This site does not offer market timing or specific investment advice. I comment on general economic conditions and generally conclude that gold will protect you in the event that less than optimal conditions develope. I believe we are in a period of horrendous conditions entirely because the US Government in collusion with the US Central Bank has now run 50 years worth of negative real rates with the resulting massive deficits. FIFTY YEARS - starting in 1981 running right through to the present. Now we've reached the conclusion: Massive inflation, low growth and a ghoulish army of zombie companies running on malinvestment fumes.

Anyway, everyone who follows the economy knows that. (except every US politician who blame everything on their political enemies thus making a solution impossible.)

Gold as a result has been in a major uptrend, though it is a heavily controlled market. Eventually it will be much more difficult for the Fed and the bullion bamks to control the gold price. Everyone knows that too.

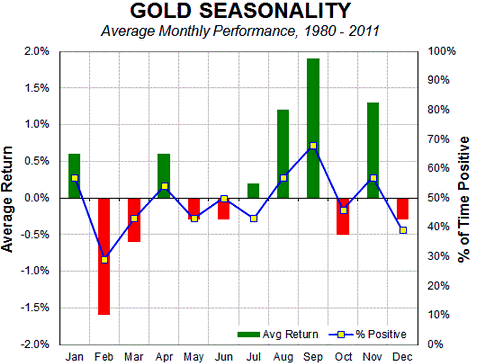

But meanwhile most years (not every year, but most) gold seems to follow a seasonal pattern. It has something to do with China and India (and Asians and East Asians all over the world) buying bullion in preparation for the wedding and festival seasons where gold is gifted to the near and the dear, as has happened for thousands of years in the traditions of those people. The gold season starts in earnest in September but gold tends to begin to run up in advance. The chart above shows this tendency.

This it not investment advice. This is jsut pointing out that historically the gold low for the yars occurs around the July 4th weekend.

It's often a good thing to know.