 1, 2014 by Ellen Brown

On the weekend of November 16th, the G20 leaders

whisked into Brisbane, posed for their photo ops, approved some

proposals, made a show of roundly disapproving of Russian President

Vladimir Putin, and whisked out again. It was all so fast, they may not

have known what they were endorsing when they rubber-stamped the

Financial Stability Board’s “Adequacy of Loss-Absorbing Capacity of

Global Systemically Important Banks in Resolution,” which completely

changes the rules of banking.Russell Napier, writing in ZeroHedge, called it “the day money died.” In any case, it may have been the day deposits died as money. Unlike coins and paper bills, which cannot be written down or given a “haircut,” says Napier, deposits are now “just part of commercial banks’ capital structure.” That means they can be “bailed in” or confiscated to save the megabanks from derivative bets gone wrong.

Rather than reining in the massive and risky derivatives casino, the new rules prioritize the payment of banks’ derivatives obligations to each other, ahead of everyone else. That includes not only depositors, public and private, but the pension funds that are the target market for the latest bail-in play, called “bail-inable” bonds.

“Bail in” has been sold as avoiding future government bailouts and eliminating too big to fail (TBTF). But it actually institutionalizes TBTF, since the big banks are kept in business by expropriating the funds of their creditors.

It is a neat solution for bankers and politicians, who don’t want to have to deal with another messy banking crisis and are happy to see it disposed of by statute. But a bail-in could have worse consequences than a bailout for the public. If your taxes go up, you will probably still be able to pay the bills. If your bank account or pension gets wiped out, you could wind up in the street or sharing food with your pets.

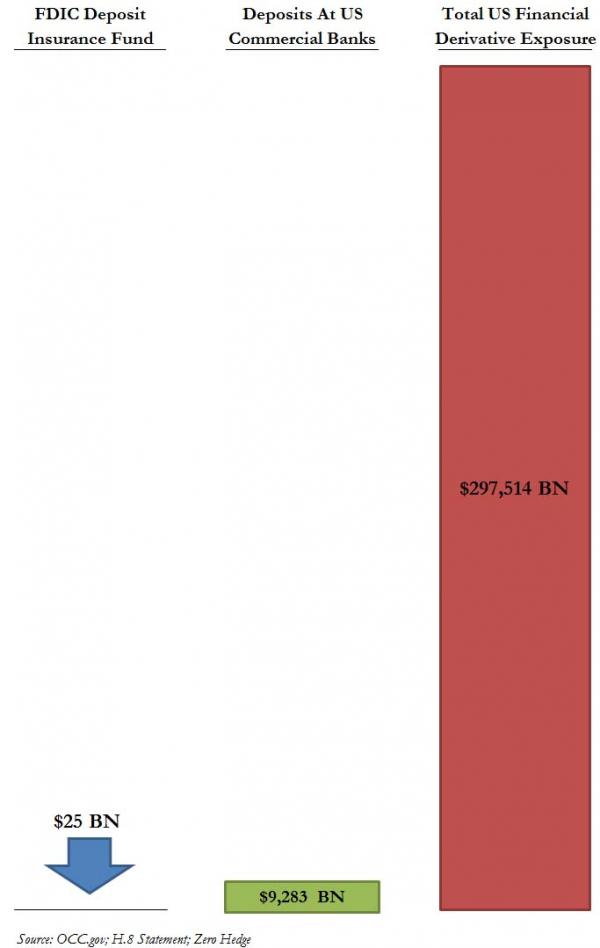

In theory, US deposits under $250,000 are protected by federal deposit insurance; but deposit insurance funds in both the US and Europe are woefully underfunded, particularly when derivative claims are factored in. The problem is graphically illustrated in this chart from a March 2013 ZeroHedge post:

No comments:

Post a Comment